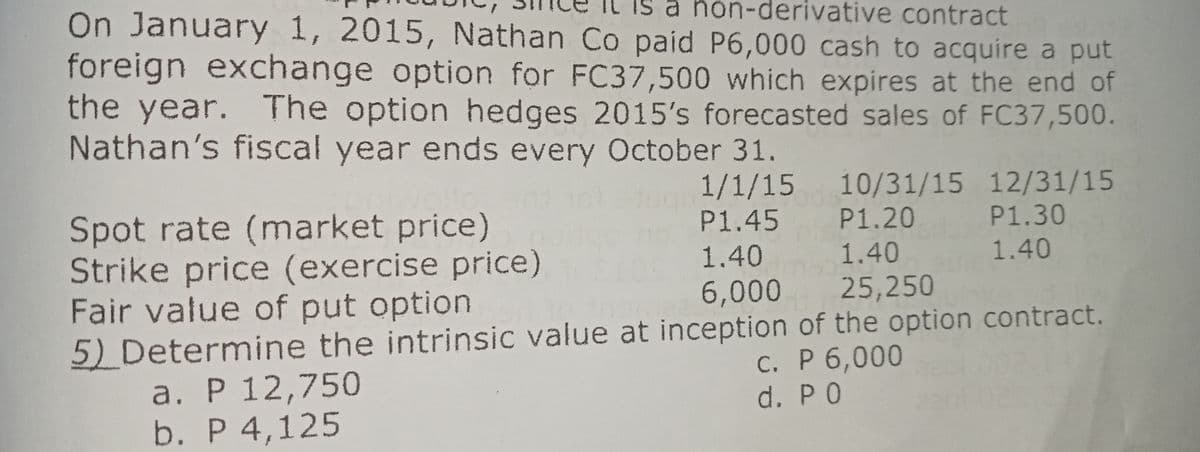

ative contract On January 1, 2015, Nathan Co paid P6,000 cash to acquire a put foreign exchange option for FC37,500 which expires at the end of the year. The option hedges 2015's forecasted sales of FC37,500. Nathan's fiscal year ends every October 31. 1/1/15 P1.45 1.40 Fair value of put option 6,000 5) Determine the intrinsic value at inception of the option contract. c. P 6,000 d. PO Spot rate (market price) Strike price (exercise price) a. P 12,750 b. P 4,125 10/31/15 12/31/15 P1.30 1.40 P1.20 1.40 25,250

Q: Pinas Corporation issued 16% p.a., 10-year Debenture bond, P6,000 face value, interest due every 4…

A: Here, Face Value of Bond is P6,000 Coupon Rate of Bond is 16% Offered Price is 96-1/2 Required Rate…

Q: (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will…

A: Here, Particulars AA Rating bond A Rating bond Par value (FV) $ 1,000.00 $ 1,000.00 Years…

Q: Ace Development Company is trying to structure a loan with the First National Bank. Ace would like…

A: The loan-to-value ratio illustrates how much the borrower owes to the lender for the amount of loan…

Q: The following table summarizes the yields to maturity on several one-year, zero- coupon securities:…

A: Yield of treasury = 3.09% Yield of AAA corporate = 3.17% Yield of BBB corporate = 4.14% Yield of B…

Q: Shanks Corporation is considering a capital budgeting project that involves investing $632,000 in…

A: Introduction: Net present value (NPV) is defined as the sum of the present values of all future cash…

Q: Rental Costs Annual rent Insurance Security deposit Buying Costs Annual mortgage payments Property…

A: Capital budgeting involves the evaluation of various options available for Investments or projects.…

Q: Fingen's 15-year, $1,000 par value bonds pay 15 percent interest annually. The market price of the…

A: Yield to maturity refers to the internal rate of return which is earned by the investor who makes…

Q: Consider a project to supply 103 million postage stamps per year to the U.S. Posta Service for the…

A: Bid price should include all cost including variable cost and fixed cost and also initial investment…

Q: You have sold a put option on British pound and receive $0.03 per pound. The exercise price is $0.75…

A: Receive amount on the sale of put option=$0.3 per pound Exercise price =$0.75 per British pound…

Q: The equity section of Luthra corp is shown below. Calculate the book value per common share if there…

A: Number of Shares = n = 1,000,000 Common Stock = c = $1,500,000

Q: m 0 1 2 32 50 6 B 100 119.2 142.09 169.37 201.89 240.65 286.85 Joelle prefers to pay by credit card,…

A: A credit card is a payment card that allows the cardholder to make purchases and borrow funds from a…

Q: Suppose you have a student loan of $35,000 with an APR of 6% for 40 years. Complet parts (a) through…

A: A loan is a financial arrangement in which one party, typically a lender or a financial institution,…

Q: Walnut Co held its quarterly dividend meeting on December 8. At that meeting, the directors decided…

A: Cash dividends are distributions of profits to shareholders, typically paid out of a company's…

Q: Suppose you have a student loan of $35,000 with an APR of 6% for 40 years. Comp parts (a) through…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: characteristics similar to the firm's average project. Bellinger's WACC is 10%. 0 1 2 3 4 Project A…

A: The net present value (NPV) method estimates how much a potential project will contribute to…

Q: Blue Square's Stock price and dividend history are as follows: Year Beginning Year Price Dividend…

A: The average return on a stock is calculated using the arithmetic return, which does not take…

Q: Elaborate on how, by analysing a firm’s financial statements, risks can be identified?

A: Risk identification is said to be the most important part in order to analyse your risk and hence…

Q: ing investing in a project that will cost $160,700 and have no salvage value at the end o s…

A: Annuity is a series of equal payment at equal interval for a specified period. Present value of…

Q: Daysha bought a house with a mortgage of $395,100. The mortgage is being financed with an interest…

A: We need to use NPER function in excel to calculate number of payments in both ordinary annuity and…

Q: Ivanna is leasing a car originally valued at $37,010. The lease is being financed with an interest…

A: Monthly payments carry the payment for interest and also payment for lease payments also and these…

Q: Consider a home mortgage of $150,000 at a fixed APR of 6% for 30 years. a. Calculate the monthly…

A: To calculate the monthly payment for a mortgage, we can use the formula for the fixed monthly…

Q: You have been provided the following data on the securities of three firms, the market portfolio,…

A: By using the below equation we calculate the missing figures for different stocks. Correlation…

Q: What is the purpose of a budget in financial management?

A: Financial management refers to the process of planning, organizing, directing, and controlling the…

Q: Loaded-Up Fund charges a 12b-1 fee of 1% and maintains an expense ratio of 0.90%. Economy Fund…

A: A no-load fund is a mutual fund in which shares are sold without a commission or Sales Charges. This…

Q: Consider a $25,000, three-year loan at an interest rate of 5%, payments to be made monthly. What is…

A: Monthly payment in the case of the add-on interest method can be computed by dividing the loan…

Q: Suppose the spot and three-month forward rates for the yen are ¥79.70 and ¥79.04, respectively. b.…

A: Data given: Spot rate=¥ 79.70 3 months forward rate=¥ 79.04

Q: What are some benefits of a portfolio that is internationally diversified? Discus.

A: An internationally diversified portfolio is a collection of investments that includes assets from…

Q: Which one of the following transactions occurred in the primary market? O Telstra Inc. sold 1000…

A: Companies who have never traded a new securities on an exchange do so on the primary market. A…

Q: Problem 11-1 Stock Market History (LO1) Use the data in the tables below to answer the following…

A: A treasury bill is a kind of debt security issued by the government and private companies for…

Q: The expected return according to CAPM is: OA. 13.2% OB. 14.3% OC. 19.8 % OD. 18.6% OE 12.0% OF.…

A: Capital Asset Pricing Model (CAPM) provides the relation to determine the expected return on the…

Q: Problem 11-1 Stock Market History (L01) Use the data in the tables below to answer the following…

A: Businesses examine possible significant projects or expenditures using the capital budgeting…

Q: Technical analysis' goal? Explain how technicians utilise it to enhance investment timing.

A: Technical analysis is a methodology for studying and predicting price movements by looking at…

Q: QUESTION 2 Using the following information, calculate the price of a 12-month long call option using…

A: A call option refers to a derivative instrument that provides its holder the choice of purchasing…

Q: Use the data in the tables below to answer the following questions: Average rates of return on…

A: Businesses examine possible significant projects or expenditures using the capital budgeting…

Q: Returns of a Single Asset. Suppose you have invested in 2 assets whose annual returns are shown in…

A: Data given: Asset A Asset B Year Annual Return Year Annual Return 1 -6.01% 1 -9.98% 2…

Q: Golden Rule. Under the gold standard, the price of an ounce of gold in U.S. dollars was $ 20.62,…

A: Under the gold standard, exchange rate between 2 countries is defined in terms of gold. We can…

Q: Someone needs to borrow $14,000 to buy a car and the person has determined that monthly payments of…

A: Loans represent the amount provided by the lender to the borrower. The borrower makes periodic…

Q: Draw the position diagram for the straddle.

A: Straddle is an option strategy you use when you expect a high change in price of the stock but not…

Q: you are buying a house and will borrow $225,000 on a 30-year fixed reate mortgage with monthly…

A: Monthly payment refers to an amount that is paid at every month for the repayment of loan amount by…

Q: a. What are your required monthly payments? The required monthly payment is $ 192.57. (Do not round…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: How risk management framework can help customers if the bank is going through a financial crisis

A: Banks and other financial institutions play a vital role in the economic growth of any country. Risk…

Q: Selected financial data for Amberjack Corporation follows. Sales Cost of goods sold Net income Cash…

A: Ratio analysis is a financial analysis technique used to evaluate the performance, liquidity,…

Q: The yield on a 15-year TIPS is 3% and the yield on a 15-year Treasury bond is 5%. What is the…

A: Inflation premium means additional return investors demand to compensate for expected inflation over…

Q: Sulzer Metco Corp purchased a new coating machine to improve performance of its power supply panels.…

A: The required rate of return, also known as the hurdle rate or minimum acceptable rate of return, is…

Q: A manufacturer is considering investing in a new production line that requires an initial capital…

A: This can be solved using the Hit and Trial method to find the IRR. Under this method, we calculate…

Q: Calculating Enterprise Value All figures in USD thousands unless stated Levered free Cashflow Debt…

A: Enterprise value refers to the company's value including the current share price and cost of paying…

Q: F-i-n-a-n-c-i-a-l- -M-a-r-k-e-t M-o-n-e-y- -M-a-r-k-e-t- -a-n-d- -C-a-p-i-t-a-l- -M-a-r-k-e-t…

A: Dear Student, As per answering guidelines, I am providing the solution to only first 3 subparts.…

Q: CAN U PLEASEE PLEASE PLEASE HELP ME WITH THISS 21. A bank recently loaned $18,204.00 to buy a car.…

A: Present Value is the Cumulative Value of interest and Principal being paid in instalments at future…

Q: Suppose you own a mutual fund that has 10,311,515 shares outstanding. If its total assets are…

A: NAV = (Total Assets - Total liabilities) / No of units Total Assets = $36,600,019 Total liabilities…

Q: How much would $300 invested at 4% interest compounded monthly be worth after 8 years? Round your…

A: Compound = Monthly = 12 Present Value = pv = $300 Interest rate = r = 4 / 12 % Time = t = 8 * 12 =…

Step by step

Solved in 3 steps

- On January 1,2015, Nathan Co paid 6,000 cash to acquire a put foreign exchange option FC37,500 which expires at the end of the year. The option hedges 2015's forecasted sales of FC37,500.Nathan's fiscal year ends every October 31. 1/1/15 10/31/15 12/31/15Spot rate ( market price) 1.45. 1.20 1.30Strike price (exercise price) 1.40 1.40 1.40Fair value of put action 6,000 25,250 Determine the intrinsic value at inception of the option contract.12,7504,1256,0000At the close of business on December 31, 2021 Tempest Corp pays a $80,000 premium to purchase a foreign currency option giving Tempest the right but not the obligation to purchase 100,000 euros and sell $130,000 US dollars in six months as a hedge of a future euro rental obligation. What is reported on the balance sheet at December 31, 2021 (in US dollars) asset of $0 asset of $80,000 asset of $210,000 liability of $110,000 liability of $130,000On June 1, 2017, Micro Corp. received an order for parts from a Mexican customer at a price of 1,000,000 Mexican pesos with a delivery date of July 31, 2017. On June 1, when the U.S. dollar–Mexican peso spot rate is $0.115, Micro Corp. entered into a two month forward contract to sell 1,000,000 pesos at a forward rate of $0.12 per peso. Micro designates the forward contract as a fair value hedge of the firm commitment to receive pesos, and the fair value of the firm commitment is measured by referring to changes in the peso forward rate. Micro delivers the parts and receives payment on July 31, 2017, when the peso spot rate is $0.118. On June 30, 2017, the Mexican peso spot rate is $0.123, and the forward contract has a fair value of $2,400. What is the net impact on Micro’s net income for the quarter ended June 30, 2017, as a result of this forward contract hedge of a firm commitment?a. $–0–.b. $2,400 increase in net income.c. $4,000 decrease in net income.d. $8,000 increase in net…

- On June 1, 2017, Micro Corp. received an order for parts from a Mexican customer at a price of 1,000,000 Mexican pesos with a delivery date of July 31, 2017. On June 1, when the U.S. dollar–Mexican peso spot rate is $0.115, Micro Corp. entered into a two month forward contract to sell 1,000,000 pesos at a forward rate of $0.12 per peso. Micro designates the forward contract as a fair value hedge of the firm commitment to receive pesos, and the fair value of the firm commitment is measured by referring to changes in the peso forward rate. Micro delivers the parts and receives payment on July 31, 2017, when the peso spot rate is $0.118. On June 30, 2017, the Mexican peso spot rate is $0.123, and the forward contract has a fair value of $2,400.What is the net impact on Micro’s net income for the quarter ended September 30, 2017, as a result of this forward contract hedge of a firm commitment? Choose the correct.a. $–0–.b. $115,000 increase in net income.c. $118,000 increase in net…On June 1, 2017, Micro Corp. received an order for parts from a Mexican customer at a price of 1,000,000 Mexican pesos with a delivery date of July 31, 2017. On June 1, when the U.S. dollar–Mexican peso spot rate is $0.115, Micro Corp. entered into a two month forward contract to sell 1,000,000 pesos at a forward rate of $0.12 per peso. Micro designates the forward contract as a fair value hedge of the firm commitment to receive pesos, and the fair value of the firm commitment is measured by referring to changes in the peso forward rate. Micro delivers the parts and receives payment on July 31, 2017, when the peso spot rate is $0.118. On June 30, 2017, the Mexican peso spot rate is $0.123, and the forward contract has a fair value of $2,400.What is Micro’s net increase or decrease in cash flow from having entered into this forward contract hedge? Choose the correct.a. $–0–.b. $1,000 increase in cash flow.c. $1,500 decrease in cash flow.d. $2,000 increase in cash flow.On May 1, 2019, LAG Co. purchased a short-term P2,000,000 face value, 9% debt instruments for P1,860,000 including the accrued interest and classified it as a trading security. The debt instruments mature on January 1, 2022, and pay interest semi-annually on January 1 and July 1. On December 31, 2019, the fair market value of the instruments is 98%. On March 2, 2020, LAG Co. sold the trading security for P1,980,000. 31. How much will be recognized as gain (loss) on sale of trading security on 2020 income statement? a. (P10,000) b. P20,000 c. P120,000 d. P150,000

- Q4 An analyst holds a set of forward contracts on euro, against usd (=hc). Compute the fair value of the contracts.(a) Purchased: eur 1m 60 days (remaining). Historic rate: 1.350; current rate for same date: 1.500; risk-free rates (simple per annum): 3% in usd, 4% in euro. (b) Purchased: eur 2.5m 75 days (remaining). Historic rate: 1.300; current spot rate: 1.5025; risk-free rates (simple per annum): 3% in usd, 4% in euro. (c) Sold: eur 0.75m 180 days (remaining). Historic rate: 1.400; current rate for same date: 1.495; risk-free rates (simple per annum): 3% in usd, 4% in euro.On May 1, 2020, GAL Co. purchased a short-term P2,000,000 face value, 9% debt instruments for P1,860,000 including the accrued interest and classified it as a trading security. The debt instruments mature on January 1, 2023, and pay interest semi-annually on January 1 and July 1. On December 31, 2020, the fair market value of the instruments is 98%. On March 2, 2021, GAL Co. sold the trading security for P1,980,000. How much will be recognized as income on the 2020 income statement? a. P100,000 b. P120,000 c. P160,000 d. P280,000 e. answer not givenOn January 1, GEN enters into a contract with LORD for the sale of a high-end security scanner for P630,000. The contract includes a put option the obliges GEN to repurchase the scanner machine from LORD for P567,000 on or before December 31. The market value is expected to be P495,000 on December 31. LORD pays GEN P630,000 on January 1. The transaction should be accounted for as a:A. Sale C. No sale/leaseB. Lease D. Cannot be determined PLEASE SHOW HOW THE ANSWER WAS FORMULATED WITH COMPLETE SOLUTION IN GOOD ACCOUNTING FORM.

- Zoro Company enters into a contract to sell Product A and Product B on July 1, 2020 for an upfront cash payment of P250,000. Product A will be delivered at the end of the year, and Product B will be delivered the following year. Zoro Company sells Product A for P80,000 and Product B for P240,000. 1. How many performance obligations are there in the contract? 2.what is the transaction price? 3.how much is revenue to be recognized in 2020? 4. how much is revenue to be recognized in 2021?. On December 31, 2020, SSNIT and SIC (non-life) entered into a six year swap arrangement with first payment to be exchanged on December 31st, 2022 and each December 31st thereafter under the following terms: SIC will pay SSNIT an amount equals to 5% per annum on a notional principal of US$50 million. (FIXED Amount) SSNIT will pay SIC an amount equals to one-year LIBOR +1.25% per annum on a notional amount of US$50 million. (Flexible Amount). On 31stDecember 2022, one-year LIBOR is projected to be 2.75%. What will be the payment flows for the first year, December 31st?ABC Company Ltd purchased 5000 cocoa futures contract at a price of $150per contract. As part of the contract, ABC was required to deposit $10 percontract initially in their account with the maintenance margin set at $5 percontract. If the price per contract falls to $142 overnight, what action will theexchange require ABC to undertake?