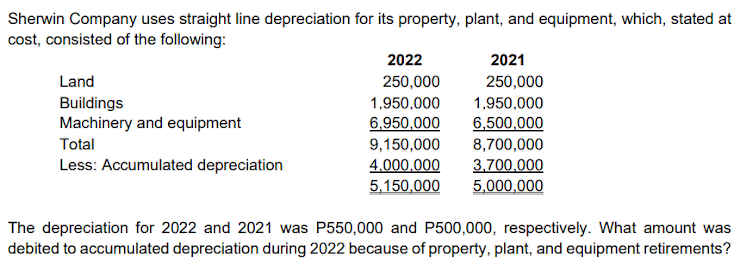

The depreciation for 2022 and 2021 was P550,000 and P500,000, respectively. What amount was debited to accumulated depreciation during 2022 because of property, plant, and equipment retirements?

Q: Manual, what method is used in computing the ending inventory of materials and supplies? First-in,…

A: there are different methods available for valuation of the inventory is available. for most of the…

Q: 00,000 d revenue from subscri

A: The deferred revenues from subscriptions account accounts for subscription fees which was received…

Q: 3.Unadjusted Trial Balance

A: Answer:

Q: e Php 1,150,000.00 and Php 500,000.00, respectively. She opted to avail of the 8% preferential…

A: Income tax payable is a type of account in the current liabilities area of a company's balance…

Q: Ephrayim Oil and Gas Company abandoned a proved property late in 2020. Costs relating to the…

A: Given: - Particulars Amount Proved Property 2,150,000 Wells and Equipment 1,750,000…

Q: Swifty Company uses the perpetual inventory system and the moving-average method to value…

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods…

Q: Please prepare the following reports: 1.General Journal 2.General Ledger

A: General Ledger is the ledger in which the accounts of the transactions which are involved are…

Q: rue or False: Sarah is a manager who pays workers less than what they deserve because she knows they…

A: Any action can be termed as illegal only when it is against the law. An unethical action that is not…

Q: [The following information applies to the questions displayed below.] Cane Company manufactures two…

A: Contribution margin is the difference between sales and variable cost where as net profit is the…

Q: Gahen Coporon ha 000 cato of orarg thteere haved ata prce of S4SO The inoeme cont of $00 The orarge…

A: Incremental gain = $49,850 - $33,520 = $16,330 Incremental cost = $12,775

Q: On November 15, 2021, Trade Company made payments for the following expenditures: Replacement…

A: Solution Concept The expenditures which increases the life of the assets and the operating…

Q: Cullumber Corporation is about to issue $1.120,000 of 9-year bonds that pay a 5% annual interest…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: The statement of financial position for the partnership of AA, BB and CC who share profits in the…

A: Partnership is a formal arrangement by two or more parties to manage and operate a business and…

Q: The following information on a de fined benefit plan is provided: FVPA, beg 2,800,000 PVOBO, beg…

A: Employees of the entity are given with a defined benefit plan after they have retired from service.…

Q: 17. Most lease agreements between landlords and tenants are classified as an estate for years. True…

A: Leasehold estate is an ownership of a temporary right to hold land or property in which a lesser or…

Q: Ramos, Inc. began work in 2017 on contract #3814. The contract price is $7,200,000. The contract is…

A: The gross profit and revenue are recognised on the basis of percentage of the work completed during…

Q: Sales Cost of Sales Gross Profit Operating Expenses (b) Net Income P75,000 (a) P40,000 P17,000

A: Formula used for Cost of sales: Cost of sales = Sales - Gross profit.

Q: Cost of service 3,000,000 Stockholders’ Equity 5,000,000 Gross profit 2,000,000…

A: A tax liability is the total amount of tax debt owed by an individual, corporation, or other entity…

Q: Marvin's profit plan for the year included budgeted direct labor of P320,000 and factory overhead of…

A: solution concept The overhead are generally applied using the budgeted information At the end of the…

Q: S1: Abnormal spoilage is considered a period cost. S2: Backflush costing requires fewer allocations…

A: Product cost are direct cost in producing the product. Period cost is indirect cost of the product.…

Q: Loren Company uses many kinds of machines in operations. The entity acquires some machines from…

A: Note: Insurance costs incurred on the machine for the transit to the destination are only…

Q: hich one of the following statements about revenue is not correct? A. Revenue can result in…

A: Revenue is the amount of money earned on account of sale of goods or rendering of services.

Q: Debit Credit ash $14,000 upplies 2,000

A: Adjusting entries are adjusting entries to be made to journal entries for changes to income and…

Q: 4. For the year ended December 31, 2008, Carter would recognize gross profit from contract # 3814 in…

A: Under percentage of completion method revenue is calculated on the basis of the percentage of cost…

Q: Which of the following types of messages might the Active Auditor display? Question 9 options:…

A: The active auditor display is a tool used by the auditor while carrying out the audit procedures. It…

Q: 9- The direct costs are: a. apportioned to products/centres b. absorbed by products c. traced to…

A: Cost is normally categorised as a direct cost and indirect cost. Direct costs are those cost that is…

Q: n additional shares of common stock. shares of common stock after July 1, 202 harket price of…

A: Earnings per share are the earnings of the company that is held in hands of the each shareholder of…

Q: 1. Describe the quality of following types of evidence giving two examples of each form of evidence…

A: An auditor verifies the accuracy of reported business transactions. Auditors are responsible for…

Q: Labi Company reported a net loss of $13,000 for the year ended December 31, 2021. During the year,…

A: Operating activities means the procedures occurred in the daily running of the business.

Q: Ferkil Corporation manufacturers a single product that has a selling price of $100 per unit. Fixed…

A: Formula: Required sales units to earn a target profit = ( Fixed cost + target profit ) / Unit…

Q: 3. A project requires an initial investment of $1,000,000 and generates annual income of $300,000…

A: Depreciation Accounting is the method of debiting the cost of an asset and crediting it to a…

Q: 3. Assume that on January 1, 2018, the company received a new estimate that the mine now contained…

A: Answer:- 3 Journal entry:- Date Particulars Amount (Dr.) Amount (Cr.) January 1 2018…

Q: 18,526 23. If the step method of allocation is used, how much would be allocated from supervision to…

A: Overhead means the amount of expenses incurred indirectly to produce the goods. These expenses can…

Q: at is the income tax due if X corporation is a regular domestic corporation? P75,000 P60,000…

A: Domestic corporation are subjected to corporate tax rate and also depending on assets held by them…

Q: The amortization of prior service costs will affect the pension expense for the period along with…

A: solution for above requirement are as follows

Q: e just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door ope The…

A: Activity variances are based on Budgeted amounts at the planned level and budgeted amounts at the…

Q: On January 1, 2021, Tonge Industries had outstanding 540,000 common shares ($1 par) that originally…

A: Basic earnings per share: - Basic EPS measures how much a business earns per share without going…

Q: 5. Compute the following financial ratios for 2015 and 2016 and interpreting the results in the…

A: as per the guidelines we can provide the answer for 3 sub part ( first 3) of any question . answer…

Q: 3. ABC Company designated residential property for the use of its managerial employee. The lot has…

A: calculation of quarterly monetary value are as follows

Q: Answer the following questions correctly. 1. What is the treatment of a delinquent subscription?

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: 16. This is a joint tenancy between husband and wife where each person owns the property in its…

A: Ans. C Tenants by the Entirety

Q: 2. A man invested P10,000 in 2 years earning an interest of P1,600. What was the interest rate…

A: Simple interest is the interest charged on the amount of investment using a flat rate.

Q: Below are summary numbers for 2020 and 2021 for S-Mart Ltd. (in million dollars). 2020 2021e…

A: Free cash flow- FCF (free cash flow) is a measure of how much cash a company generates after…

Q: 2. Jerson, married, 15 dependents, had the following income within and outside the Philippines:…

A: The Philippines taxes its resident citizens on their income from worldwide whereas the non- resident…

Q: On January 1, 2018, Allgood Company purchased equipment and signed a six =year mortgage note for…

A: For calculating interest expense, we will need to make amortization schedule of loan over a period…

Q: For fiscal year 2021, ABC Corporation, a retailer, has Pl.4 billion in gross sales, P560 million in…

A: The amount of income tax due is the difference between the net income received and the amount paid…

Q: . Briefly explain the major components of AIS

A: Accounting information systems: Accounting information system is an integrated that collects,…

Q: (a) A chemical process has a normal wastage of 10% of input. In a period, 2,500bags of material were…

A: Normal wastage is the inherent loss in the process of operations. Abnormal loss is the loss suffered…

Q: Momix Corp. has two divisions, King and Queen. King produces a widget that Queen could use in its…

A: Transfer price means the price charged by one department from other department of the same company…

Q: Following information is given below prepare the statement of profit or loss: Capital at the end of…

A: Profit and loss (P&L) statements are financial statements that summarize the sales,…

11. Sherwin Company

Step by step

Solved in 2 steps

- Dickinson Inc. owns the following assets. Asset 00Cost00 0Salvage0 Estimated Useful Life A $70,000 $7,000 10 years000 B 50,000 5,000 5 years000 C 82,000 4,000 12 years000 Compute the composite depreciation rate and the composite life of Dickinson’s assets.The t accounts for equipment and the related accumulated depreciation-equipment for Goldstone Co. at the end of 2022 are shown here. Equipment Beg. Bal. $80000. Displ $22000 Acqutn $41600 Ending Bal $99600 Accum Dep-Eqpt Displ. $5100. Beg bal. $44500 Dep. Ex. $12000 End. Bal. $51400 In addition, Goldstone's income statement reported a loss on the disposal of plant assets of $3500. What amount was reported on the statement of cash flows as "cash flow from sale of equipment"? Calculate free cash flowIn 2015, Zee Tee Inc. acquired production machinery at a cost of $640,000, which now has a accumulated depreciation of $380,000. The sum of undiscounted future cash flows from use of the machinery is $210,000. and its fair value is $198,000. What amount should Zee Tee recognize as a loss on impairment? Group of answer choices $50,000 $62,000 $318,000 -0-

- In 2009, Cilla Company acquired production machinery at a cost of $420,000, which now has accumulated depreciation of $230,000. The sum of undiscounted future cash flows from use of the machinery is $150,000 and its fair value is $164,000. What amount should Cilla recognize as a loss on impairment? Group of answer choices $0 $66,000 $40,000 $26,000The T-accounts for Equipment and the related Accumulated Depreciation—Equipment for Skysong, Inc. at the end of 2022 are shown here. Equipment Beg. bal. 60,000 Disposals 16,500 Acquisitions 31,200 End. bal. 74,700 Accum. Depr.—Equipment Disposals 3,825 Beg. bal. 33,375 Depr. exp. 9,000 End. bal. 38,550 In addition, Skysong, Inc.’s income statement reported a loss on the disposal of plant assets of $2,625. What amount was reported on the statement of cash flows as “cash flow from sale of equipment”? (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)On 1/1/19, O. Corp acquired equipment at a cost of $867k. O. Corp adopted the sum-of-the-yrs-digits method of depreciation for this equipment and had been recording depreciation over an estimated life of 8 yrs, with no residual value. At the beginning of 2022, a decision was made to change to the straight-line method of depreciation for this equipment. The depreciation expense for 2022 would be $173400 $72250 $45156 $108375

- Coachwhip Corporation purchased a machinery on January 1, 2022 for P5,000,000. The same had an expected useful life of 8 years. Straight line depreciation method is in place for similar items. On January 1, 2024, the asset is appraised as having a sound value ofP4,500,000. OnJanuary1,2027, theasset hada recoverable value ofP1,375,000. 64) How much is credited to the revaluation surplus as a result of the revaluation in 2024? A. 1,500,000B. 1,250,000 C. 1,000,000 D.750,000 65) What is the correct depreciation to be recognized in 2024? A. 750,000 B. 1,000,000 C. 1,250,000 D. 1,500,000 66) How much is the loss on impairment should be recognized on January 1, 2027? A. 750,000B. 500,000 C. 250,000D.0On January 1, 2016, Greenhills Company acquired property, plant and equipment for each as follows:Cost Life in yearsLand 5,000,000Building 25,000,000 2513Machinery 10,000,000 5Equipment 3,000,000 10At the beginning of 2019, a revaluation of property items was made by professionally qualified valuers.While no change in the life of the assets was indicated, it was ascertained that replacement cost of theassets acquired in 2016 had increased by the following percentage:Land 100%Building 80%Machinery 50%Equipment 40%It was authorized that such revaluation be recorded in the accounts and that depreciation be recorded onthe basis of revalued amount.Required:a. Prepare journal entry to record the revaluation on January 1, 2019.b. Prepare the journal entry to record the depreciation for 2019.c. Prepare the journal entry to record the piecemeal realization of the revaluation surplus.d. Present the assets in the statement of financial position on December 31, 2019.Garrett Corporation paid $300,000 to acquire land, buildings, and equipment. At the time of acquisition, Garrett paid $20,000 for an appraisal, which revealed the following values: land, $140,000; buildings, $175,000; and equipment, $35,000. Required: 1. What cost should the company assign to the land, buildings, and equipment, respectively? 2. Assume that Garrett uses IFRS and chooses to use the revaluation model to value its property, plant, and equipment. At the end of the year, the book value of the land, buildings, and equipment are $128,000, $155,000, and $28,000, respectively. The company determines that the fair value of the land, buildings, and equipment at the end of year is $153,000, $157,000, and $25,000, respectively. Prepare the journal entries that Garrett should make to value its property, plant, and equipment.

- Coachwhip Corporation purchased a machinery on January 1, 2022 for P5,000,000. The same had an expected useful life of 8 years. Straight line depreciation method is in place for similar items. On January 1, 2024, the asset is appraised as having a sound value ofP4,500,000. OnJanuary1,2027, theasset hada recoverable value ofP1,375,000. How much is credited to the revaluation surplus as a result of the revaluation in 2024? A. 1,500,000B. 1,250,000 C. 1,000,000 D.750,000Garrett Corporation paid $200,000 to acquire land, buildings, and equipment. At the time of acquisition, Garrett paid $20,000 for an appraisal, which revealed the following values: land, $100,000; buildings, $125,000; and equipment, $25,000. Required: 1. What cost should the company assign to the land, buildings, and equipment, respectively? 2. Assume that Garrett uses IFRS and chooses to use the revaluation model to value its property, plant, and equipment. At the end of the year, the book value of the land, buildings, and equipment are $88,000, $104,000, and $18,000, respectively. The company determines that the fair value of the land, buildings, and equipment at the end of year is $110,000, $106,000, and $15,000.Presented below is information related to Wolfie Corp.’s equipment on 12/31/2022: Description Amount Capitalized cost $900,000 Accumulated depreciation to date 750,000 Estimated residual value 40,000 Expected future cash flows 125,000 Estimated Fair value 100,000 The amount of the impairment loss, if any, that Wolfie Corp. should record on 12/31/22 is: $45,000 $50,000 $10,000 $20,000 $25,000 There is no impairment.