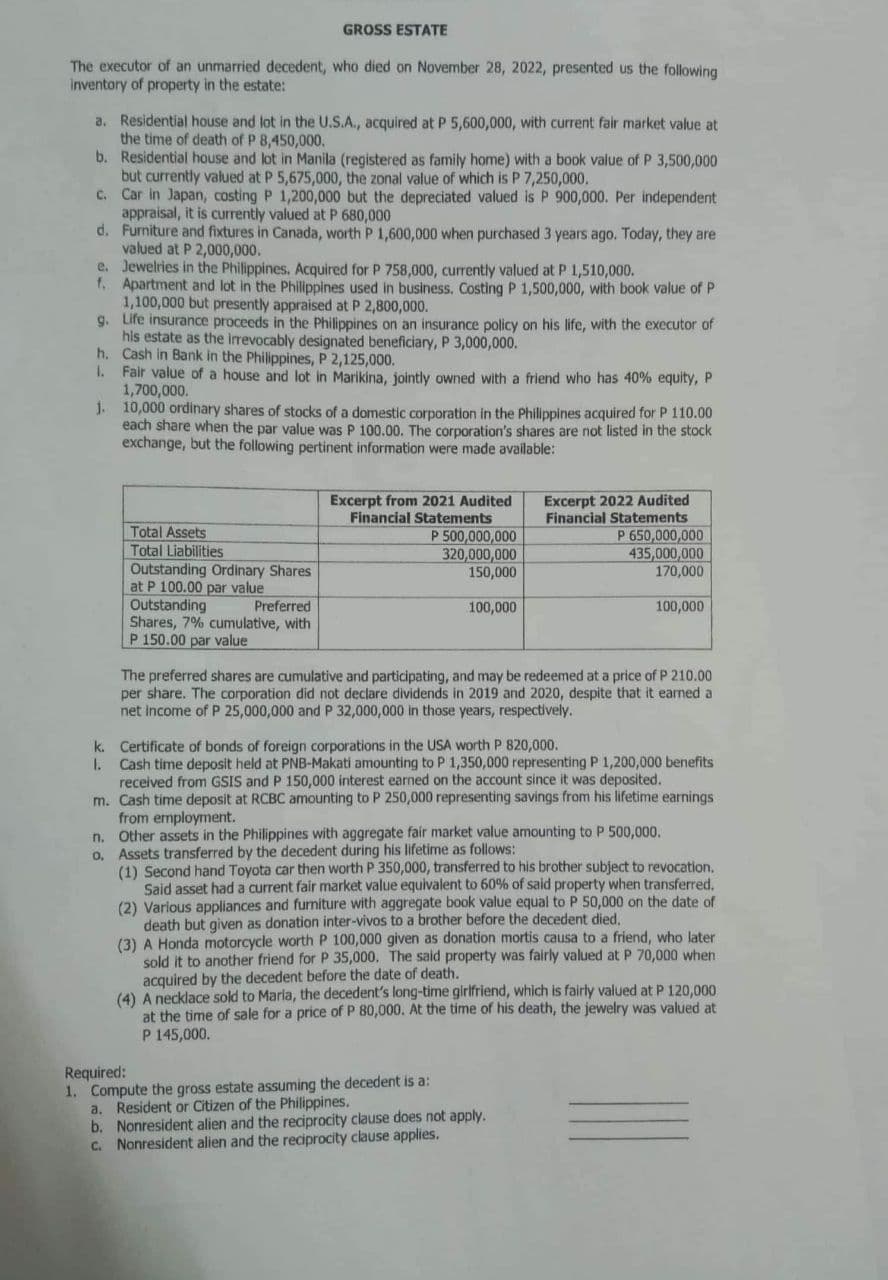

The executor of an unmarried decedent, who died on November 28, 2022, presented us the following inventory of property in the estate: a. Residential house and lot in the U.S.A., acquired at P 5,600,000, with current fair market value at the time of death of P 8,450,000. b. Residential house and lot in Manila (registered as family home) with a book value of P 3,500,000 but currently valued at P 5,675,000, the zonal value of which is P 7,250,000. c. Car in Japan, costing P 1,200,000 but the depreciated valued is P 900,000. Per independent appraisal, it is currently valued at P 680,000 d. Furniture and fixtures in Canada, worth P 1,600,000 when purchased 3 years ago. Today, they are valued at P 2,000,000. e. Jewelries in the Philippines. Acquired for P 758,000, currently valued at P 1,510,000. f. Apartment and lot in the Philippines used in business. Costing P 1,500,000, with book value of P 1,100,000 but presently appraised at P 2,800,000. 9. Life insurance proceeds in the Philippines on an insurance policy on his life, with the executor of his estate as the irrevocably designated beneficiary, P 3,000,000. Cash in Bank in the Philippines, P 2,125,000. Fair value of a house and lot in Marikina, jointly owned with a friend who has 40% equity, P 1,700,000. h. 1. GROSS ESTATE j. 10,000 ordinary shares of stocks of a domestic corporation in the Philippines acquired for P 110.00 each share when the par value was P 100.00. The corporation's shares are not listed in the stock exchange, but the following pertinent information were made available: k. 1. Total Assets Total Liabilities Outstanding Ordinary Shares at P 100.00 par value Outstanding Preferred Shares, 7% cumulative, with P 150.00 par value Excerpt from 2021 Audited Financial Statements P 500,000,000 320,000,000 150,000 100,000 Excerpt 2022 Audited Financial Statements P 650,000,000 435,000,000 170,000 100,000 The preferred shares are cumulative and participating, and may be redeemed at a price of P 210.00 per share. The corporation did not declare dividends in 2019 and 2020, despite that it earned a net income of P 25,000,000 and P 32,000,000 in those years, respectively. Certificate of bonds of foreign corporations in the USA worth P 820,000. Cash time deposit held at PNB-Makati amounting to P 1,350,000 representing P 1,200,000 benefits received from GSIS and P 150,000 interest earned on the account since it was deposited. m. Cash time deposit at RCBC amounting to P 250,000 representing savings from his lifetime earnings from employment. n. Other assets in the Philippines with aggregate fair market value amounting to P 500,000. o. Assets transferred by the decedent during his lifetime as follows: (1) Second hand Toyota car then worth P 350,000, transferred to his brother subject to revocation. Said asset had a current fair market value equivalent to 60% of said property when transferred. (2) Various appliances and furniture with aggregate book value equal to P 50,000 on the date of death but given as donation inter-vivos to a brother before the decedent died. Required: 1. Compute the gross estate assuming the decedent is a: a. Resident or Citizen of the Philippines. b. Nonresident alien and the reciprocity clause does not apply. c. Nonresident alien and the reciprocity clause applies. (3) A Honda motorcycle worth P 100,000 given as donation mortis causa to a friend, who later sold it to another friend for P 35,000. The said property was fairly valued at P 70,000 when acquired by the decedent before the date of death. (4) A necklace sold to Maria, the decedent's long-time girlfriend, which is fairly valued at P 120,000 at the time of sale for a price of P 80,000. At the time of his death, the jewelry was valued at P 145,000.

The executor of an unmarried decedent, who died on November 28, 2022, presented us the following inventory of property in the estate: a. Residential house and lot in the U.S.A., acquired at P 5,600,000, with current fair market value at the time of death of P 8,450,000. b. Residential house and lot in Manila (registered as family home) with a book value of P 3,500,000 but currently valued at P 5,675,000, the zonal value of which is P 7,250,000. c. Car in Japan, costing P 1,200,000 but the depreciated valued is P 900,000. Per independent appraisal, it is currently valued at P 680,000 d. Furniture and fixtures in Canada, worth P 1,600,000 when purchased 3 years ago. Today, they are valued at P 2,000,000. e. Jewelries in the Philippines. Acquired for P 758,000, currently valued at P 1,510,000. f. Apartment and lot in the Philippines used in business. Costing P 1,500,000, with book value of P 1,100,000 but presently appraised at P 2,800,000. 9. Life insurance proceeds in the Philippines on an insurance policy on his life, with the executor of his estate as the irrevocably designated beneficiary, P 3,000,000. Cash in Bank in the Philippines, P 2,125,000. Fair value of a house and lot in Marikina, jointly owned with a friend who has 40% equity, P 1,700,000. h. 1. GROSS ESTATE j. 10,000 ordinary shares of stocks of a domestic corporation in the Philippines acquired for P 110.00 each share when the par value was P 100.00. The corporation's shares are not listed in the stock exchange, but the following pertinent information were made available: k. 1. Total Assets Total Liabilities Outstanding Ordinary Shares at P 100.00 par value Outstanding Preferred Shares, 7% cumulative, with P 150.00 par value Excerpt from 2021 Audited Financial Statements P 500,000,000 320,000,000 150,000 100,000 Excerpt 2022 Audited Financial Statements P 650,000,000 435,000,000 170,000 100,000 The preferred shares are cumulative and participating, and may be redeemed at a price of P 210.00 per share. The corporation did not declare dividends in 2019 and 2020, despite that it earned a net income of P 25,000,000 and P 32,000,000 in those years, respectively. Certificate of bonds of foreign corporations in the USA worth P 820,000. Cash time deposit held at PNB-Makati amounting to P 1,350,000 representing P 1,200,000 benefits received from GSIS and P 150,000 interest earned on the account since it was deposited. m. Cash time deposit at RCBC amounting to P 250,000 representing savings from his lifetime earnings from employment. n. Other assets in the Philippines with aggregate fair market value amounting to P 500,000. o. Assets transferred by the decedent during his lifetime as follows: (1) Second hand Toyota car then worth P 350,000, transferred to his brother subject to revocation. Said asset had a current fair market value equivalent to 60% of said property when transferred. (2) Various appliances and furniture with aggregate book value equal to P 50,000 on the date of death but given as donation inter-vivos to a brother before the decedent died. Required: 1. Compute the gross estate assuming the decedent is a: a. Resident or Citizen of the Philippines. b. Nonresident alien and the reciprocity clause does not apply. c. Nonresident alien and the reciprocity clause applies. (3) A Honda motorcycle worth P 100,000 given as donation mortis causa to a friend, who later sold it to another friend for P 35,000. The said property was fairly valued at P 70,000 when acquired by the decedent before the date of death. (4) A necklace sold to Maria, the decedent's long-time girlfriend, which is fairly valued at P 120,000 at the time of sale for a price of P 80,000. At the time of his death, the jewelry was valued at P 145,000.

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 58P

Related questions

Question

Transcribed Image Text:GROSS ESTATE

The executor of an unmarried decedent, who died on November 28, 2022, presented us the following

inventory of property in the estate:

a. Residential house and lot in the U.S.A., acquired at P 5,600,000, with current fair market value at

the time of death of P 8,450,000.

b. Residential house and lot in Manila (registered as family home) with a book value of P 3,500,000

but currently valued at P 5,675,000, the zonal value of which is P 7,250,000.

c.

Car in Japan, costing P 1,200,000 but the depreciated valued is P 900,000. Per independent

appraisal, it is currently valued at P 680,000

d.

Furniture and fixtures in Canada, worth P 1,600,000 when purchased 3 years ago. Today, they are

valued at P 2,000,000.

e. Jewelries in the Philippines. Acquired for P 758,000, currently valued at P 1,510,000.

f. Apartment and lot in the Philippines used in business. Costing P 1,500,000, with book value of P

1,100,000 but presently appraised at P 2,800,000.

9. Life insurance proceeds in the Philippines on an insurance policy on his life, with the executor of

his estate as the irrevocably designated beneficiary, P 3,000,000.

Cash in Bank in the Philippines, P 2,125,000.

h.

1. Fair value of a house and lot in Marikina, jointly owned with a friend who has 40% equity, P

1,700,000.

j.

10,000 ordinary shares of stocks of a domestic corporation in the Philippines acquired for P 110.00

each share when the par value was P 100.00. The corporation's shares are not listed in the stock

exchange, but the following pertinent information were made available:

Total Assets

Total Liabilities

Outstanding Ordinary Shares

at P 100.00 par value

Outstanding

Preferred

Shares, 7% cumulative, with

P 150.00 par value

Excerpt from 2021 Audited

Financial Statements

P 500,000,000

320,000,000

150,000

100,000

Excerpt 2022 Audited

Financial Statements

P 650,000,000

435,000,000

170,000

100,000

The preferred shares are cumulative and participating, and may be redeemed at a price of P 210.00

per share. The corporation did not declare dividends in 2019 and 2020, despite that it earned a

net income of P 25,000,000 and P 32,000,000 in those years, respectively.

k.

Certificate of bonds of foreign corporations in the USA worth P 820,000.

1. Cash time deposit held at PNB-Makati amounting to P 1,350,000 representing P 1,200,000 benefits

received from GSIS and P 150,000 interest earned on the account since it was deposited.

m. Cash time deposit at RCBC amounting to P 250,000 representing savings from his lifetime earnings.

from employment.

n. Other assets in the Philippines with aggregate fair market value amounting to P 500,000.

o. Assets transferred by the decedent during his lifetime as follows:

(1) Second hand Toyota car then worth P 350,000, transferred to his brother subject to revocation.

Said asset had a current fair market value equivalent to 60% of said property when transferred.

(2) Various appliances and furniture with aggregate book value equal to P 50,000 on the date of

death but given as donation inter-vivos to a brother before the decedent died.

Required:

1. Compute the gross estate assuming the decedent is a:

a. Resident or Citizen of the Philippines.

b. Nonresident alien and the reciprocity clause does not apply.

c. Nonresident alien and the reciprocity clause applies.

(3) A Honda motorcycle worth P 100,000 given as donation mortis causa to a friend, who later

sold it to another friend for P 35,000. The said property was fairly valued at P 70,000 when

acquired by the decedent before the date of death.

(4) A necklace sold to Maria, the decedent's long-time girlfriend, which is fairly valued at P 120,000

at the time of sale for a price of P 80,000. At the time of his death, the jewelry was valued at

P 145,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT