The following are financial statements of AR Sdn Bhd. AR Sdn Bhd Income Statement for the vear ended 31/12/2015 RM RM RM Sales 18600 RInward (440) Net Sales 18160 COGS Opening stock 3776

The following are financial statements of AR Sdn Bhd. AR Sdn Bhd Income Statement for the vear ended 31/12/2015 RM RM RM Sales 18600 RInward (440) Net Sales 18160 COGS Opening stock 3776

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 53E: Exercise 1-53 Relationships Among the Financial Statements During 2019, Moore Corporation paid...

Related questions

Question

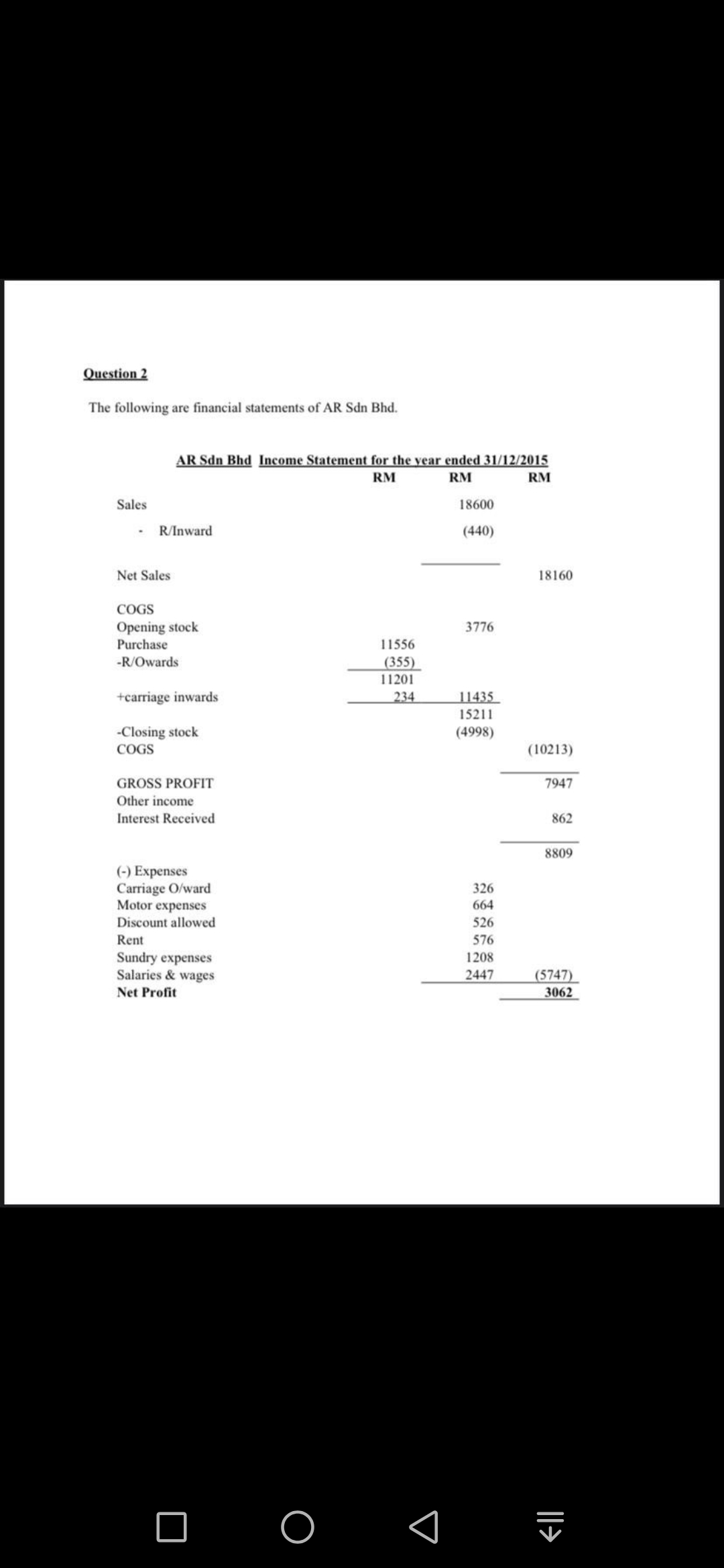

Transcribed Image Text:Question 2

The following are financial statements of AR Sdn Bhd.

AR Sdn Bhd Income Statement for the year ended 31/12/2015

RM

RM

RM

Sales

18600

R/Inward

(440)

Net Sales

18160

COGS

Opening stock

Purchase

3776

11556

-R/Owards

(355)

11201

+carriage inwards

234

11435

15211

-Closing stock

COGS

(4998)

(10213)

GROSS PROFIT

7947

Other income

Interest Received

862

8809

(-) Expenses

Carriage O/ward

Motor expenses

326

664

Discount allowed

526

Rent

576

Sundry expenses

Salaries & wages

1208

2447

(5747)

3062

Net Profit

□ ㅇ

|l>

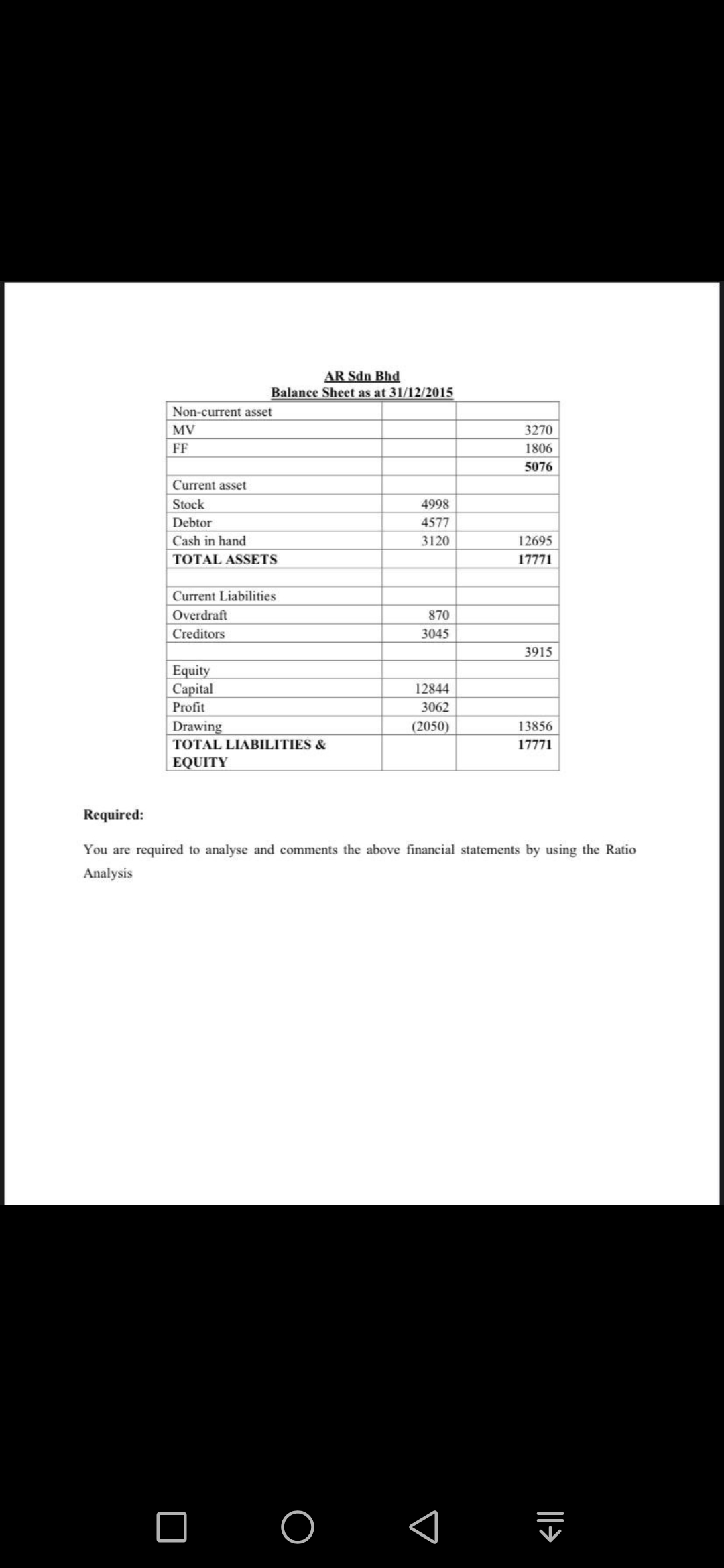

Transcribed Image Text:AR Sdn Bhd

Balance Sheet as at 31/12/2015

Non-current asset

MV

3270

FF

1806

5076

Current asset

Stock

4998

Debtor

4577

Cash in hand

3120

12695

TOTAL ASSETS

17771

Current Liabilities

Overdraft

870

Creditors

3045

3915

Equity

Capital

12844

Profit

3062

Drawing

(2050)

13856

TOTAL LIABILITIES &

17771

EQUITY

Required:

You are required to analyse and comments the above financial statements by using the Ratio

Analysis

□ ㅇ

|l>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning