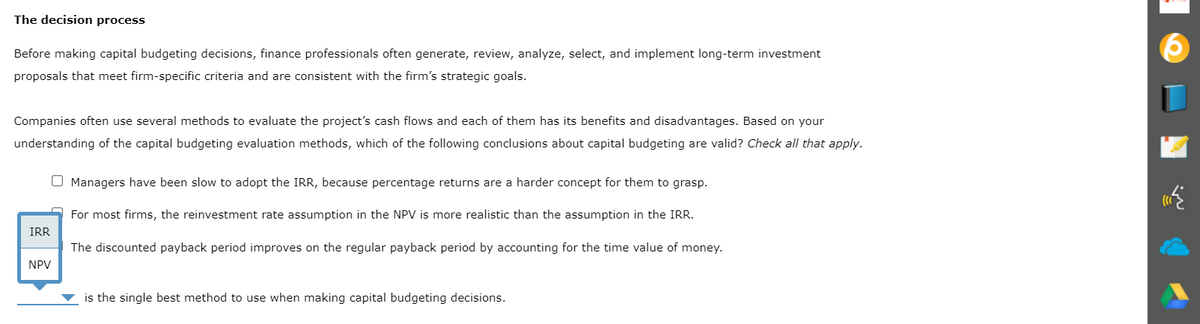

The decision process Before making capital budgeting decisions, finance professionals often generate, review, analyze, select, and implement long-term investment proposals that meet firm-specific criteria and are consistent with the firm's strategic goals. Companies often use several methods to evaluate the project's cash flows and each of them has its benefits and disadvantages. Based on your understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check all that apply. O Managers have been slow to adopt the IRR, because percentage returns are a harder concept for them to grasp. For most firms, the reinvestment rate assumption in the NPV is more realistic than the assumption in the IRR. IRR The discounted payback period improves on the regular payback period by accounting for the time value of money. NPV is the single best method to use when making capital budgeting decisions.

The decision process Before making capital budgeting decisions, finance professionals often generate, review, analyze, select, and implement long-term investment proposals that meet firm-specific criteria and are consistent with the firm's strategic goals. Companies often use several methods to evaluate the project's cash flows and each of them has its benefits and disadvantages. Based on your understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check all that apply. O Managers have been slow to adopt the IRR, because percentage returns are a harder concept for them to grasp. For most firms, the reinvestment rate assumption in the NPV is more realistic than the assumption in the IRR. IRR The discounted payback period improves on the regular payback period by accounting for the time value of money. NPV is the single best method to use when making capital budgeting decisions.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 2MCQ: To make a capital investment decision, a manager must a. estimate the quantity and timing of cash...

Related questions

Question

100%

Transcribed Image Text:The decision process

Before making capital budgeting decisions, finance professionals often generate, review, analyze, select, and implement long-term investment

proposals that meet firm-specific criteria and are consistent with the firm's strategic goals.

Companies often use several methods to evaluate the project's cash flows and each of them has its benefits and disadvantages. Based on your

understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check all that apply.

O Managers have been slow to adopt the IRR, because percentage returns are a harder concept for them to grasp.

For most firms, the reinvestment rate assumption in the NPV is more realistic than the assumption in the IRR.

IRR

The discounted payback period improves on the regular payback period by accounting for the time value of money.

NPV

is the single best method to use when making capital budgeting decisions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning