The Financial Advisor is a weekly column in the local newspaper. Assume you must answer the following question. "I need a ne that I will keep for 4 years. I have three options. I can (A) pay $32,999 now, (B) make monthly payments for a 7% 4-year loan w down, or (C) make lease payments of $425 per month for the next 4 years. The lease option also requires an up-front payment $3500. What should I do?" Assume that the number of miles driven matches the assumptions for the lease, and the vehicle's va after 4 years is $14,500, Remember that lease payments are made at the beginning of the month, and the salvage value is rece only if you own the vehicle. Based on the provided information, the Equivalent Uniform Annual Cost (EUAC) graph with the alternatives is shown below: 5600.00 $550 00 5500.00 S450.00 5400.00 5350.00 S00 00 11% 13% 15%

The Financial Advisor is a weekly column in the local newspaper. Assume you must answer the following question. "I need a ne that I will keep for 4 years. I have three options. I can (A) pay $32,999 now, (B) make monthly payments for a 7% 4-year loan w down, or (C) make lease payments of $425 per month for the next 4 years. The lease option also requires an up-front payment $3500. What should I do?" Assume that the number of miles driven matches the assumptions for the lease, and the vehicle's va after 4 years is $14,500, Remember that lease payments are made at the beginning of the month, and the salvage value is rece only if you own the vehicle. Based on the provided information, the Equivalent Uniform Annual Cost (EUAC) graph with the alternatives is shown below: 5600.00 $550 00 5500.00 S450.00 5400.00 5350.00 S00 00 11% 13% 15%

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 4P

Related questions

Question

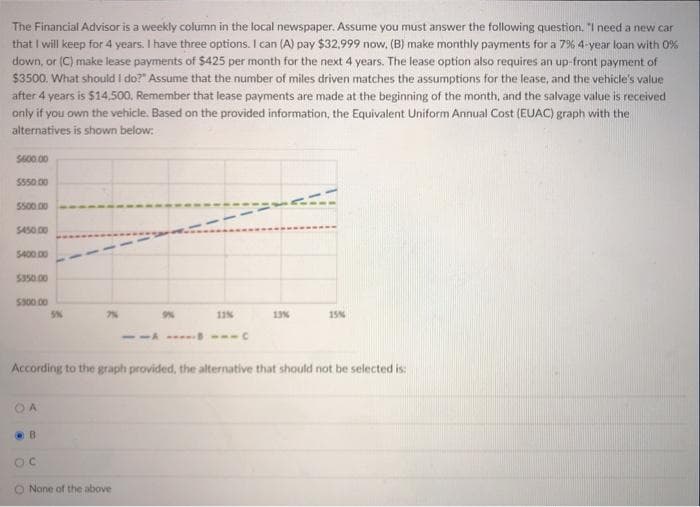

Transcribed Image Text:The Financial Advisor is a weekly column in the local newspaper. Assume you must answer the following question. "I need a new car

that I will keep for 4 years. I have three options. I can (A) pay $32,999 now, (B) make monthly payments for a 7% 4-year loan with 0%

down, or (C) make lease payments of $425 per month for the next 4 years. The lease option also requires an up-front payment of

$3500. What should I do?" Assume that the number of miles driven matches the assumptions for the lease, and the vehicle's value

after 4 years is $14,500, Remember that lease payments are made at the beginning of the month, and the salvage value is received

only if you own the vehicle. Based on the provided information, the Equivalent Uniform Annual Cost (EUAC) graph with the

alternatives is shown below:

S600.00

S550.00

5500.00

S450.00

5400.00

S350.00

S300 00

5%

11N

13%

15%

-A ---C

According to the graph provided, the alternative that should not be selected is:

OC

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning