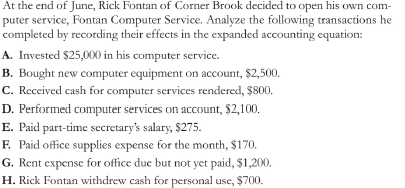

puter service, Fontan Computer Service. Analyze the following transactions he completed by recording their effects in the expanded accounting equation: A. Invested $25,000 in his computer service. B. Bought new computer equipment on account, $2,500. C. Received cash for computer services rendered, $800. D. Performed computer services on account, $2,100. E. Paid part-time secretary's salary, $275. F. Paid office supplies expense for the month, $170. G. Rent expense for office due but not yet paid, $1,200. H. Rick Fontan withdrew cash for personal use $700

Q: Using March 31, 2003 as the journal entry date, enter the following items in the General Journal.…

A: Please fallow the answer below: Answer: i)Journal entries from the subsidiary ledgers are as…

Q: xercise 14-8 (Algo) Preparing financial statements for a manufacturer LO P1 Prepare Income…

A: Answer: Please see the answer below: Garcon Pepper Company Company Direct…

Q: Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct…

A: Plantwide predetermined overhead rate is determined to calculate the overhead applied to the job.…

Q: Exercise 1-14 Statement of changes in equity LO6 On July 1, 2023, Academic Learning Services entered…

A: A statement of change in equity is one of the financial statements that show the change in the value…

Q: Assume that IBM leased equipment that was carried at a cost of $163,000 to Ivanhoe Company. The term…

A: Journal entries is a tool for recording business transactions into accounting records.

Q: On March 30, Century Link received an invoice dated March 28 from ACME Manufacturing for 59…

A: The discount is a concession from the selling price of the profit, This may be in percentage form or…

Q: would you please explain in step 4 from where you got the total assets and total equity

A: P/E ratio means Price -Earnings ratio. 1) P/E ratio = Market Price per share/Earnings per…

Q: Emily Moore is a licensed dentist. During the first month of opera Apr. 1 Invested $18,000 cash in…

A: When a business enters into a transaction, it records the event in the form on journal entry in the…

Q: DEC has the following client account debit balances as of 31/12/2018: Client K 4000€, Client L…

A: Debtors refer to individuals or companies that owe money to another party, known as the creditor.…

Q: Mauro Products distributes a single product, a woven basket whose selling price is $19 per unit and…

A: Break Even Point (BEP) :— It is the point where total cost is equal to total revenue. At this point,…

Q: If a commercial real estate asset had produced an annual cash flow of $325,000 in Year 1 and…

A: Calculation of changes in the value at the end of year 2. Working notes:- Formula used: Value of…

Q: annual lease payments

A: A lease is actually a contractual arrangement wherein the user pays the owner for the use of the…

Q: Journalize the following transactions for the seller, Hughes Company, using the gross method to…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: Pleasant Company has decided to begin accumulating a fund for plant expansion. The company deposited…

A: Solution: Future value of fund at the end of 2023 = Initial deposit * FV for 1 at 4% for 5 periods +…

Q: 7. The following differences between financial and taxable income were reported by Dimaano…

A: When a taxpayer earns income from any source which is taxable as per IRS provisions then the…

Q: The case study proposes that regular rotation and changes of the auditing firms could be an answer…

A: Computer Assisted Auditing Techniques (CAATs) are a set of tools and methods that are used to assist…

Q: 1. Shown below are the account balances for Barnie Corp. for their year-end December 31, 2022: $…

A: Lets understand the basics. There various stages through which statement of financial position gets…

Q: Required: 5. Refer to the original data. As an alternative to (4) above, the company is considering…

A: A breakeven point is the production level at which total production revenue equals total production…

Q: It has been suggested that published accounting statements should attempt to be relevant,…

A: Verifiable: Verifiable accounting information is information that can be verified to ensure…

Q: A retail chain sells Go-Pro Cameras for$349.94plus provincial and federal retail tax. Calculate thea…

A: Let's calculate the total price of the camera in City A: Price of the camera: $349.94 HST: 11% of…

Q: IT MUST BE ACCURATE AND COMPLETE EXPLANATION Discuss the computation of Operating Cash Flow using…

A: The cash flows from operating activities solely contain the cash inflows and outflows associated…

Q: Espresso Express operates a number of espresso coffee stands in busy suburban malls. The fixed…

A: Variables cost : Variable cost varies with the change in the production level. If production…

Q: 7. On January 1, 2024, the Marjlee Company began construction of an office building to be used as…

A: Lets understand the basics. As per IAS 23 "Borrowing costs", interest expense incurred for the…

Q: Journal entry worksheet < 1 Record Oak Creek Furniture Factory's payroll costs. Assume the direct…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: In which of the following funds is it appropriate to record depreciation of capital assets?

A: The Capital Projects Fund is designed to account for the acquisition, construction, or improvement…

Q: The following ratios are available Profit Margin Return on Assets Leverage Asset Turnover Allowance…

A: Accounting Ratios The ratios that determine the company's performance in terms of profitability,…

Q: The following data from the just completed year are taken from the accounting records of Mason…

A: Cost of goods manufactured is the total production cost of a company during a specific period of…

Q: Activity based costing is likely a more advantageous costing methold versus traditonal costing, to…

A: The costing uses different method in order to consider all the cost that are involve the…

Q: Given the following tax structure: Taxpayer Mae Pedro Salary $ 11,000 $ 21,000 Total tax $ 550 222…

A: Regressive , Proportionate or progressive A regressive tax system applies the same percentage to…

Q: Purpose of Costing Methods in Management Accounting.

A: Costing Method A costing is a method of calculating the price of goods or services. Different…

Q: Required information Problem 9-6 (Algo) Retail inventory method; average cost and conventional…

A: An accounting technique called the "Retail Inventory Method" is used to predict the value of a…

Q: Delaware Company incurred the following research and development costs during 2024, Salaries and…

A: Answer:- Research and development expenses:- Research and development expenses are those expenses…

Q: Assume that IBM leased equipment that was carried at a cost of $96,000 to Blossom Company. The term…

A: Journal Entry :- The act of logging any transaction, whether or not it is an economic one, is known…

Q: $1,153,000 of 11% bonds are issued at 102 1/2, the amount of cash received from the sale is

A: Bonds are fixed-interest-bearing financial instruments that are raised when money is needed. If the…

Q: On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a…

A: When entering into a finance lease, the lessee should immediately acknowledge the lease as both an…

Q: Following is a bank reconciliation for Zocar Enterprises for June 30, Year 2: Cash Account…

A: "Not sufficient funds" is referred to as NSF. An NSF check is one that the bank of the entity…

Q: What are the main procedures used by an auditor when performing review or moderate assurance level…

A: A review engagement - is known also by the phrases "limited assurance" or "negative engagement". In…

Q: share price

A: A dividend policy is essentially a policy a company employs to structure dividend payout to its…

Q: LO 6-4 E6-12 Reporting Net Sales after Sales Discounts and Sales Returns And to dinem ad aud The…

A: The gross sales revenue is the amount of sales revenue recorded at the time of sales. The deduction…

Q: For the movement of the INVEST commodity from 01.01.20X1 to 31.12.20X1 you are given the following…

A: Answer is as fallows below: Calculation of Cost of Sales, Gross Profit , Sales & Ending…

Q: Lawmakers should demand reform of government accounting standards?

A: Yes, lawmakers should demand reform of government accounting standards. Government accounting…

Q: per share. During the year, the following occurred. r. 1 ane 15 ly ec. 10 1 15 Issued 21,000…

A: Answer :Journal entries : Date Account title Debit Credit April 1 Cash (21,000*$17) $357,000…

Q: Valentino is a patient in a nursing home for 53 days of 2022. While in the nursing home, he incurs…

A: Gross income of an individual or an organization can be define as total amount of revenue or other…

Q: Kylie's Cookies is considering the purchase of a larger oven that will cost $2,200 and will increase…

A: Income Statement: An income statement helps organizations in calculating the profits or losses…

Q: Jimmy has fallen on hard times recently. Last year he borrowed $343,000 and added an additional…

A: Answer The real estate is worth $277,800 and Jimmy has $47,200 in other assets but no other…

Q: Advantages and disadvantages of Activity-Based Costing (ABC), Fixed Overhead Absorption, and…

A: Activity-based Costing (ABC): Activity-based costing (ABC) is a costing method that assigns costs to…

Q: The following year-end information is taken from the December 31 adjusted trial balance and other…

A: The product cost are directly or indirectly related to the production. The product cost can be…

Q: Instructions Mer Corporation acquired 30% of the outstanding common stock of Crowell Corporation for…

A: In an organization's accounting system, a journal entry documents a commercial transaction. Journal…

Q: Quan Corp. manufactures construction equipment. Journalize the entries to record the following…

A: Please fallow the answer below: Solution: Step-1: The effects of a transaction on the various…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- During December of this year, G. Elden established Ginnys Gym. The following asset, liability, and owners equity accounts are included in the chart of accounts: During December, the following transactions occurred: a. Elden deposited 35,000 in a bank account in the name of the business. b. Bought exercise equipment for cash, 8,150, Ck. No. 1001. c. Bought advertising on account from Hazel Company, 105. d. Bought a display rack on account from Cyber Core, 790. e. Bought office equipment on account from Office Aids, 185. f. Elden invested her exercise equipment with a fair market value of 1,200 in the business. g. Made a payment to Cyber Core, 200, Ck. No. 1002. h. Sold services for the month of December for cash, 800. Required 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental accounting equation, as well as the plus and minus signs and Debit and Credit. 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction. 4. Foot and balance the accounts.On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001 (Rent Expense). c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600 (Professional Fees). g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005 (Utilities Expense). i. Paid the salary of the assistant, 1,150, Ck. No. 2006 (Salary Expense). j. Sold professional services for cash, 3,868 (Professional Fees). k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.During February of this year, H. Rose established Rose Shoe Hospital. The following asset, liability, and owners equity accounts are included in the chart of accounts: The following transactions occurred during the month of February: a. Rose deposited 25,000 cash in a bank account in the name of the business. b. Bought shop equipment for cash, 1,525, Ck. No. 1000. c. Bought advertising on account from Milland Company, 325. d. Bought store shelving on account from Inger Hardware, 750. e. Bought office equipment from Sharas Office Supply, 625, paying 225 in cash and placing the balance on account, Ck. No. 1001. f. Paid on account to Inger Hardware, 750, Ck. No. 1002. g. Rose invested his personal leather working tools with a fair market value of 800 in the business h. Sold services for the month of February for cash, 250. PART 1: The Accounting Cycle for a Service Business: Analyzing Business Transactions Required 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental accounting equation, as well as the plus and minus signs and Debit and Credit. 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts. 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction. 4. Foot and balance the accounts.

- On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001. c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600. g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005. i. Paid the salary of the assistant, 1,150, Ck. No. 2006. j. Sold professional services for cash, 3,868. k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.