the defective units was $110,000. Instructions: a. Prepare a journal entry to accrue for the estimated warranty costs for the November and December sales at December 31, 2021. b. Prepare one summary journal entry at December 31, 2021 to record the cost of replacing the defective cell phones returned during November and December. c. What amounts will be included in Carrot's 2021 income statement and balance sheet at December 31, 2021, with regard to the warranty? Round amounts to the nearest dollar, Show ALL calculations for full marks.

the defective units was $110,000. Instructions: a. Prepare a journal entry to accrue for the estimated warranty costs for the November and December sales at December 31, 2021. b. Prepare one summary journal entry at December 31, 2021 to record the cost of replacing the defective cell phones returned during November and December. c. What amounts will be included in Carrot's 2021 income statement and balance sheet at December 31, 2021, with regard to the warranty? Round amounts to the nearest dollar, Show ALL calculations for full marks.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.4AP

Related questions

Question

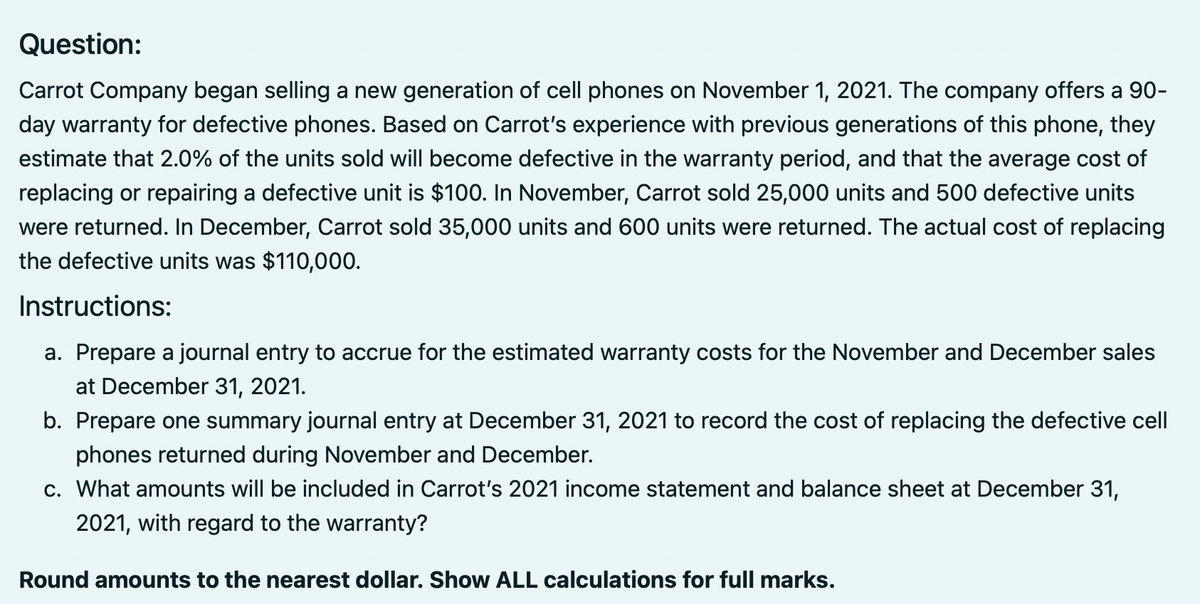

Transcribed Image Text:Question:

Carrot Company began selling a new generation of cell phones on November 1, 2021. The company offers a 90-

day warranty for defective phones. Based on Carrot's experience with previous generations of this phone, they

estimate that 2.0% of the units sold will become defective in the warranty period, and that the average cost of

replacing or repairing a defective unit is $100. In November, Carrot sold 25,000 units and 500 defective units

were returned. In December, Carrot sold 35,000 units and 600 units were returned. The actual cost of replacing

the defective units was $110,000.

Instructions:

a. Prepare a journal entry to accrue for the estimated warranty costs for the November and December sales

at December 31, 2021.

b. Prepare one summary journal entry at December 31, 2021 to record the cost of replacing the defective cell

phones returned during November and December.

c. What amounts will be included in Carrot's 2021 income statement and balance sheet at December 31,

2021, with regard to the warranty?

Round amounts to the nearest dollar. Show ALL calculations for full marks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College