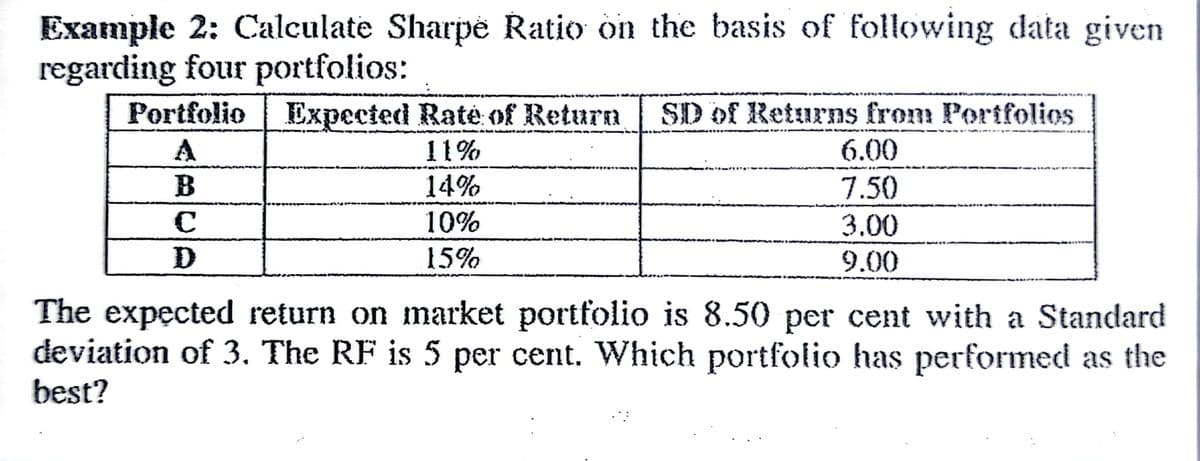

The expected return on market portfolio is 8.50 per cent with a Standard deviation of 3. The RF is 5 per cent. Which portfolio has performed as the best?

The expected return on market portfolio is 8.50 per cent with a Standard deviation of 3. The RF is 5 per cent. Which portfolio has performed as the best?

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter5: A Survey Of Other Common Functions

Section5.3: Modeling Data With Power Functions

Problem 6E: Urban Travel Times Population of cities and driving times are related, as shown in the accompanying...

Related questions

Question

Transcribed Image Text:Example 2: Calculate Sharpë Ratio on the basis of following data given

regarding four portfolios:

Portfolio Expected Rate of Return

SD of Returns from Portfolios

A

11%

6.00

14%

7.50

10%

3.00

9.00

15%

The expected return on market portfolio is 8.50 per cent with a Standard

deviation of 3. The RF is 5 per cent. Which portfolio has performed as the

best?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill