Q: You have an investment opportunity that requires an initial investment of $3,600 today and will pay…

A: The present value is the value of the sum received at time 0 or the current period. It is the value…

Q: About how many years would it take for your investment to grow sixfold if it were invested at an APR…

A: Using NPER in Excel

Q: If you receive a total return of 6% on your investment portfolio but inflation is running at 3% per…

A: Given the following information: Nominal return: 6% Inflation rate: 3%

Q: Find the effective yield of an investment that earns 2.35% compounded weekly. % round to the nearest…

A:

Q: Find the annual percentage yield for an investment at the following rates. (Round your answers to…

A: Annual percentage yield = [(1 + i/n)^n] - 1 where, i = nominal interest rate n = compounding period…

Q: An investment pays you $100 at the end of each of the next 3 years. The investment will then pay you…

A: Here,

Q: Find the annual percentage yield for an investment at the following rates. (Round your answers to…

A: A. Annual percentage yield (APY)= (1+ r/n)^nt -1 r= Rate of interest e= Exponential function nt=…

Q: Approximately, what is the value of PG (present worth of arithmetic gradient) if G=100, n=21 years,…

A: Arithmetic gradient is a no. of payments which is increased or decreased with same rate over the…

Q: An investment will pay $2,445 two years from now, $3,433 four years from now, and $1,611 five years…

A: Present value is also known as a present discounted value, in which the future value of cash inflows…

Q: Approximately, what is the value of PG present worth of arithmetic gradient) if G=170, n=4 years,…

A: The aggregate present worth of the series of the arithmetic gradient is computed using the present…

Q: What is the dollar-weighted return on a $100 investment that generates annual returns of $20, $15,…

A: Return is that portion which a person receives over the investment amount during the whole period.…

Q: If the investment amounting to 45,000 earned an interest of 3,500 how much will be the maturity…

A: Maturity Value is the Value which an investor will receive at the end of tenure of the Investment.…

Q: If money is invested at an interest rate of 5.7 percent per year, find the annual percent yield…

A: Effective yield or the APY takes into consideration the number of times compounding is done in a…

Q: What is the future value of a $12,500 investment, earning eight-percent interest per period, after…

A: Given details are : Present value of investment = $12500 Interest rate = 8% Time period = 3 years…

Q: A. You invested $100 6 months ago. Today the value of your investment is $110. What is the CCR over…

A: CCR can be be calculated by using this equation Future worth of investment =present value of…

Q: What is the internal rate of return (IRR) of an investment that requires an initial investmen of…

A: Internal Rate of return is the rate at which the Net Present Value of the investment is zero. It can…

Q: Find the he effective yield of an investment that earns 3.45% compounded weekly.

A: The effective yield shows increase in invested principal in terms of percentage over a period.…

Q: approximately how many years would it take for an investment to grow fourfold if it were invested at…

A: Given: Rate=11%/4=0.0275Pmt =0Pv =$-1FV =$4

Q: Suppose that $2700 is invested in an account with an APR of 3.9% compounded continuously. Determine…

A: Future value = Present value*e^rate*time

Q: About how many years would it take for your investment to grow if it were invested at an APR of 9…

A: In the given question we require to calculate the the number of years that make the investment…

Q: What annual rate of return is earned on a $1,000 investment when it grows to $2,700 in eight years?…

A: A concept through which it is studied that the current worth of money is higher than its future…

Q: About how many years would it take for your investment to grow threefold if it were invested at an…

A: In the given problem we require to calculate the number of years that will make the investment three…

Q: About how many years would it take for your investment to grow fourfold if it were invested at an…

A: We require to calculate the time period i.e. number of years that will make out investment four fold…

Q: An investment offers a total return of 11 percent over the coming year. Alex Hamilton thinks the…

A: 1) Nominal return is 11% and real rate of return is 7.4% Nominal rate of return when adjusted for…

Q: Suppose that a 10-year T-note is purchased with a face value of $20,000 and a coupon rate of 3.4%…

A: Return means an additional amount earned over the invested amount. It is computed on the basis of…

Q: Suppose you have an investment worth $800 and you want it to increase in value by 400%. a) What is…

A: Investment amount = $ 800 Increase in value = 400%

Q: When interest is compounded continuously, the rate of change of the amount x of the investment is…

A: Continuous Compounding interest assumes interest is compounded and added back into the balance an…

Q: If a cell in an Excel spreadsheet uses the following formula to determine the future value of an…

A: The question is based on the concept of spreadsheet function of future value calculation.

Q: Suppose an investment offers to triple your money in 12 months. What rate of return per quarter are…

A: In this question we requires to calculate rate of return per quarter that will make our money triple…

Q: Approximately, what is the value of PG (present worth of arithmetic gradient) if G=185, n=7 years,…

A: gradient = 185 time period = 5 interest rate = 7.5% below is the given formula to calculate present…

Q: About how many years would it take for your investment to grow sixfold if it were invested at an APR…

A: In the given question we require to calculate the the number of years that make the investment six…

Q: What is the rate of return on an investment of $10,606 if the company will receive $2,000 each year…

A: The rate of return on an investment is the ratio of profits earned on an investment made by the…

Q: (Solving for n with nonannual periods) About how many years would it take for your investment to…

A: In the given question we require to calculate the the number of years that make the investment…

Q: The present worth of income from an investment that follows an arithmetic gradient was projected to…

A: Annuity refers to series of equalized payments that are paid or received at start or ending of…

Q: How long does it take for an investment to double in value if it is invested at 5% compounded…

A: Assuming Investment = 100 Future value = 2*Investment = 200 Interest rate = 5% Continuous…

Q: What is the annual percentage yield (APY) for money invested at an annual rate of 5% compounded…

A: Annual Percentage Yield (APY):APY is an effective annual return rate that takes compounding…

Q: If you receive a total return of 8% on your investment portfolio but inflation is running at 5% per…

A: Given the following information: Nominal return: 8% Inflation rate: 5%

Q: Suppose that an investment promises to pay a real 9% annual rate of interest and inflation rate is…

A: The effective annual rate of interest is the real return on the savings account when the effects of…

Q: Calculate, to the nearest cent, the present value of an investment that will be worth $1,000 at the…

A: In finance, the term future value shows a dollar sum expected to be received at some point in the…

Q: Find the annual percentage yield for an investment at the following rates. (Round your answers to…

A: b)Calculation of annual percentage yield at 9% compounded continuouslyNote: Use the scientific…

Q: What is the present value of an investment that will pay $1,000 in one year's time, and $1,000 every…

A: Calculation of Present value of perpetuity:Answer:The present value of the investment is $12,500

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Suppose you are valuing a healthy, growing, profitable firm and you project that the firm will generate negative free cash flows for equity shareholders in each of the next five years. Can you use a free-cash-flows-based valuation approach when cash flows are negative? If so, explain how a free-cash-flows approach can produce positive valuations of firms when they are expected to generate negative free cash flows over the next five years.Assume you have just been hired as a business manager of PizzaPalace, a regional pizza restaurant chain. The companys EBIT was 120 million last year and is not expected to grow. PizzaPalace is in the 25% state-plus-federal tax bracket, the risk-free rate is 6 percent, and the market risk premium is 6 percent. The firm is currently financed with all equity, and it has 10 million shares outstanding. When you took your corporate finance course, your instructor stated that most firms owners would be financially better off if the firms used some debt. When you suggested this to your new boss, he encouraged you to pursue the idea. If the company were to recapitalize, then debt would be issued, and the funds received would be used to repurchase stock. As a first step, assume that you obtained from the firms investment banker the following estimated costs of debt for the firm at different capital structures: a. Using the free cash flow valuation model, show the only avenues by which capital structure can affect value.Fenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?

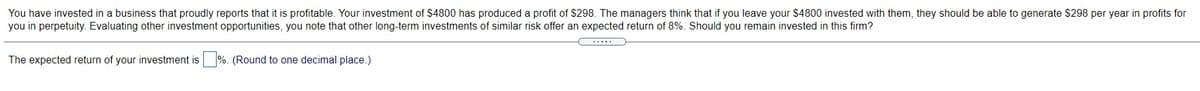

- You have invested in a business that proudly reports that it is profitable. Your investment of $4000 has produced a profit of $201. The managers think that if you leave your $4500 levested with them, they should be able to generate $291 per year in profits for you in perpetuity. Evaluating other investment opportunites, you note that other long-term investments of similar risk offer an expected return of 7.9%. Should you remain invested in this fr ? The expected ratus of your envestment is__? (Round to one decimal)You are evaluating the potential purchase of a small business currently generating $ 42,500 of after-tax cashflow. On the basis of a review of similar risk investment opportunities, you must earn 15% rate of return on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm’s value using several assumptions about the growth rate of cash flows. What is the firm’s value if cash flows are expected to grow at an annual rate 12% for the first 2 years, followed by a constant rate of 9% from year 3 to infinity?Sally is invested in a MLP that has just paid an annual dividend. The energy, oil, and gas industry is really booming so she expects the company will increase dividends by 7% for three years, 5% for two years, and will hold it stable at 3% from then on. The company's recent financial statements show earnings per share of $12 and a retention ratio of 60%. If Sally requires at least an 8% rate of return on her investment, what is the value? $112.97 $114.04 $115.63 $116.22

- You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $7 million. The product will generate free cash flow of $0.76 million the first year, and this free cash flow is expected to grow at a rate of 6% per year. Markum has an equity cost of capital of 10.9%, a debt cost of capital of 5.35%, and a tax rate of 42%. Markum maintains a debt-equity ratio of 0.40. What is the NPV of the new product line (including any tax shields from leverage)? (Round to two decimalplaces.) How much debt will Markum initially take on as a result of launching this product line? (Round to two decimalplaces.) How much of the product line's value is attributable to the present value of interest tax shields? (Round to two decimalplaces.)As part of their investment strategy, the Carringtons have decided to put $100,000 into stock market investments and also into purchasing precious metals. The performance of the investments depends on the state of the economy in the next year. In an expanding economy, it is expected that their stock market investment will outperform their investment in precious metals, whereas an economic recession will have precisely the opposite effect. Suppose the following payoff matrix gives the expected percentage increase or decrease in the value of each investment for each state of the economy. Expanding Economic economy recession Stock market investment Commodity investment 20 10 -10 15 (a) Determine the optimal investment strategy for the Carringtons' investment of $100,000. (Round your answers to the nearest dollar.) stocks $ commodities $ (b) What profit can the Carringtons expect to make on their…As part of their investment strategy, the Carringtons have decided to put $100,000 into stock market investments and also into purchasing precious metals. The performance of the investments depends on the state of the economy in the next year. In an expanding economy, it is expected that their stock market investment will outperform their investment in precious metals, whereas an economic recession will have precisely the opposite effect. Suppose the following payoff matrix gives the expected percentage increase or decrease in the value of each investment for each state of the economy. Expanding Economic economy recession Stock market investment Commodity investment 30 5 -10 20 (a) Determine the optimal investment strategy for the Carringtons' investment of $100,000. (Round your answers to the nearest dollar.) stocks $ commodities $

- You have been asked by your employers to demonstrate your knowledge in business valuation process, by analyzing the value of Best Group Savings and Loans Company (BGSLC). The company paid a dividend of GH¢ 250,000 this year. The current return to shareholders of companies in the same industry as BGSLC is 12%, although it is expected that an additional risk premium of 2% will be applicable to BGSLC, being a smaller and unquoted company. Compute the expected valuation of BGSLC, if: The current level of dividend is expected to continue into the foreseeable future The dividend is expected to grow at a rate 4% par into foreseeable future The dividend is expected to grow at a 3% rate for three years and 2% afterwardsYou are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $8 million. The product will generate free cash flow of $0.70 million the first year, and this free cash flow is expected to grow at a rate of 6% per year. Markum has an equity cost of capital of 10.8%, a debt cost of capital of 6.38%, and a tax rate of 25%. Markum maintains a debt-equity ratio of 0.50. a. What is the NPV of the new product line (including any tax shields from leverage)? b. How much debt will Markum initially take on as a result of launching this product line? c. How much of the product line's value is attributable to the present value of interest tax shields? Question content area bottom Part 1 a. What is the NPV of the new product line (including any tax shields from leverage)? The NPV of the new product line is million. (Round to two decimal places.) Part 2 b. How much debt will…You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $8 million. The product will generate free cash flow of $0.70 million the first year, and this free cash flow is expected to grow at a rate of 6% per year. Markum has an equity cost of capital of 10.8%, a debt cost of capital of 6.38%, and a tax rate of 25%. Markum maintains a debt-equity ratio of 0.50. a. What is the NPV of the new product line (including any tax shields from leverage)? b. How much debt will Markum initially take on as a result of launching this product line? c. How much of the product line's value is attributable to the present value of interest tax shields? Question content area bottom Part 1 a. What is the NPV of the new product line (including any tax shields from leverage)? The NPV of the new product line is $enter your response here million. (Round to two decimal places.)