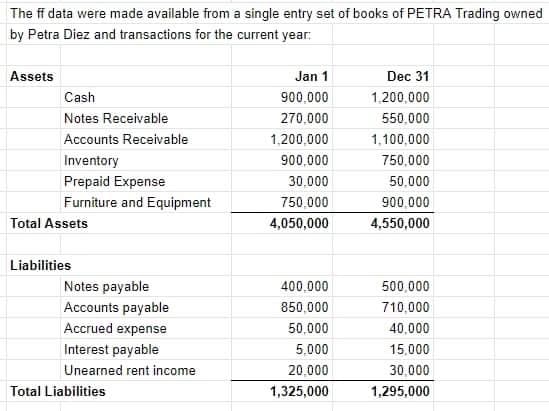

The ff data were made available from a single entry set of books of PETRA Trading owned by Petra Diez and transactions for the current year: Assets Jan 1 Dec 31 Cash 900,000 1,200,000 Notes Receivable 270,000 550,000 Accounts Receivable 1,200,000 1,100,000 Inventory Prepaid Expense Furniture and Equipment 900,000 750,000 30,000 50,000 750,000 900,000 Total Assets 4,050,000 4,550,000 Liabilities Notes payable 400,000 500,000 Accounts payable 850,000 710,000 Accrued expense Interest payable 50,000 40,000 5,000 15,000 Unearned rent income 20,000 30,000 Total Liabilities 1,325,000 1,295,000

The ff data were made available from a single entry set of books of PETRA Trading owned by Petra Diez and transactions for the current year: Assets Jan 1 Dec 31 Cash 900,000 1,200,000 Notes Receivable 270,000 550,000 Accounts Receivable 1,200,000 1,100,000 Inventory Prepaid Expense Furniture and Equipment 900,000 750,000 30,000 50,000 750,000 900,000 Total Assets 4,050,000 4,550,000 Liabilities Notes payable 400,000 500,000 Accounts payable 850,000 710,000 Accrued expense Interest payable 50,000 40,000 5,000 15,000 Unearned rent income 20,000 30,000 Total Liabilities 1,325,000 1,295,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.6E

Related questions

Question

Topic: Single entry

Requirement:

- Compute the expenses

- Compute the gross sales

- Compute the net income

Transcribed Image Text:The ff data were made available from a single entry set of books of PETRA Trading owned

by Petra Diez and transactions for the current year:

Assets

Jan 1

Dec 31

Cash

900,000

1,200,000

Notes Receivable

270,000

550,000

Accounts Receivable

1,200,000

1,100,000

Inventory

900,000

750,000

Prepaid Expense

30,000

50,000

Furniture and Equipment

750,000

900,000

Total Assets

4,050,000

4,550,000

Liabilities

Notes payable

400,000

500,000

Accounts payable

850,000

710,000

Accrued expense

50,000

40.000

Interest payable

5,000

15,000

Unearned rent income

20,000

30,000

Total Liabilities

1,325,000

1,295,000

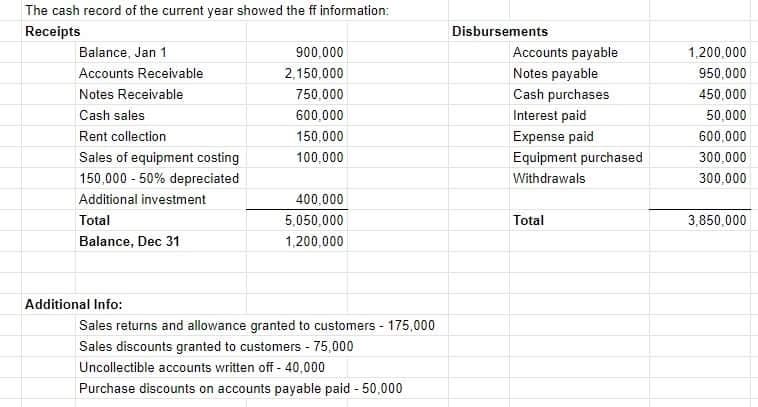

Transcribed Image Text:The cash record of the current year showed the ff information:

Receipts

Disbursements

Balance, Jan 1

900,000

Accounts payable

1,200,000

Accounts Receivable

2,150,000

Notes payable

950,000

Notes Receivable

750,000

Cash purchases

450,000

Cash sales

600,000

Interest paid

50,000

Rent collection

150,000

Expense paid

600,000

Sales of equipment costing

100,000

Equipment purchased

300,000

150,000 - 50% depreciated

Withdrawals

300,000

Additional investment

400,000

Total

5.050,000

Total

3,850,000

Balance, Dec 31

1,200,000

Additional Info:

Sales returns and allowance granted to customers - 175,000

Sales discounts granted to customers - 75,000

Uncollectible accounts written off - 40,000

Purchase discounts on accounts payable paid - 50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning