The employees of Parma Company are entitled to one day's vacation for each month worked. The average daily pay for each of the 50 employees is $130. The adjusting entry to record the vacation expense f $6,500 ($130 x 50) at the end of each month is: Vacation Benefits Expense Vacation Benefits Payable 6,500.00 At the end of April, Hernandez Company had a balance of $36,950 in the vacation benefits payable account. During May, employees earned an additional $2,810 in vacation benefits, but some employees used vacation days that amounted to $1,890 of the vacation benefits. The $1,890 was charged to Wages Expense when it was paid in May. What adjusting entry would Hernandez Company make at the end of May to bring the vacation benefits payable account up to date? Account 6,500.00 Vacation Benefits Payable If an amount box does not require an entry, leave it blank. Debit Credit

The employees of Parma Company are entitled to one day's vacation for each month worked. The average daily pay for each of the 50 employees is $130. The adjusting entry to record the vacation expense f $6,500 ($130 x 50) at the end of each month is: Vacation Benefits Expense Vacation Benefits Payable 6,500.00 At the end of April, Hernandez Company had a balance of $36,950 in the vacation benefits payable account. During May, employees earned an additional $2,810 in vacation benefits, but some employees used vacation days that amounted to $1,890 of the vacation benefits. The $1,890 was charged to Wages Expense when it was paid in May. What adjusting entry would Hernandez Company make at the end of May to bring the vacation benefits payable account up to date? Account 6,500.00 Vacation Benefits Payable If an amount box does not require an entry, leave it blank. Debit Credit

Chapter6: Analysing And Journalizing Payroll

Section: Chapter Questions

Problem 12PA: Kelsey Gunn is the only employee of Arsenault Company. His pay rate is 23.00 per hour with an...

Related questions

Question

Mk. 121.

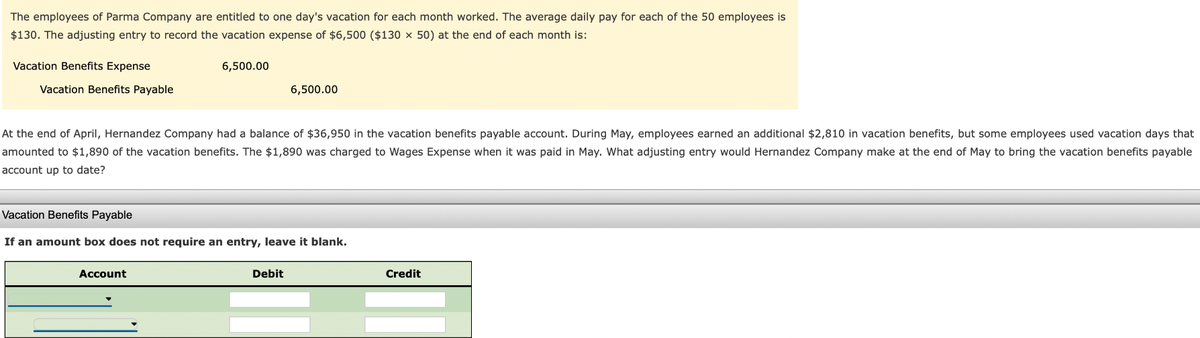

Transcribed Image Text:The employees of Parma Company are entitled to one day's vacation for each month worked. The average daily pay for each of the 50 employees is

$130. The adjusting entry to record the vacation expense of $6,500 ($130 x 50) at the end of each month is:

Vacation Benefits Expense

Vacation Benefits Payable

6,500.00

At the end of April, Hernandez Company had a balance of $36,950 in the vacation benefits payable account. During May, employees earned an additional $2,810 in vacation benefits, but some employees used vacation days that

amounted to $1,890 of the vacation benefits. The $1,890 was charged to Wages Expense when it was paid in May. What adjusting entry would Hernandez Company make at the end of May to bring the vacation benefits payable

account up to date?

Account

6,500.00

Vacation Benefits Payable

If an amount box does not require an entry, leave it blank.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning