The following are the balance sheets of Entity A and Entity B as of June 30, 2021: Entity A Current Assets 500 Noncurrent Assets 1,300 Capital Stock - 100 Shares 300 Retained Earnings 800 Current Liabilities 300 Non Current Liabilities 400 Entity B Current Assets 700 Noncurrent Assets 3,000 Capital Stock -60 shares 600 Retained Earnings 1,400 Current Liabilities 600 Non Current Liabilities 1,100 On July 1, 2021, A acquired all issued shares of B giving in exchange 2.50 A shares for each ordinary shares of B in order for B to obtain public listing. The fair value of each ordinary share of B at July 1, is 40., while the quoted market price of A's ordinary shares is 16. The fair values of A's identifiable net assets at acquisition date are the same of their carrying amounts, except for noncurrent assets whose fair value was 1,500. On the other hand, the fair value of the net assets of B are approximately their carrying amounts. 30. Calculate the goodwill(excess) resulting from the combination Select the correct response: O 400 O 300 O (400) O 360

The following are the balance sheets of Entity A and Entity B as of June 30, 2021: Entity A Current Assets 500 Noncurrent Assets 1,300 Capital Stock - 100 Shares 300 Retained Earnings 800 Current Liabilities 300 Non Current Liabilities 400 Entity B Current Assets 700 Noncurrent Assets 3,000 Capital Stock -60 shares 600 Retained Earnings 1,400 Current Liabilities 600 Non Current Liabilities 1,100 On July 1, 2021, A acquired all issued shares of B giving in exchange 2.50 A shares for each ordinary shares of B in order for B to obtain public listing. The fair value of each ordinary share of B at July 1, is 40., while the quoted market price of A's ordinary shares is 16. The fair values of A's identifiable net assets at acquisition date are the same of their carrying amounts, except for noncurrent assets whose fair value was 1,500. On the other hand, the fair value of the net assets of B are approximately their carrying amounts. 30. Calculate the goodwill(excess) resulting from the combination Select the correct response: O 400 O 300 O (400) O 360

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10SPB: RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem...

Related questions

Question

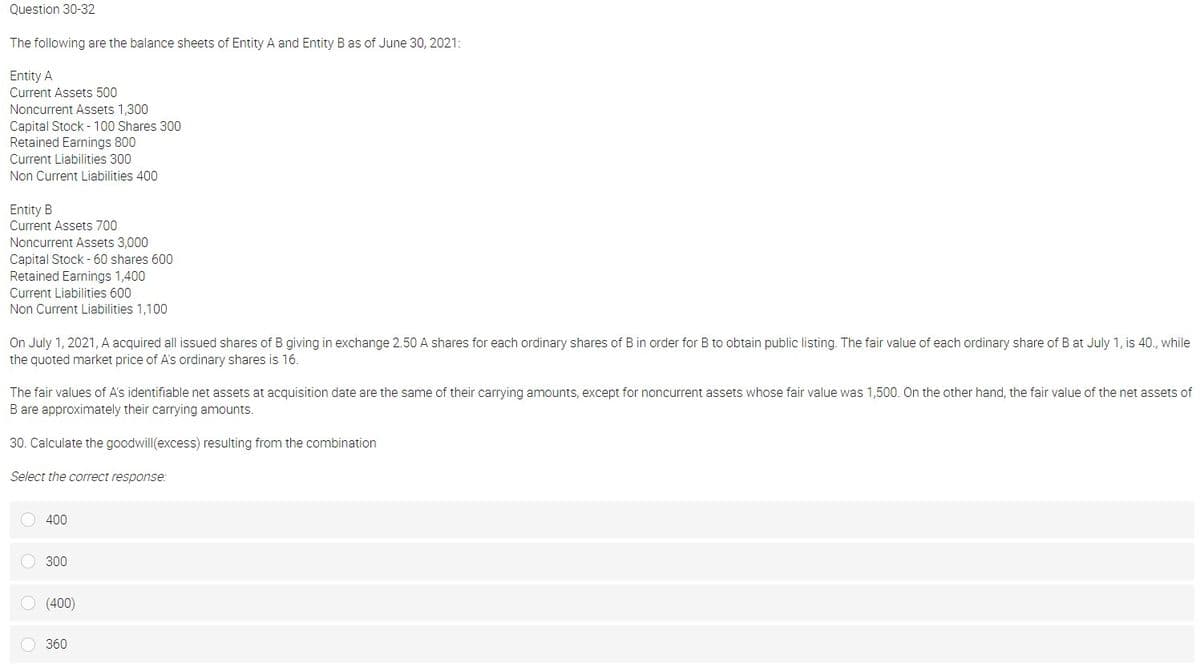

Transcribed Image Text:Question 30-32

The following are the balance sheets of Entity A and Entity B as of June 30, 2021:

Entity A

Current Assets 500

Noncurrent Assets 1,300

Capital Stock - 100 Shares 300

Retained Earnings 800

Current Liabilities 300

Non Current Liabilities 400

Entity B

Current Assets 700

Noncurrent Assets 3,000

Capital Stock - 60 shares 600

Retained Earnings 1,400

Current Liabilities 600

Non Current Liabilities 1,100

On July 1, 2021, A acquired all issued shares of B giving in exchange 2.50 A shares for each ordinary shares of B in order for B to obtain public listing. The fair value of each ordinary share of B at July 1, is 40., while

the quoted market price of A's ordinary shares is 16.

The fair values of A's identifiable net assets at acquisition date are the same of their carrying amounts, except for noncurrent assets whose fair value was 1,500. On the other hand, the fair value of the net assets of

B are approximately their carrying amounts.

30. Calculate the goodwill(excess) resulting from the combination

Select the correct response:

400

300

(400)

360

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning