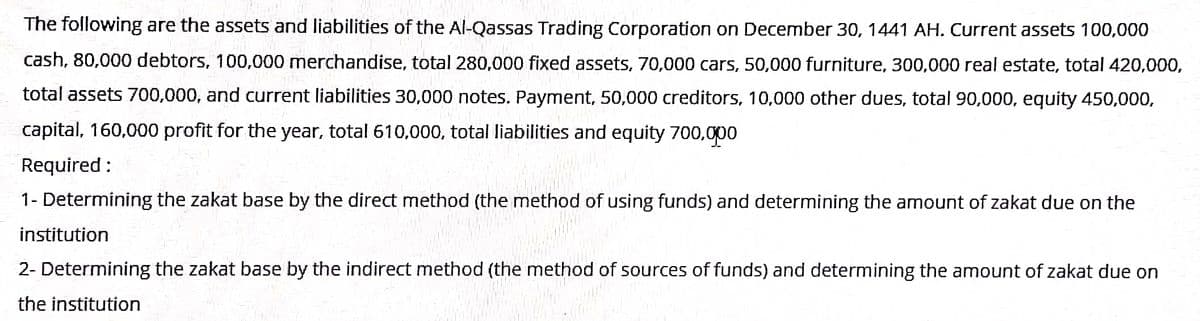

The following are the assets and liabilities of the Al-Qassas Trading Corporation on December 30, 1441 AH. Current assets 100,000 cash, 80,000 debtors, 100,000 merchandise, total 280,000 fixed assets, 70,000 cars, 50,000 furniture, 300,000 real estate, total 420,000, total assets 700,000, and current liabilities 30,000 notes. Payment, 50,000 creditors, 10,000 other dues, total 90,000, equity 450,000, capital, 160,000 profit for the year, total 610,000, total liabilities and equity 700,000 Required : 1- Determining the zakat base by the direct method (the method of using funds) and determining the amount of zakat due on the institution 2- Determining the zakat base by the indirect method (the method of sources of funds) and determining the amount of zakat due on the institution

The following are the assets and liabilities of the Al-Qassas Trading Corporation on December 30, 1441 AH. Current assets 100,000 cash, 80,000 debtors, 100,000 merchandise, total 280,000 fixed assets, 70,000 cars, 50,000 furniture, 300,000 real estate, total 420,000, total assets 700,000, and current liabilities 30,000 notes. Payment, 50,000 creditors, 10,000 other dues, total 90,000, equity 450,000, capital, 160,000 profit for the year, total 610,000, total liabilities and equity 700,000 Required : 1- Determining the zakat base by the direct method (the method of using funds) and determining the amount of zakat due on the institution 2- Determining the zakat base by the indirect method (the method of sources of funds) and determining the amount of zakat due on the institution

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 50E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

help me with this accounting question

Transcribed Image Text:The following are the assets and liabilities of the Al-Qassas Trading Corporation on December 30, 1441 AH. Current assets 100,000

cash, 80,000 debtors, 100,000 merchandise, total 280,000 fixed assets, 70,000 cars, 50,000 furniture, 300,000 real estate, total 420,000,

total assets 700,000, and current liabilities 30,000 notes. Payment, 50,000 creditors, 10,000 other dues, total 90,000, equity 450,000,

capital, 160,000 profit for the year, total 610,000, total liabilities and equity 700,000

Required :

1- Determining the zakat base by the direct method (the method of using funds) and determining the amount of zakat due on the

institution

2- Determining the zakat base by the indirect method (the method of sources of funds) and determining the amount of zakat due on

the institution

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub