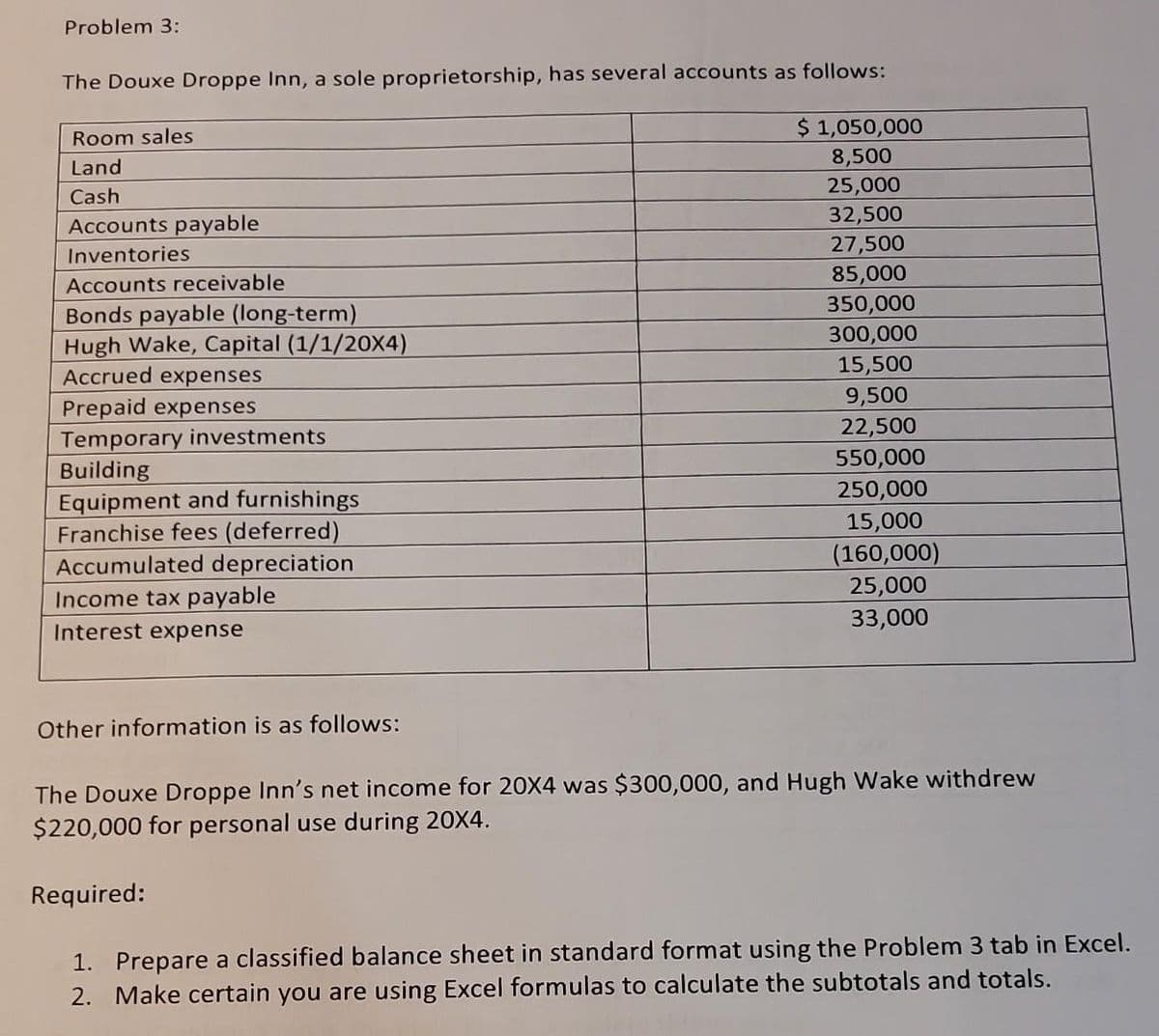

The Douxe Droppe Inn, a sole proprietorship, has several accounts as follows: Room sales Land Cash Accounts payable Inventories Accounts receivable Bonds payable (long-term) Hugh Wake, Capital (1/1/20X4) Accrued expenses Prepaid expenses Temporary investments Building Equipment and furnishings Franchise fees (deferred) Accumulated depreciation Income tax payable Interest expense Other information is as follows: $ 1,050,000 8,500 25,000 32,500 27,500 85,000 350,000 300,000 15,500 9,500 22,500 550,000 250,000 15,000 (160,000) 25,000 33,000 The Douxe Droppe Inn's net income for 20X4 was $300,000, and Hugh Wake withdrew $220,000 for personal use during 20X4.

The Douxe Droppe Inn, a sole proprietorship, has several accounts as follows: Room sales Land Cash Accounts payable Inventories Accounts receivable Bonds payable (long-term) Hugh Wake, Capital (1/1/20X4) Accrued expenses Prepaid expenses Temporary investments Building Equipment and furnishings Franchise fees (deferred) Accumulated depreciation Income tax payable Interest expense Other information is as follows: $ 1,050,000 8,500 25,000 32,500 27,500 85,000 350,000 300,000 15,500 9,500 22,500 550,000 250,000 15,000 (160,000) 25,000 33,000 The Douxe Droppe Inn's net income for 20X4 was $300,000, and Hugh Wake withdrew $220,000 for personal use during 20X4.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.26E: Accounting concepts Match each of the following statements with the appropriate accounting concept....

Related questions

Question

Do not give answer in image

Transcribed Image Text:Problem 3:

The Douxe Droppe Inn, a sole proprietorship, has several accounts as follows:

Room sales

Land

Cash

Accounts payable

Inventories

Accounts receivable

Bonds payable (long-term)

Hugh Wake, Capital (1/1/20X4)

Accrued expenses

Prepaid expenses

Temporary investments

Building

Equipment and furnishings

Franchise fees (deferred)

Accumulated depreciation

Income tax payable

Interest expense

Other information is as follows:

$ 1,050,000

8,500

25,000

32,500

27,500

85,000

350,000

300,000

15,500

9,500

22,500

550,000

250,000

15,000

(160,000)

25,000

33,000

The Douxe Droppe Inn's net income for 20X4 was $300,000, and Hugh Wake withdrew

$220,000 for personal use during 20X4.

Required:

1. Prepare a classified balance sheet in standard format using the Problem 3 tab in Excel.

2. Make certain you are using Excel formulas to calculate the subtotals and totals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning