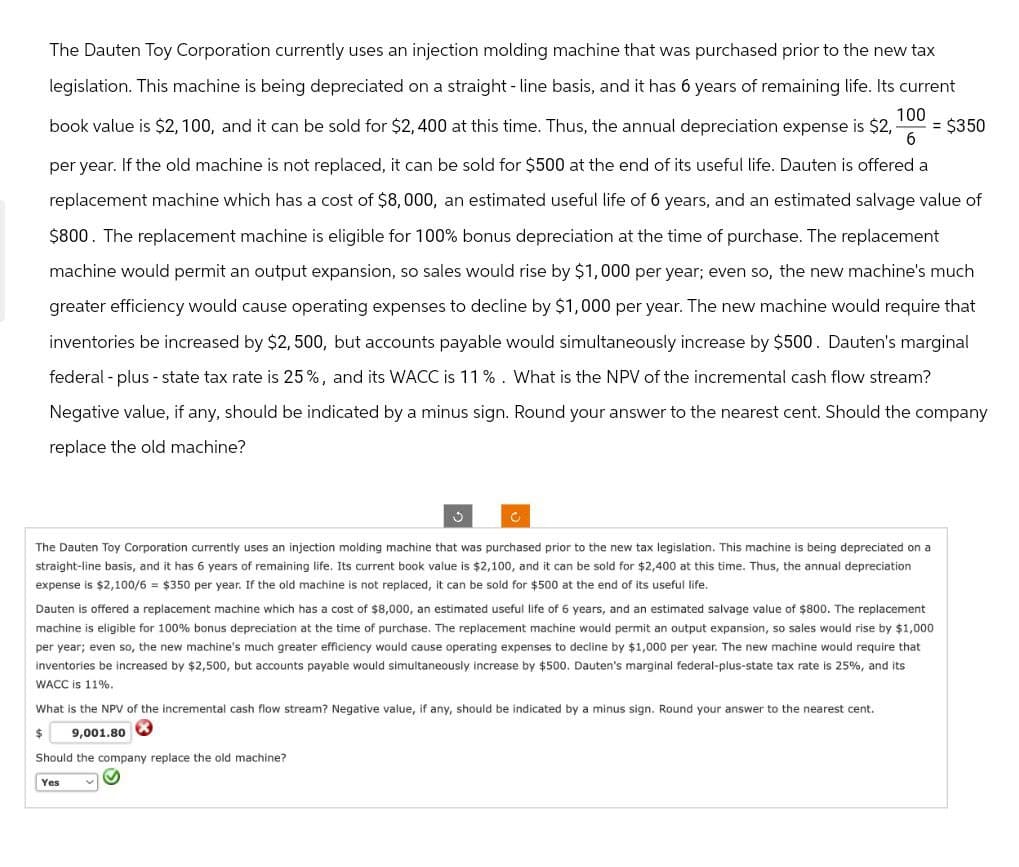

The Dauten Toy Corporation currently uses an injection molding machine that was purchased prior to the new tax legislation. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current 100 book value is $2,100, and it can be sold for $2,400 at this time. Thus, the annual depreciation expense is $2,- = $350 6 per year. If the old machine is not replaced, it can be sold for $500 at the end of its useful life. Dauten is offered a replacement machine which has a cost of $8,000, an estimated useful life of 6 years, and an estimated salvage value of $800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase. The replacement machine would permit an output expansion, so sales would rise by $1,000 per year; even so, the new machine's much greater efficiency would cause operating expenses to decline by $1,000 per year. The new machine would require that inventories be increased by $2,500, but accounts payable would simultaneously increase by $500. Dauten's marginal federal-plus-state tax rate is 25%, and its WACC is 11%. What is the NPV of the incremental cash flow stream? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. Should the company replace the old machine? The Dauten Toy Corporation currently uses an injection molding machine that was purchased prior to the new tax legislation. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current book value is $2,100, and it can be sold for $2,400 at this time. Thus, the annual depreciation expense is $2,100/6 = $350 per year. If the old machine is not replaced, it can be sold for $500 at the end of its useful life. Dauten is offered a replacement machine which has a cost of $8,000, an estimated useful life of 6 years, and an estimated salvage value of $800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase. The replacement machine would permit an output expansion, so sales would rise by $1,000 per year; even so, the new machine's much greater efficiency would cause operating expenses to decline by $1,000 per year. The new machine would require that inventories be increased by $2,500, but accounts payable would simultaneously increase by $500. Dauten's marginal federal-plus-state tax rate is 25%, and its WACC is 11%. What is the NPV of the incremental cash flow stream? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. $ 9,001.80 Should the company replace the old machine? Yes

The Dauten Toy Corporation currently uses an injection molding machine that was purchased prior to the new tax legislation. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current 100 book value is $2,100, and it can be sold for $2,400 at this time. Thus, the annual depreciation expense is $2,- = $350 6 per year. If the old machine is not replaced, it can be sold for $500 at the end of its useful life. Dauten is offered a replacement machine which has a cost of $8,000, an estimated useful life of 6 years, and an estimated salvage value of $800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase. The replacement machine would permit an output expansion, so sales would rise by $1,000 per year; even so, the new machine's much greater efficiency would cause operating expenses to decline by $1,000 per year. The new machine would require that inventories be increased by $2,500, but accounts payable would simultaneously increase by $500. Dauten's marginal federal-plus-state tax rate is 25%, and its WACC is 11%. What is the NPV of the incremental cash flow stream? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. Should the company replace the old machine? The Dauten Toy Corporation currently uses an injection molding machine that was purchased prior to the new tax legislation. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current book value is $2,100, and it can be sold for $2,400 at this time. Thus, the annual depreciation expense is $2,100/6 = $350 per year. If the old machine is not replaced, it can be sold for $500 at the end of its useful life. Dauten is offered a replacement machine which has a cost of $8,000, an estimated useful life of 6 years, and an estimated salvage value of $800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase. The replacement machine would permit an output expansion, so sales would rise by $1,000 per year; even so, the new machine's much greater efficiency would cause operating expenses to decline by $1,000 per year. The new machine would require that inventories be increased by $2,500, but accounts payable would simultaneously increase by $500. Dauten's marginal federal-plus-state tax rate is 25%, and its WACC is 11%. What is the NPV of the incremental cash flow stream? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. $ 9,001.80 Should the company replace the old machine? Yes

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section: Chapter Questions

Problem 1CP

Related questions

Question

None

Transcribed Image Text:The Dauten Toy Corporation currently uses an injection molding machine that was purchased prior to the new tax

legislation. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current

100

book value is $2,100, and it can be sold for $2,400 at this time. Thus, the annual depreciation expense is $2,- = $350

6

per year. If the old machine is not replaced, it can be sold for $500 at the end of its useful life. Dauten is offered a

replacement machine which has a cost of $8,000, an estimated useful life of 6 years, and an estimated salvage value of

$800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase. The replacement

machine would permit an output expansion, so sales would rise by $1,000 per year; even so, the new machine's much

greater efficiency would cause operating expenses to decline by $1,000 per year. The new machine would require that

inventories be increased by $2,500, but accounts payable would simultaneously increase by $500. Dauten's marginal

federal-plus-state tax rate is 25%, and its WACC is 11%. What is the NPV of the incremental cash flow stream?

Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. Should the company

replace the old machine?

The Dauten Toy Corporation currently uses an injection molding machine that was purchased prior to the new tax legislation. This machine is being depreciated on a

straight-line basis, and it has 6 years of remaining life. Its current book value is $2,100, and it can be sold for $2,400 at this time. Thus, the annual depreciation

expense is $2,100/6 = $350 per year. If the old machine is not replaced, it can be sold for $500 at the end of its useful life.

Dauten is offered a replacement machine which has a cost of $8,000, an estimated useful life of 6 years, and an estimated salvage value of $800. The replacement

machine is eligible for 100% bonus depreciation at the time of purchase. The replacement machine would permit an output expansion, so sales would rise by $1,000

per year; even so, the new machine's much greater efficiency would cause operating expenses to decline by $1,000 per year. The new machine would require that

inventories be increased by $2,500, but accounts payable would simultaneously increase by $500. Dauten's marginal federal-plus-state tax rate is 25%, and its

WACC is 11%.

What is the NPV of the incremental cash flow stream? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent.

$ 9,001.80

Should the company replace the old machine?

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning