The final option is for Tully to complete a doctorate degree in economics after finishing his undergrad degree. There would be no direct costs as he would get scholarships, but he could not work in period 2 while he completed his PhD. After finishing his PhD he would earn $200,000 as an Econ Prof at Kings University in period 3. His interest rate is 15 percent per period. What should Tully choose to do? How does the discount rate influence his decision? Carefully explain.

The final option is for Tully to complete a doctorate degree in economics after finishing his undergrad degree. There would be no direct costs as he would get scholarships, but he could not work in period 2 while he completed his PhD. After finishing his PhD he would earn $200,000 as an Econ Prof at Kings University in period 3. His interest rate is 15 percent per period. What should Tully choose to do? How does the discount rate influence his decision? Carefully explain.

Chapter2: The Deduction For qualified Business Income For Pass-through Entities

Section: Chapter Questions

Problem 3DQ

Related questions

Question

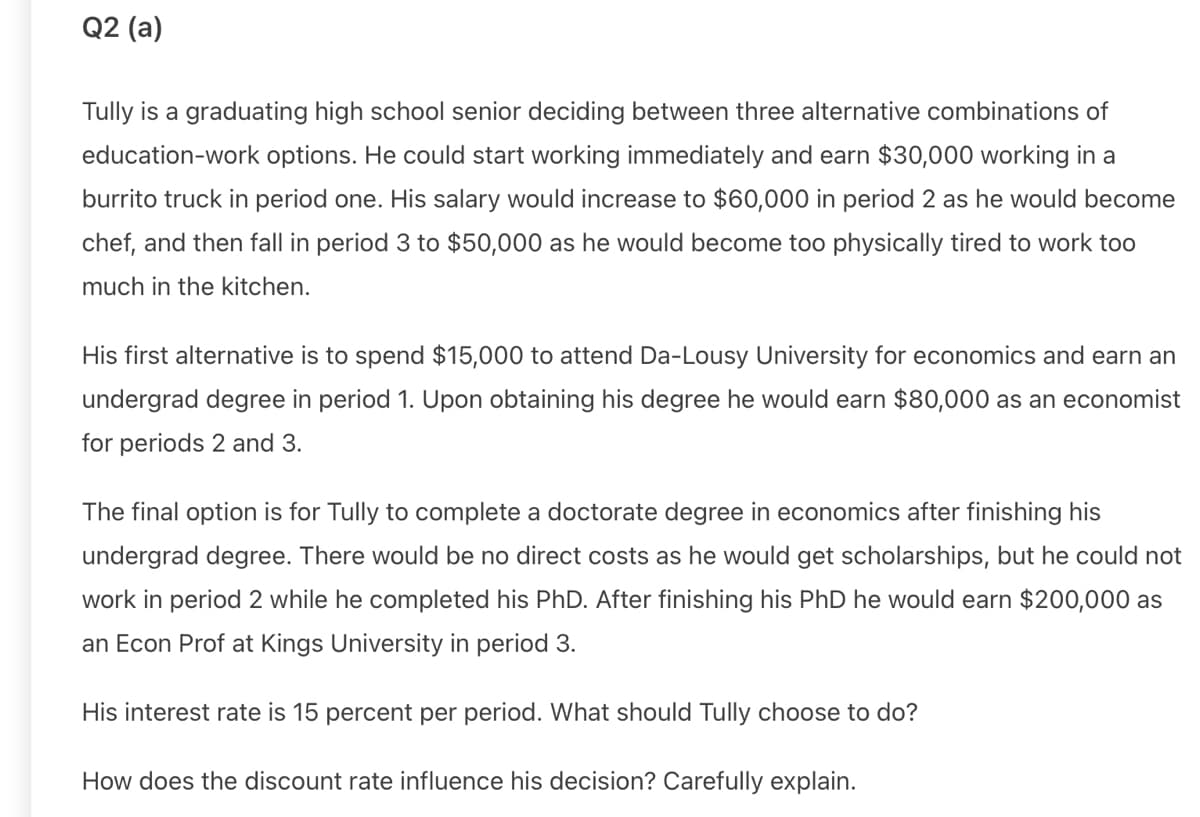

Transcribed Image Text:Q2 (a)

Tully is a graduating high school senior deciding between three alternative combinations of

education-work options. He could start working immediately and earn $30,000 working in a

burrito truck in period one. His salary would increase to $60,000 in period 2 as he would become

chef, and then fall in period 3 to $50,000 as he would become too physically tired to work too

much in the kitchen.

His first alternative is to spend $15,000 to attend Da-Lousy University for economics and earn an

undergrad degree in period 1. Upon obtaining his degree he would earn $80,000 as an economist

for periods 2 and 3.

The final option is for Tully to complete a doctorate degree in economics after finishing his

undergrad degree. There would be no direct costs as he would get scholarships, but he could not

work in period 2 while he completed his PhD. After finishing his PhD he would earn $200,000 as

an Econ Prof at Kings University in period 3.

His interest rate is 15 percent per period. What should Tully choose to do?

How does the discount rate influence his decision? Carefully explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you