Concept explainers

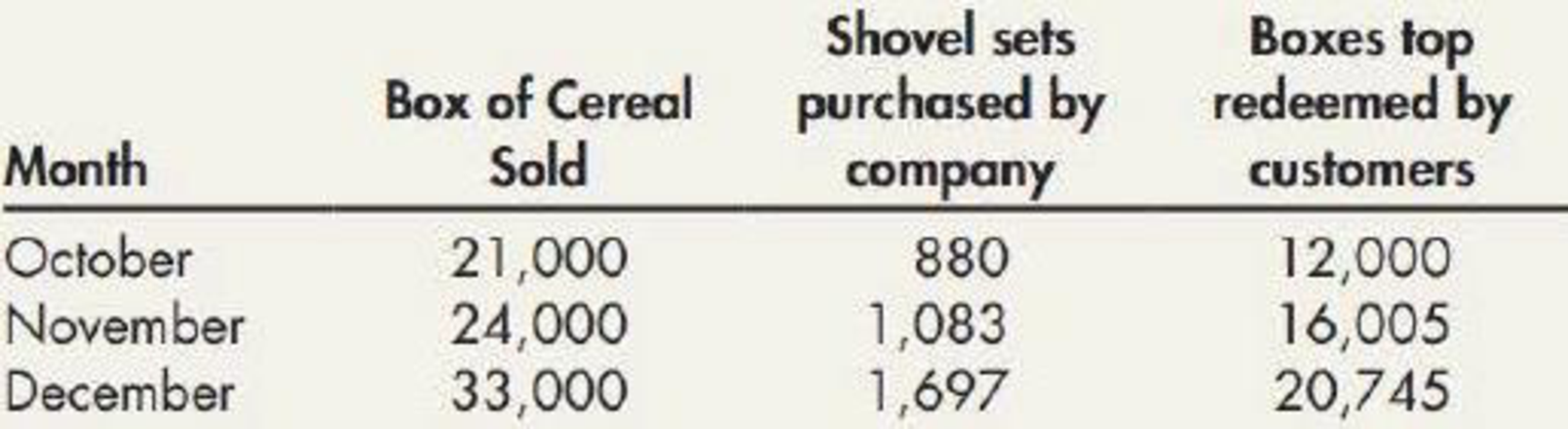

Premium Obligation Yummy Cereal Company is offering one toy shovel set for 15 box tops of its cereal. Year-to-date sales have been off, and it is hoped that this offer will stimulate demand. Each shovel set costs the company $3. The following data are available for the last 3 months of 2019:

It is estimated that only 70% of the box tops will be redeemed. The cereal sells for $2.80 per box.

Required:

- 1. Prepare

journal entries for each month to record sales, shovel set purchases, and redemptions. - 2. Assuming Yummy prepares monthly financial statements, indicate how the inventory of premiums and the estimated liability would be disclosed on Yummy’s ending balance sheets for October, November, and December.

1.

Prepare the journal entry to record the sales, shovel set purchases and redemption for each month in the books of Company YC.

Explanation of Solution

Prepare the journal entry to record the sales made during October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Cash or Accounts receivable | 58,800 | |

| Sales | 58,800 | ||

| (To record the sale of 21,000 cereal boxes) |

Table (1)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Inventory of premiums | 2,640 | |

| Cash | 2,640 | ||

| (To record the purchase of toy shovel sets) |

Table (2)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Premium expenses (2) | 2,940 | |

| Estimated premium liability | 2,940 | ||

| (To record the recognition of estimated premium liability) |

Table (3)

Working note (1):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in October 2019 (A) | 21,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | 14,700 |

Table (4)

Working note (2):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 12,000 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (3) | 2,400 | |

| Inventory of premiums | 2,400 | ||

| (To record the redemption of 12,000 top boxes of cereals) |

Table (5)

Working note (3):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during November:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Cash or Accounts receivable | 67,200 | |

| Sales | 67,200 | ||

| (To record the sale of 24,000 cereal boxes) |

Table (6)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Inventory of premiums | 3,249 | |

| Cash | 3,249 | ||

| (To record the purchase of toy shovel sets) |

Table (7)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (4) | 3,360 | |

| Estimated premium liability | 3,360 | ||

| (To record the recognition of estimated premium liability) |

Table (8)

Working note (3):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in November 2019 (A) | 24,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $16,800 |

Table (9)

Working note (4):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 16,005 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (5) | 3,201 | |

| Inventory of premiums | 3,201 | ||

| (To record the redemption of 16,005 top boxes of cereals) |

Table (10)

Working note (5):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during December:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Cash or Accounts receivable | 92,400 | |

| Sales | 92,400 | ||

| (To record the sale of 33,000 cereal boxes) |

Table (11)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Inventory of premiums | 5,091 | |

| Cash | 5,091 | ||

| (To record the purchase of toy shovel sets) |

Table (12)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (7) | 4,620 | |

| Estimated premium liability | 4,620 | ||

| (To record the recognition of estimated premium liability) |

Table (13)

Working note (6):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in December 2019 (A) | 33,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $23,100 |

Table (14)

Working note (7):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 20,475top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (8) | 4,149 | |

| Inventory of premiums | 4,149 | ||

| (To record the redemption of 20,475 top boxes of cereals) |

Table (15)

Working note (8):

Calculate the amount of estimated premium liability:

2.

Indicate the way in which the inventory of premiums and the estimated liability would be disclosed in the ending balance sheets of Company YC for the months October, November and December.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

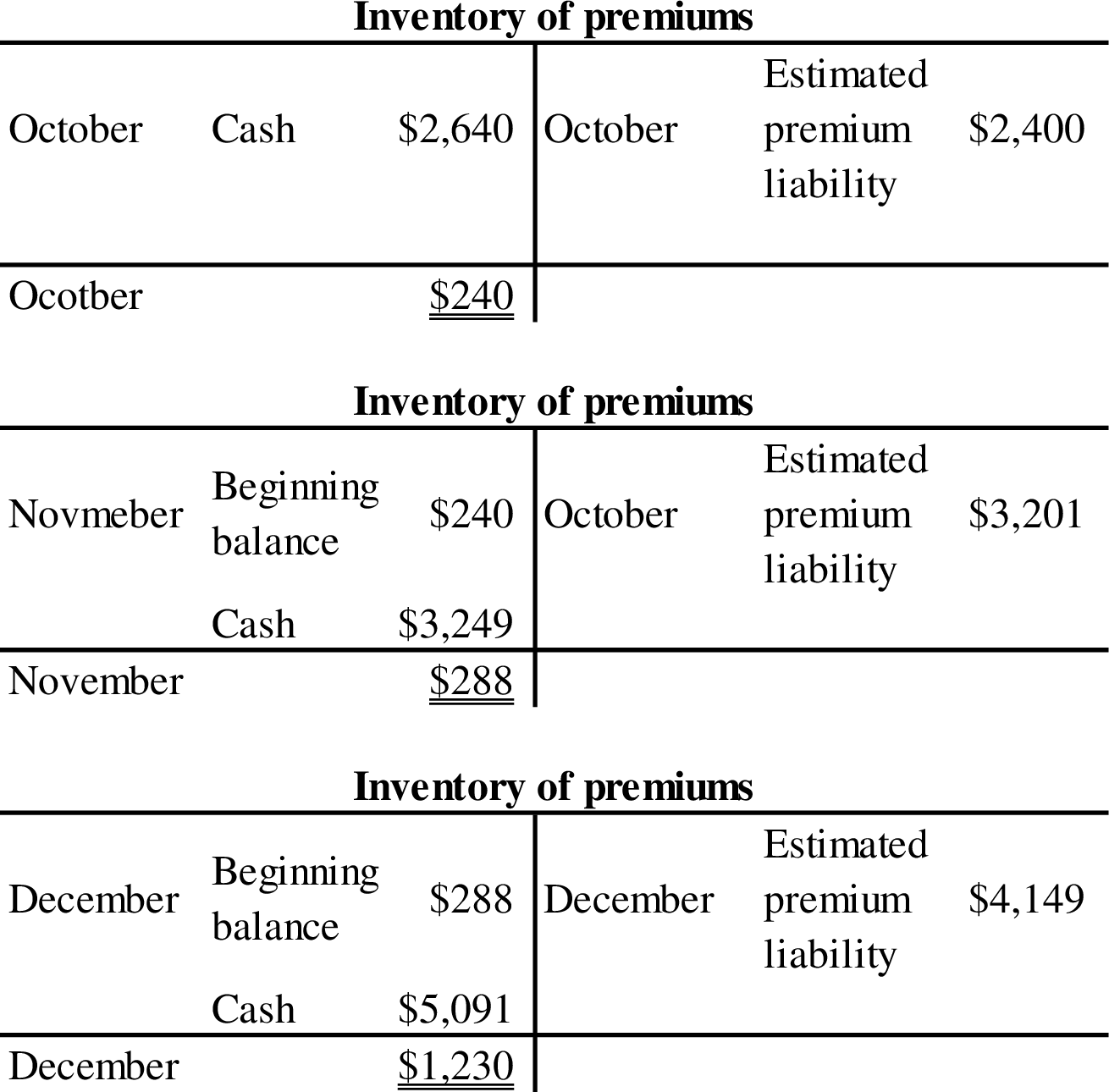

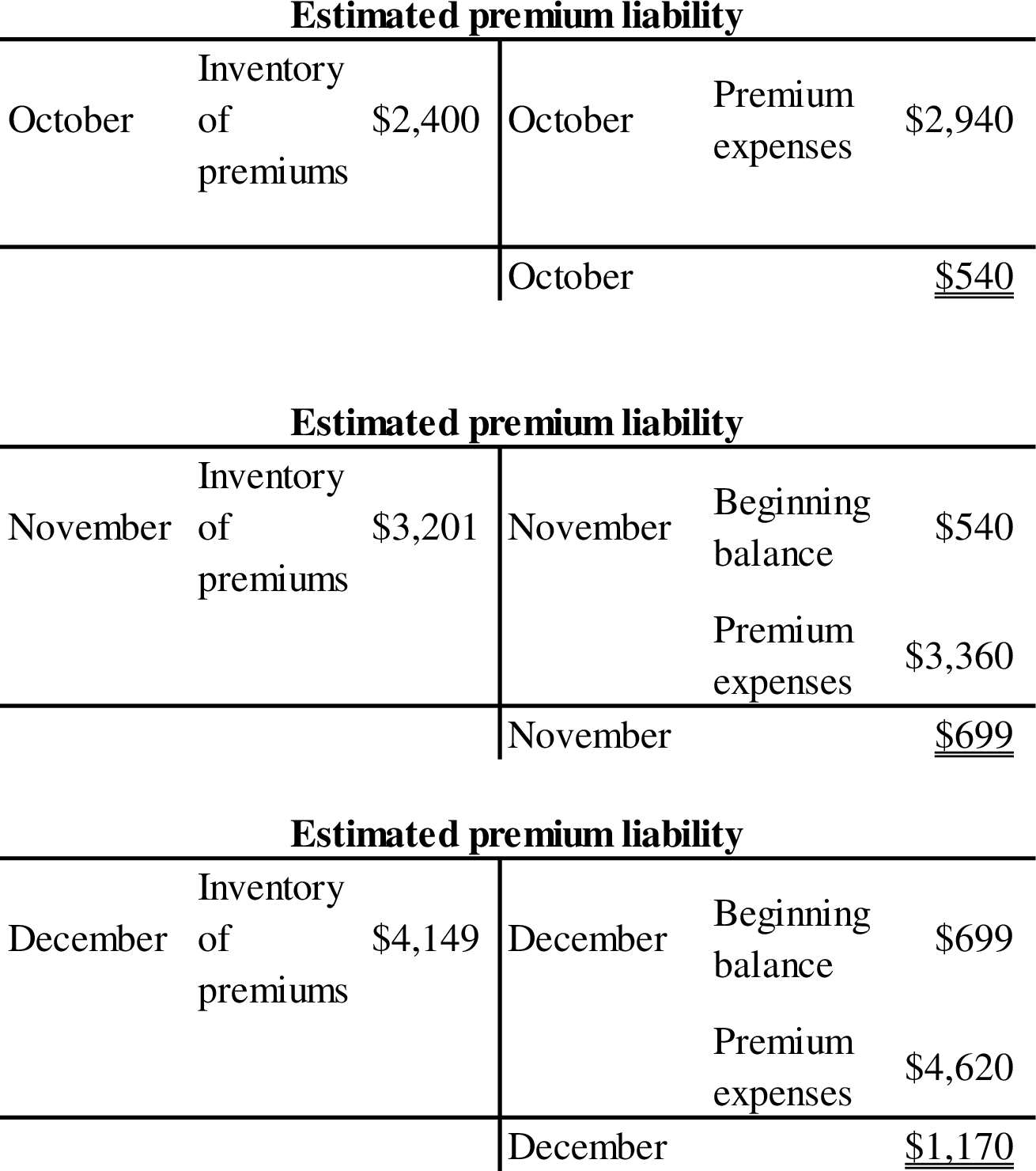

Prepare the partial balance sheet to record the inventory of premiums and the estimated liability:

| Company YC | |||

| Balance Sheet Statement (Partial) | |||

| At The End of | |||

| Assets | October | November | December |

| Current assets: | |||

| Inventory of premiums | $240 | $288 | $1,230 |

| Liabilities | October | November | December |

| Current liabilities: | |||

| Estimated premium liability | $540 | $699 | $1,170 |

Table (16)

Prepare the T-accounts to determine the estimated premium liability and inventory of premiums:

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Accounting: Reporting And Analysis

- Cash Rebates On January 1, 2020, Fro-Yo Inc. began offering customers a cash rebate of 5.00 if the customer mails in 10 proof-of-purchase labels from its frozen yogurt containers. Eased on historical experience, the company estimates that 20% of the labels will be redeemed. During 2020, the company sold 5,000,000 frozen yogurt containers at 1 per container. From these sales, 800,000 labels were redeemed in 2020, 150,000 labels were redeemed in 2021, and the remaining labels were never redeemed. Required: 1. Prepare the journal entries related to the sale of frozen yogurt and the cash rebate offer for 2020 and 2021. 2. Next Level Assume that 300,000 labels were redeemed in 2021. Prepare the journal entries related to the cash rebate offer for 2021.arrow_forwardAirplanes Unlimited purchases airplane parts from a supplier on March 19 at a quantity of 4,800 parts at $12.50 per part. Terms of the purchase are 3/10, n/30. Airplanes pays one-third of the amount due in cash on March 30 but cannot pay the remaining balance due. The supplier renegotiates the terms on April 18 and allows Airplanes to convert its purchase payment into a short-term note, with an annual interest rate of 9%, payable in six months. Show the entries for the initial purchase, the partial payment, and the conversion.arrow_forwardInstallment Sale Baileys Billiards sold a pool table to Sheri Sipka on October 31, 2020. The terms of the sale are no money down and payments of $50 per month for 30 months, with the first payment due on November 30, 2020. The table they sold to Sipka cost Baileys $800, and Bailey uses a perpetual inventory system. Baileys uses an interest rate of 12% compounded monthly (1% per month). Required: Note: Round answers to two decimal places. 1. Prepare the cash flow diagram for this sale. 2. Calculate the amount of revenue Baileys should record on October 31, 2020. 3. Prepare the journal entry to record the sale on October 31. Assume that Baileys records cost of goods sold at the time of the sale (perpetual inventory accounting). 4. Determine how much interest income Baileys will record from October 31, 2020, through December 31, 2020, 5. Determine how much Baileys 2020 income before taxes increased by this sale.arrow_forward

- Subscriptions Horse Country Living publishes a monthly magazine for which a 12-month subscription costs $30. All subscriptions require payment of the full $30 in advance. On August 1, the balance in the Subscriptions Received in Advance account was $40,500. During the month of August, the company sold 900 yearly subscriptions. After the adjusting entry at the end of August, the balance in the Subscriptions Received in Advance account is $60,000. Required Prepare the journal entry to record the sale of the 900 yearly subscriptions during the month of August. Prepare the adjusting journal entry on August 31. Assume that the accountant made the correct entry during August to record the sale of the 900 subscriptions but forgot to make the adjusting entry on August 31. Would net income for August be overstated or understated? Explain your answer.arrow_forwardUnearned Sales Revenue Brand Landscaping offers a promotion where a customers lawn will be mowed 20 times if the customer pays $700 in advance. Required: Prepare the journal entry to record (1) the customers' prepayment of S700 and (2) Brands mowing of the lawn one time.arrow_forwardGear Up Co. pays 65% of its purchases in the month of purchase, 30% in the month after the purchase, and 5% in the second month following the purchase. What are the cash payments if it made the following purchases in 2018?arrow_forward

- PROBLEM: On August, 2019, HBO consigned to GEO 10 laptops costing $15,000 each, paying freight charge of $15,000. At the end of the month, GEO reported sales of 6 handbags at $30,000 each and incurred expenses of $12,500 and remitted the net proceeds due to HBO after deducting a 20% commission on the sales price. REQUIREMENT: How much net income did HBO realize in August on the consignment? A. 37,500 income. B. 32,500 income C. 33,500 loss D. 32,500 loss What is the total cost of inventory of the unsold handbags A. 60,000 B. 66,000 C. 71,000 D. 75,000 THANK YOU SO MUCH IN ADVANCE FOR THE HELP :)arrow_forwardSweet Dates Company offers a premium to its customers—a glass bowl (cost to Sweet Dates is $0.90) upon return of 40 coupons. Two coupons are placed in each box of dates sold. The company estimates, on the basis of past experience, that only 70% of the coupons will ever be redeemed. During 2019, 10 million boxes of dates are sold at $0.30 each. Eight million coupons are redeemed during 2019. Sweet Dates purchased 360,000 glass bowls for the plan on January 1, 2019. Required: 1. Prepare the journal entries related to the sale of dates and the premium plan in 2019. 2. Show how the preceding items would be reported on the December 31, 2019, balance sheet.arrow_forwardABC sells products to customers with a warranty. Customers can return the products to ABC for a free replacement within 90 days of purchase. During April 2022, ABC sold 1,500 products to customers. During May, ABC sold 1,800 products to customers. Based on past sales, ABC estimates that 5% of all products sold will be returned for a free replacement. The products cost ABC $20 to produce and they are sold for $35 per item. During April, 100 products were returned and during May, 120 items were returned. As of March 31, 2022, ABC's Warranty Liability had a credit balance of $12,000. If ABC had an inventory balance of $80,000 on March 31, 2022, what should the inventory balance be on April 30, 2022? No purchases of inventory were made during April or May, 2022. Please enter all amounts as a positive number with no dollar signs or commas. For example, if the answer is $2,100, enter 2100. THE ANSWER IS NOT : 49800 , 30000 , 14880 , 48000arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College