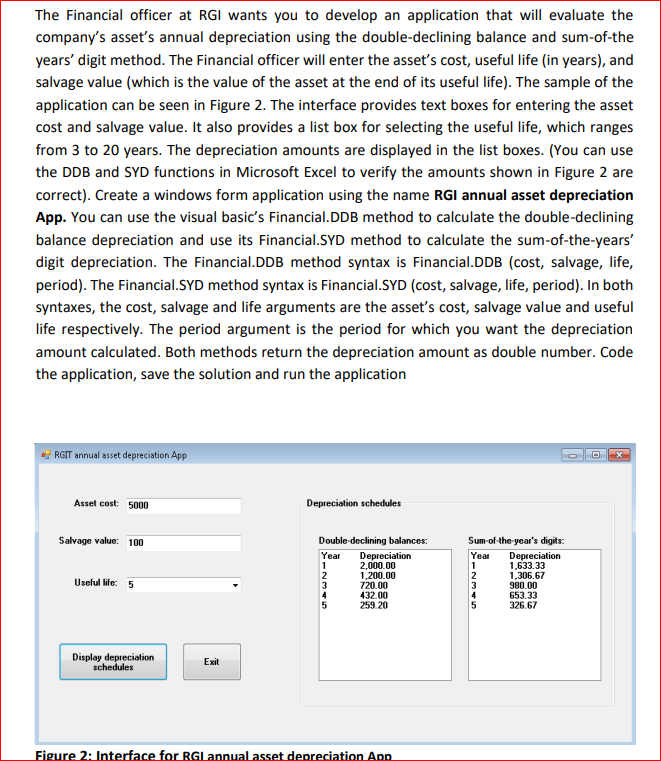

The Financial officer at RGI wants you to develop an application that will evaluate the company's asset's annual depreciation using the double-declining balance and sum-of-the years' digit method. The Financial officer will enter the asseť's cost, useful life (in years), and salvage value (which is the value of the asset at the end of its useful life). The sample of the application can be seen in Figure 2. The interface provides text boxes for entering the asset cost and salvage value. It also provides a list box for selecting the useful life, which ranges from 3 to 20 years. The depreciation amounts are displayed in the list boxes. (You can use the DDB and SYD functions in Microsoft Excel to verify the amounts shown in Figure 2 are correct). Create a windows form application using the name RGI annual asset depreciation App. You can use the visual basic's Financial.DDB method to calculate the double-declining balance depreciation and use its Financial.SYD method to calculate the sum-of-the-years' digit depreciation. The Financial.DDB method syntax is Financial.DDB (cost, salvage, life, period). The Financial.SYD method syntax is Financial.SYD (cost, salvage, life, period). In both syntaxes, the cost, salvage and life arguments are the asset's cost, salvage value and useful life respectively. The period argument is the period for which you want the depreciation amount calculated. Both methods return the depreciation amount as double number. Code the application, save the solution and run the application RGIT annual asset depreciation App Asset cost: 5000 Deprecialion schedules Sum-of-the year's digits: Year Salvage value: 100 Double declining balances: Year 1 Depreciation 2,000.00 1,200.00 720.00 432.00 259.20 Depreciation 1,633.33 1,306.67 980.00 Useful life: 5 3 4 5 653.33 326.67 Display depreciation schedules Exit

The Financial officer at RGI wants you to develop an application that will evaluate the company's asset's annual depreciation using the double-declining balance and sum-of-the years' digit method. The Financial officer will enter the asseť's cost, useful life (in years), and salvage value (which is the value of the asset at the end of its useful life). The sample of the application can be seen in Figure 2. The interface provides text boxes for entering the asset cost and salvage value. It also provides a list box for selecting the useful life, which ranges from 3 to 20 years. The depreciation amounts are displayed in the list boxes. (You can use the DDB and SYD functions in Microsoft Excel to verify the amounts shown in Figure 2 are correct). Create a windows form application using the name RGI annual asset depreciation App. You can use the visual basic's Financial.DDB method to calculate the double-declining balance depreciation and use its Financial.SYD method to calculate the sum-of-the-years' digit depreciation. The Financial.DDB method syntax is Financial.DDB (cost, salvage, life, period). The Financial.SYD method syntax is Financial.SYD (cost, salvage, life, period). In both syntaxes, the cost, salvage and life arguments are the asset's cost, salvage value and useful life respectively. The period argument is the period for which you want the depreciation amount calculated. Both methods return the depreciation amount as double number. Code the application, save the solution and run the application RGIT annual asset depreciation App Asset cost: 5000 Deprecialion schedules Sum-of-the year's digits: Year Salvage value: 100 Double declining balances: Year 1 Depreciation 2,000.00 1,200.00 720.00 432.00 259.20 Depreciation 1,633.33 1,306.67 980.00 Useful life: 5 3 4 5 653.33 326.67 Display depreciation schedules Exit

Computer Networking: A Top-Down Approach (7th Edition)

7th Edition

ISBN:9780133594140

Author:James Kurose, Keith Ross

Publisher:James Kurose, Keith Ross

Chapter1: Computer Networks And The Internet

Section: Chapter Questions

Problem R1RQ: What is the difference between a host and an end system? List several different types of end...

Related questions

Question

Transcribed Image Text:The Financial officer at RGI wants you to develop an application that will evaluate the

company's asset's annual depreciation using the double-declining balance and sum-of-the

years' digit method. The Financial officer will enter the asset's cost, useful life (in years), and

salvage value (which is the value of the asset at the end of its useful life). The sample of the

application can be seen in Figure 2. The interface provides text boxes for entering the asset

cost and salvage value. It also provides a list box for selecting the useful life, which ranges

from 3 to 20 years. The depreciation amounts are displayed in the list boxes. (You can use

the DDB and SYD functions in Microsoft Excel to verify the amounts shown in Figure 2 are

correct). Create a windows form application using the name RGI annual asset depreciation

App. You can use the visual basic's Financial.DDB method to calculate the double-declining

balance depreciation and use its Financial.SYD method to calculate the sum-of-the-years'

digit depreciation. The Financial.DDB method syntax is Financial.DDB (cost, salvage, life,

period). The Financial.SYD method syntax is Financial.SYD (cost, salvage, life, period). In both

syntaxes, the cost, salvage and life arguments are the asset's cost, salvage value and useful

life respectively. The period argument is the period for which you want the depreciation

amount calculated. Both methods return the depreciation amount as double number. Code

the application, save the solution and run the application

E RGIT annual asset depreciation App

Asset cost: 5000

Depreciation schedules

Salvage value: 100

Double-declining balances:

Sum-of-the-year's digits:

Year

Depreciation

2,000.00

1,200.00

720.00

432.00

259.20

Depreciation

1,633.33

1,306.67

980.00

653.33

326.67

Year

2

Uselul life: 5

3

4

4

Display depreciation

schedules

Exit

Figure 2: Interface for RGL annual asset depreciation App

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Computer Networking: A Top-Down Approach (7th Edi…

Computer Engineering

ISBN:

9780133594140

Author:

James Kurose, Keith Ross

Publisher:

PEARSON

Computer Organization and Design MIPS Edition, Fi…

Computer Engineering

ISBN:

9780124077263

Author:

David A. Patterson, John L. Hennessy

Publisher:

Elsevier Science

Network+ Guide to Networks (MindTap Course List)

Computer Engineering

ISBN:

9781337569330

Author:

Jill West, Tamara Dean, Jean Andrews

Publisher:

Cengage Learning

Computer Networking: A Top-Down Approach (7th Edi…

Computer Engineering

ISBN:

9780133594140

Author:

James Kurose, Keith Ross

Publisher:

PEARSON

Computer Organization and Design MIPS Edition, Fi…

Computer Engineering

ISBN:

9780124077263

Author:

David A. Patterson, John L. Hennessy

Publisher:

Elsevier Science

Network+ Guide to Networks (MindTap Course List)

Computer Engineering

ISBN:

9781337569330

Author:

Jill West, Tamara Dean, Jean Andrews

Publisher:

Cengage Learning

Concepts of Database Management

Computer Engineering

ISBN:

9781337093422

Author:

Joy L. Starks, Philip J. Pratt, Mary Z. Last

Publisher:

Cengage Learning

Prelude to Programming

Computer Engineering

ISBN:

9780133750423

Author:

VENIT, Stewart

Publisher:

Pearson Education

Sc Business Data Communications and Networking, T…

Computer Engineering

ISBN:

9781119368830

Author:

FITZGERALD

Publisher:

WILEY