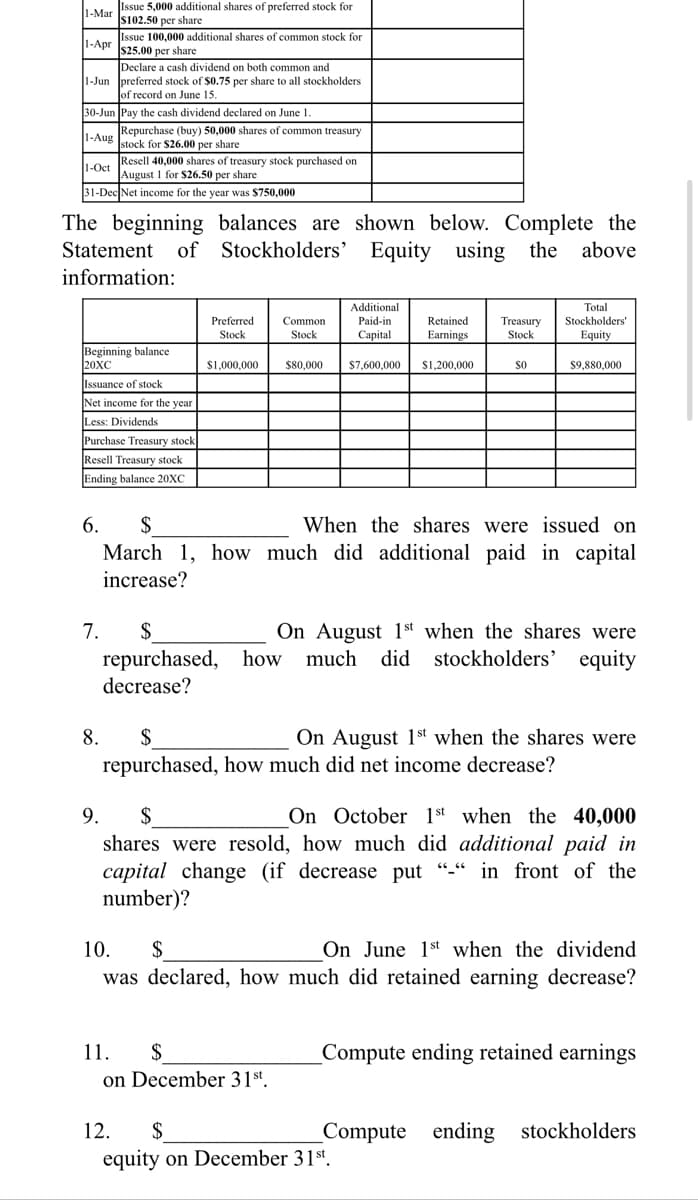

Issue 5,0 s102.50 per share nal shares of preferred stock for 1-Mar 1-Mar Issue 100,000 additional shares of common stock for s25.00 per share Declare a cash dividend on both common and 1-Jun preferred stock of $0.75 per share to all stockholders of record on June 15. 30-Jun Pay the cash dividend declared on June 1. 1-Apr Repurchase (buy) 50,000 shares of common treasury stock for $26.00 per share Resell 40,000 shares of treasury stock purchased on August I for $26.50 per share 31-Dec Net income for the year was $750,000 1-Aug 1-Oct

Issue 5,0 s102.50 per share nal shares of preferred stock for 1-Mar 1-Mar Issue 100,000 additional shares of common stock for s25.00 per share Declare a cash dividend on both common and 1-Jun preferred stock of $0.75 per share to all stockholders of record on June 15. 30-Jun Pay the cash dividend declared on June 1. 1-Apr Repurchase (buy) 50,000 shares of common treasury stock for $26.00 per share Resell 40,000 shares of treasury stock purchased on August I for $26.50 per share 31-Dec Net income for the year was $750,000 1-Aug 1-Oct

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 3SEB: COMMON AND PREFERRED CASH DIVIDENDS Ramirez Company currently has 100,000 shares of 1 par common...

Related questions

Question

What the answer for 12

Transcribed Image Text:LMar ssue 5,000 additional shares of preferred stock for

s102.50 per share

Issue 100,000 additional shares of common stock for

Is25.00 реr share

1-Apr

Declare a cash dividend on both common and

1-Jun preferred stock of $0.75 per share to all stockholders

of record on June 15.

30-Jun Pay the cash dividend declared on June 1.

1-Aug Repurchase (buy) 50,000 shares of common treasury

stock for $26.00 per share

o. Resell 40,000 shares of treasury stock purchased on

August 1 for $26.50 per share

31-Dec Net income for the year was $750,000

The beginning balances are shown below. Complete the

Stockholders' Equity

Statement of

using the above

information:

Additional

Total

Preferred

Stock

Paid-in

Capital

Stockholders'

Equity

Common

Retained

Treasury

Stock

Earnings

Stock

Beginning balance

20XC

$1,000,000

$80,000

$7,600,000

$1,200,000

so

$9,880,000

Issuance of stock

Net income for the year

Less: Dividends

Purchase Treasury stock

Resell Treasury stock

Ending balance 20XC

2$

March 1, how much did additional paid in capital

increase?

6.

When the shares were issued on

On August 1st when the shares were

equity

7.

repurchased,

decrease?

how much

did stockholders'

8.

2$

On August 1st when the shares were

repurchased, how much did net income decrease?

9.

$

On October 1st when the 40,000

shares were resold, how much did additional paid in

capital change (if decrease put "-“ in front of the

number)?

On June 1st when the dividend

was declared, how much did retained earning decrease?

10.

$

11.

$

Compute ending retained earnings

on December 31st

12.

$

Compute ending stockholders

equity on December 31st.

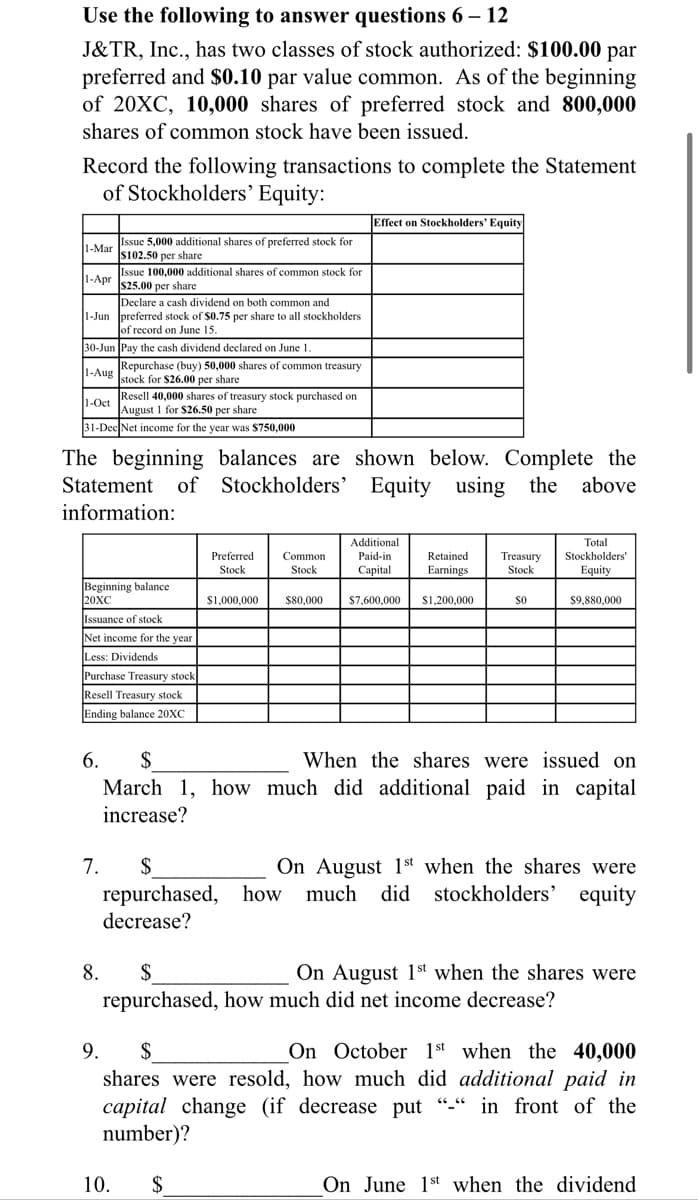

Transcribed Image Text:Use the following to answer questions 6 – 12

J&TR, Inc., has two classes of stock authorized: $100.00 par

preferred and $0.10 par value common. As of the beginning

of 20XC, 10,000 shares of preferred stock and 800,000

shares of common stock have been issued.

Record the following transactions to complete the Statement

of Stockholders’ Equity:

Effect on Stockholders' Equity

L.Mar Issue 5,000 additional shares of preferred stock for

S102.50 per share

L-Apr ssue 100,000 additional shares of common stock for

$25.00 per share

Declare a cash dividend on both common and

1-Jun preferred stock of $0.75 per share to all stockholders

of record on June 15.

30-Jun Pay the cash dividend declared on June 1.

LAve Repurchase (buy) 50,000 shares of common treasury

stock for $26.00 per share

Resell 40,000 shares of treasury stock purchased on

August 1 for $26.50 per share

31-Dec Net income for the year was $750,000

1-Oct

The beginning balances are shown below. Complete the

Equity

Statement of Stockholders'

using the

above

information:

Additional

Total

Stockholders'

Preferred

Stock

Paid-in

Сapital

Retained

Earnings

Treasury

Stock

Common

Stock

Equity

Beginning balance

20XC

$1,000,000

$80,000

$7,600,000

S1,200,000

so

$9,880,000

Issuance of stock

Net income for the year

Less: Dividends

Purchase Treasury stock

Resell Treasury stock

Ending balance 20XC

6.

2$

When the shares were issued on

March 1, how much did additional paid in capital

increase?

2$

On August 1st when the shares were

stockholders' equity

7.

repurchased, how much

decrease?

did

8.

$

On August 1st when the shares were

repurchased, how much did net income decrease?

On October 1st when the 40,000

$

shares were resold, how much did additional paid in

capital change (if decrease put "-“ in front of the

number)?

9.

10.

$

On June 1st when the dividend

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College