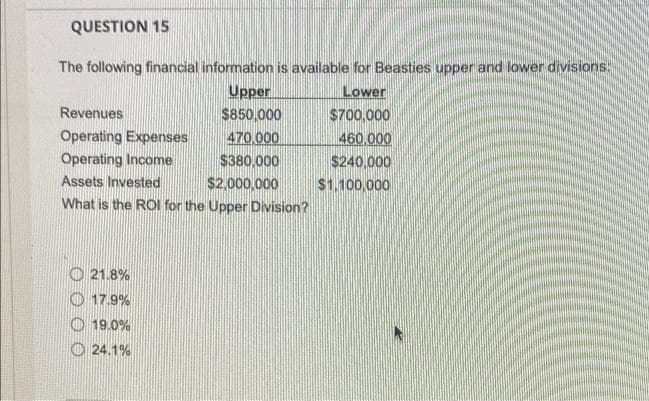

The following financial information is available for Beasties upper and lower divisions: Upper Lower Revenues $850,000 $700,000 Operating Expenses 470,000 460,000 Operating Income $380,000 $240,000 Assets Invested $2,000,000 $1,100,000 What is the ROI for the Upper Division? 21.8% 17.9% 19.0%

Q: Maturity Value (F) Principal (P) Rate (r) Time (t) Interest (I,) P 60,000.00 4% 15 (1) (2) (3) 12% P…

A: Interest = Principal x Rate x Time 1) Interest = 60,000 x 4% x 15 =36,000 2) Maturity Value =…

Q: In a congressional district somewhere in the U.S., a new representative is being elected. The voters…

A: Market supply and demand are in equilibrium, and pricing are stable as a result. In general, if…

Q: Cov1,2 = 0. %3D 4. In the general case where -1 < Cov12 < +1 express the relationship between the…

A: Portfolio return and portfolio variance: 4. Portfolio returns and portfolio variance The portfolio…

Q: Which one of the following dates is the date on which the board of directors votes to pay a…

A: Record Date is the date used as a reference to understand which shareholder will get the dividend…

Q: Analyze the change control process for the retail project's software configuration management. Your…

A: Any Development Project that retails merchandise, generally without transformation, and renders…

Q: k W has the following returns for various states of the economy: State of the Economy Probability…

A: The mean return is expected probabilistic return considering the different state of economy and…

Q: An investor is asked to invest in a project as follows: Invest RS 000 now, at year 1, invest a…

A: Year Particular Amount 0 Investment 5000 1 Investment 1000 2 Return 2000 4 Investment 3000…

Q: 9. Avicorp has a $11.7 million debt issue outstanding, with a 5.8% coupon rate. The debt has…

A: The cost of debt is the yield to maturity of a bond. It is the rate at which borrowed funds can be…

Q: If debt and equity can be modeled as options on the firm’s assets, then the firm's shareholders have…

A: If debt and equity can be modeled as options on the firm’s assets, then the firm's shareholders have…

Q: Phoenix Motors wants to lock in the cost of 10,000 ounces of platinum to be used in next quarter's…

A: Given, In this question we will have to find out the different costs at the different point of time…

Q: If a business firm has assets worth $170,000 and liabilities that total $40,000, what is the value…

A: Shareholders/ Owner’s equity: The shareholders are the owners of the company and the shareholders…

Q: a) What is the current ratio? b) What is the quick ratio?

A: Given Current liabilities = 2500 Net working capital= 800 Current assets-2500=800 Current assets =…

Q: Phoenix Motors wants to lock in the cost of 10,000 ounces of platinum to be used in next quarter's…

A: Here, Required Platinum is 10,000 ounces Future Contract Rate is $950 per ounces Time Period of…

Q: O Fall exactly by the amount of the dividend

A: A dividend refers to the amount which is to be paid to shareholders out of the company profits,…

Q: A. Payback. The company requires all projects to payback within 3 years. Calculate the payback…

A: Payback period = Year of last negative cash flow + (Absolute value of last negative cash flow/Next…

Q: The real risk-free rate of interest, r*, is 4 percent, and it is expected to remain constant over…

A: A Bond refers to an instrument that represents the loan being made by the investor to the company…

Q: An investor is considering the purchase of a(n) 8.125%, 15-year corporate bond that's being…

A: The price of a bond is the present value of future cash flows associated with the bond. This…

Q: A.K. Scott’s stock is selling for $37 a share. A 3-month call on this stock with a strike price of…

A: The put-call parity is a term used to describe the relationship between call and put options in…

Q: O Payback does not consider the time value of money

A: Capital projects refer to a project which is helpful in maintaining and improving the asset of the…

Q: The risk free rate is 3%. Calculate and rank the following funds using Jensen's Alpha, Treynor…

A: Here, To Find: Jensen's Alpha =? Treynor measure =? Sharpe Ratio =? M squared =?

Q: 6 points Save 0 million and A's present value of net cash flows after tax is $245 million, Project B…

A: Projects Initial outlay (Million $) PV of net cash flows after tax (Million $) Net Present Value…

Q: while the material quantity van materials purchased in June wa

A: Material price variance = -7000 SP*AQ-AP*AQ=-7000 SQ*SP-AQ*SP=4200 SP*SQ-AP*AQ=4200-7000=-2800…

Q: Directions: Solve the following problems completely. Find the period of deferral in each of the…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: What would the monthly payment be? It is a zero amortizing loan

A: Given Pv=300000*75%=225000 i=6%/12=0.5% n=30*12=360 Pv=pmt*(1-(1+i)^-n)/i

Q: You are to receive $ 400,000 exactly 5 years from now. You do not want to wait for the money and…

A: Present value of money can be calculated as: = Future value / ( 1 + Interest rate) ^ years

Q: You want to start to save for a major purchase. You can invest ₱320 every three months for 3 years…

A: If a payment or deposit of equal amount is made at equal intervals of time, for a fixed number of…

Q: When compounded quarterly P12,000 becomes P 20,415.23 after 4 yrs. What is the nominal rate of…

A: Present value (P) = P12,000 Future value (FV) = P 20,415.23 Period = 4 Years Quarterly periods (n) =…

Q: Which of the following is a good choice for a manager interested in fostering the cooperation of two…

A: At times the managers of companies may have to seek cooperation between different departments of the…

Q: 8. Growth Company's current share price is $20.00 and it is expected to pay a $1.30 dividend per…

A: Cost of capital is the cost of raising new funds from the market. The cost of equity is higher since…

Q: Suppose you make a down payment of 6% of $27,600 for a car and finance the rest at 1.5% compounded…

A: Given that: Total Amount=$27600 Down Payment=6% of $27600=$1656 P=$27600-$1656=$25944 t=48= 4 years…

Q: Apple Corp. had the following portfolio of financial instruments of the December 31, 2020. All…

A: Realized gain on the sale of the bond When a bond is sold before its maturity, the realized gain…

Q: 17. Monetary policy refers to the strategies employed by a central bank with regard to the amount of…

A: Monetary policy Monetary policy is handled and managed by the central bank where the central bank…

Q: ABC Fabricators just issued par 25-year bonds. The bonds sold for 738.38 and pay interest…

A: Time period = 25 years Present Value = 738.38 Interest rate = 8.5%

Q: WHY THE FORECAST INCOME HSVE DEACLINE IN THE 2022 AND 2023 OF APPLE COMPANY

A: Companies and analysts often forecast their financial statements. Here the income statement of Apple…

Q: Assume the following inputs for a call option: (1) current stock price is $25, (2) strike price is…

A: Here, Current stock price = $25, Strike price = $28, Time to expiration = 4 months, Annualized…

Q: You decide to make monthly payments into a retirement fund earning 4.75% compounded monthly. Note:…

A: We will apply the formula for calculating the future value of the money so that we can calculate the…

Q: tock W has the following returns for various states of the economy: State of the Economy…

A: Stock W return = (Probability 1 * Return 1) + (Probability 2* Return 2) + ....+ (Probability N *…

Q: 4. Consider a 20-year term insurance issued to a select life aged 40 by a single premium, with sum…

A: The present value of the policy's benefit is known as the net single premium. It is the expected…

Q: Mr. Smith is purchasing a $90000 hoyse. The down payment is 20% of the price of the house. He is…

A: A mortgage is a loan that is repaid by equal installments over a period of time. The installments…

Q: A convertible bond is selling for $800. It has 10 years to maturity, a $1000 face value, and a 10%…

A: Selling price of a convertible bond = $800 Face value = $1,000 Coupon rate (semi-annually) = 10%…

Q: . Investment Problem Cost of bldg.. =5M Gross Revenue = 9.5 M Operating expense = 4M Nominal…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Assume you have created a 2-stock portfolio by investing $30,000 in stock X with a beta of 0.8, and…

A: Expected Return and Standard deviation of each stock is calculated using below formula For…

Q: The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $40,000. It had…

A: Net present value is the difference between the present value of cash inflows and present value of…

Q: Determine the mode of the set of values. (Enter your answers as a comma-separated list. If there is…

A: Answer - Formula for Mode Calculation- Mode is the value that occurs with the greatest number of…

Q: Investments Quick and Slow cost $1,000 each, are mutually exclusive, and have the following cash…

A: NPV of Q = 1100*(1+i)^-1 - 1000 = 1100*1.07^-1 - 1000 = 1028.037 - 1000 = $28.0 NPV of S =…

Q: how does working capital management differ from capital budgeting and capital structure?

A: Working capital management is a business strategy that ensures a company's operations run smoothly…

Q: Assets, Inc., plans to issue $8 million of bonds with a coupon rate of 11 percent, a par value of…

A: Bonds are the debt securities which are issued by the corporates or governments to arrange the…

Q: Two-year Treasury securities yield 6.7 percent, while 1-year Treasury securities yield 6.3 percent.…

A: The long-term interest rate, according to the expectations theory of the term structure, is a…

Q: Question 4 Given the following information, calculate the cost per servable pound. • Yield…

A: Given: Yield Percentage = 82.6%As Purchased (AP) Price = $12.79 To Find: The cost per servable…

Q: Which of the following is NOT relevant to the evaluation of a proposed project? Incremental cash…

A: While eveluating a project all the initial cash flows and subsequent cash flows are considered. All…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- QUESTION 4 The following results are available for Division X and Y:Division X Division YProfit before interest and tax P185 000 P172, 000Capital employed P1, 540, 000 P1, 650, 000 The cost of capital is 10%.Calculate and comment on the performance of the departments based on:a. Return on capital employed b. Residual incomeQUESTION 26 BMI’s East Division has a cost of capital of 20 percent. Selected financial information for the first year of business follows. Sales revenue $ 1,800,000 Income 340,000 Investment (beginning of year) 1,800,000 Current liabilities (beginning of year) 240,000 R&D expendituresa 600,000 a R&D (Research and Development) is assumed to benefit three years. All R&D is spent at the beginning of the year. East Division’s EVA (economic value added) is: A. $356,000 B. $260,000 C. $295,000 D. $108,000 E. $308,000Q23 Selected data from Box Division's accounting records revealed the following: Sales $ 345,060 Average investment $ 200,100 Net operating income $ 24,300 Minimum rate of return (divisional cost of capital) 11% Box Division's return on sales (ROS) is: (Round your percentages to one decimal place.) Multiple Choice 11.1%. 4.1%. 7.0%. 19.2%. 12.1%.

- Problem 7-5A a, b1-b3, c (Part Level Submission) (Video) Brislin Company has four operating divisions. During the first quarter of 2020, the company reported aggregate income from operations of $210,600 and the following divisional results. Division I II III IV Sales $245,000 $197,000 $504,000 $450,000 Cost of goods sold 200,000 192,000 301,000 249,000 Selling and administrative expenses 72,400 63,000 58,000 50,000 Income (loss) from operations $ (27,400) $ (58,000) $145,000 $151,000 Analysis reveals the following percentages of variable costs in each division. I II III IV Cost of goods sold 73 % 91 % 82 % 75 % Selling and administrative expenses 39 59 50 61 Discontinuance of any division would save 50% of the fixed costs and expenses for that division.Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or…Question 10.2 Provide the missing data for the following situations: Red Division White Division Green Division Sales A $10,000,000 E Net operating income $240,000 $500,000 $288,000 Total assets B C $1,600,000 Return on investment 0.16 0.10 F Return on sales 0.05 D 0.14Q4. Division A of Kern Co. has sales of $350,000, cost of goods sold for $200,000, operating expenses of $30,000, and invested assets of $600,000. What is the return on investment for Division A? Answer: $______________ Explain your answer: __________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

- 7. Jordan Company has two divisions, which reported the following results for the most recent year. Division I Division II Income ₱ 02,700,000 ₱ 00,600,000 Average invested capital ₱ 18,000,000 ₱ 03,000,000 ROI 15% 20% Imputed interest rate = 10% Under residual income, which division is considered to have a better performance? Show solution Group of answer choices Neither Division I nor II Cannot be determined Division I Division IIQS 22-11 Performance measures LO A1, A2 Investment Center A B Sales $ ? $ 10,400,000 Net income $ 352,000 $ ? Average invested assets $ 1,400,000 $ ? Profit margin 8 % ? % Investment turnover ? 1.5 Return on investment ? % 12 % Use the information in the table above to compute each department’s contribution to overhead (both in dollars and as a percent). (Round your final answers to 2 decimal places.)chpater 6 question 6 Assume a company with two divisions (A and B) prepared the following segmented income statement: A B Total Sales $ ? $ 200,000 $ ? Variable expenses 120,000 140,000 260,000 Contribution margin ? ? ? Traceable fixed expenses 100,000 ? ? Segment margin $ ? $ (20,000 ) ? Common fixed expenses 50,000 Net operating income $ 10,000 What is the company’s total sales? Multiple Choice $500,000 $600,000 $480,000 $460,000

- Required information The Foundational 15 (Algo) [LO11-1, LO11-2] Skip to question [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year’s operations: Sales $ 1,400,000 Variable expenses 510,000 Contribution margin 890,000 Fixed expenses 610,000 Net operating income $ 280,000 Average operating assets $ 875,000 At the beginning of this year, the company has a $175,000 investment opportunity with the following cost and revenue characteristics: Sales $ 280,000 Contribution margin ratio 50 % of sales Fixed expenses $ 98,000 The company’s minimum required rate of return is 15%. Foundational 11-8 (Algo) 8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your answer to 2 decimal places.)Required information The Foundational 15 (Algo) [LO11-1, LO11-2] Skip to question [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year’s operations: Sales $ 1,400,000 Variable expenses 510,000 Contribution margin 890,000 Fixed expenses 610,000 Net operating income $ 280,000 Average operating assets $ 875,000 At the beginning of this year, the company has a $175,000 investment opportunity with the following cost and revenue characteristics: Sales $ 280,000 Contribution margin ratio 50 % of sales Fixed expenses $ 98,000 The company’s minimum required rate of return is 15%. Foundational 11-7 (Algo) 7. If the company pursues the investment opportunity and otherwise performs the same as last year, what margin will it earn this year? (Round your percentage answer to 1 decimal place (i.e .1234 should be entered as 12.3))Required information The Foundational 15 (Algo) [LO11-1, LO11-2] Skip to question [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year’s operations: Sales $ 1,400,000 Variable expenses 510,000 Contribution margin 890,000 Fixed expenses 610,000 Net operating income $ 280,000 Average operating assets $ 875,000 At the beginning of this year, the company has a $175,000 investment opportunity with the following cost and revenue characteristics: Sales $ 280,000 Contribution margin ratio 50 % of sales Fixed expenses $ 98,000 The company’s minimum required rate of return is 15%. Foundational 11-5 (Algo) 5. What is the turnover related to this year’s investment opportunity? (Round your answer to 1 decimal place.)