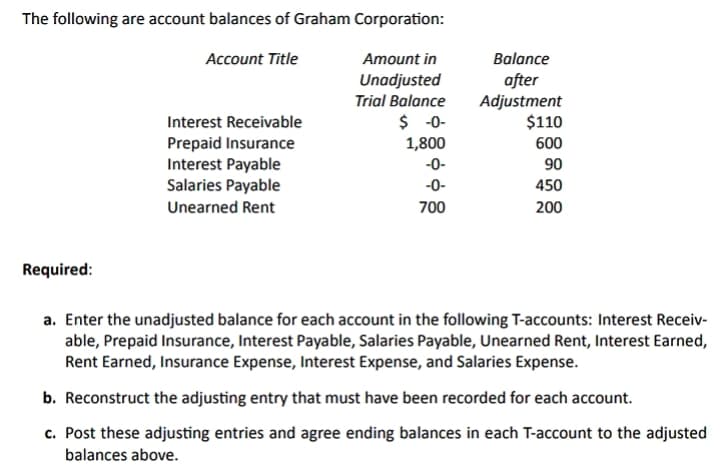

The following are account balances of Graham Corporation: Account Title Amount in Balance Unadjusted Trial Balance after Adjustment $110 $ -0- 1,800 Interest Receivable Prepaid Insurance Interest Payable Salaries Payable 600 -0- 90 -0- 450 Unearned Rent 700 200 Required: a. Enter the unadjusted balance for each account in the following T-accounts: Interest Receiv- able, Prepaid Insurance, Interest Payable, Salaries Payable, Unearned Rent, Interest Earned, Rent Earned, Insurance Expense, Interest Expense, and Salaries Expense. b. Reconstruct the adjusting entry that must have been recorded for each account. c. Post these adjusting entries and agree ending balances in each T-account to the adjusted balances above.

The following are account balances of Graham Corporation: Account Title Amount in Balance Unadjusted Trial Balance after Adjustment $110 $ -0- 1,800 Interest Receivable Prepaid Insurance Interest Payable Salaries Payable 600 -0- 90 -0- 450 Unearned Rent 700 200 Required: a. Enter the unadjusted balance for each account in the following T-accounts: Interest Receiv- able, Prepaid Insurance, Interest Payable, Salaries Payable, Unearned Rent, Interest Earned, Rent Earned, Insurance Expense, Interest Expense, and Salaries Expense. b. Reconstruct the adjusting entry that must have been recorded for each account. c. Post these adjusting entries and agree ending balances in each T-account to the adjusted balances above.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

Transcribed Image Text:The following are account balances of Graham Corporation:

Account Title

Amount in

Balance

Unadjusted

Trial Balance

$ -0-

1,800

after

Adjustment

$110

Interest Receivable

Prepaid Insurance

Interest Payable

Salaries Payable

600

-0-

90

-0-

450

Unearned Rent

700

200

Required:

a. Enter the unadjusted balance for each account in the following T-accounts: Interest Receiv-

able, Prepaid Insurance, Interest Payable, Salaries Payable, Unearned Rent, Interest Earned,

Rent Earned, Insurance Expense, Interest Expense, and Salaries Expense.

b. Reconstruct the adjusting entry that must have been recorded for each account.

c. Post these adjusting entries and agree ending balances in each T-account to the adjusted

balances above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning