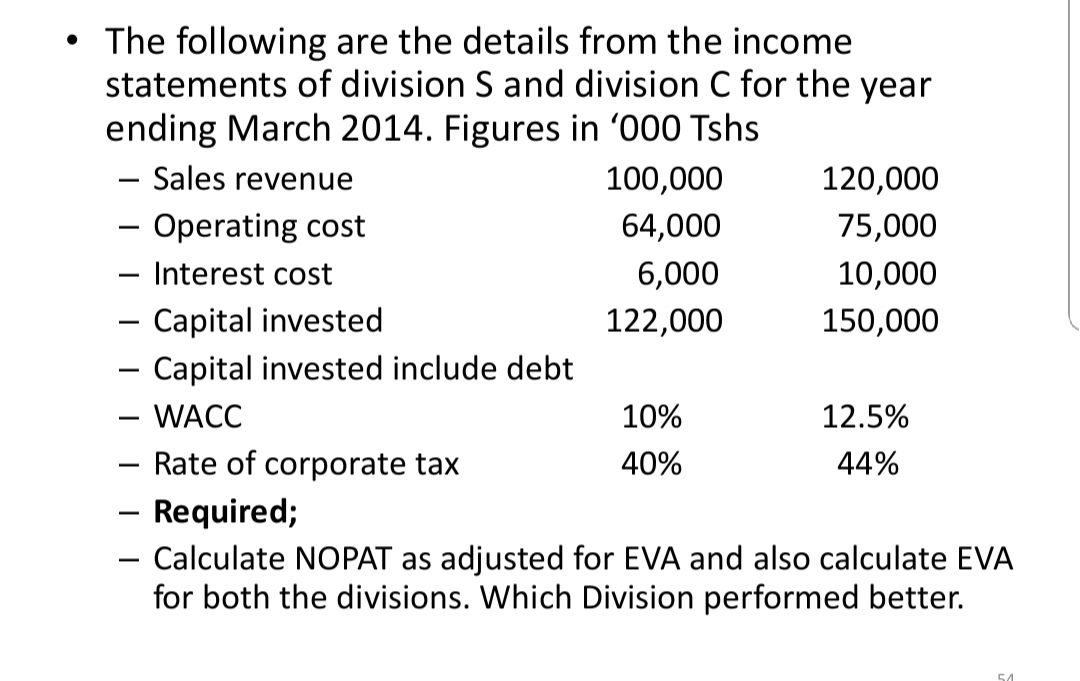

The following are the details from the income statements of division S and division C for the year ending March 2014. Figures in '000 Tshs - Sales revenue 100,000 120,000 - Operating cost - Interest cost - Capital invested - Capital invested include debt - WACC - Rate of corporate tax - Required; - Calculate NOPAT as adjusted for EVA and also calculate EVA for both the divisions. Which Division performed better. 64,000 75,000 | 6,000 10,000 - 122,000 150,000 - - 10% 12.5% - 40% 44% - -

The following are the details from the income statements of division S and division C for the year ending March 2014. Figures in '000 Tshs - Sales revenue 100,000 120,000 - Operating cost - Interest cost - Capital invested - Capital invested include debt - WACC - Rate of corporate tax - Required; - Calculate NOPAT as adjusted for EVA and also calculate EVA for both the divisions. Which Division performed better. 64,000 75,000 | 6,000 10,000 - 122,000 150,000 - - 10% 12.5% - 40% 44% - -

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 52E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Transcribed Image Text:The following are the details from the income

statements of division S and division C for the year

ending March 2014. Figures in '000 Tshs

– Sales revenue

100,000

120,000

- Operating cost

- Interest cost

64,000

75,000

|

6,000

10,000

- Capital invested

– Capital invested include debt

- WACC

- Rate of corporate tax

- Required;

- Calculate NOPAT as adjusted for EVA and also calculate EVA

for both the divisions. Which Division performed better.

122,000

150,000

10%

12.5%

40%

44%

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning