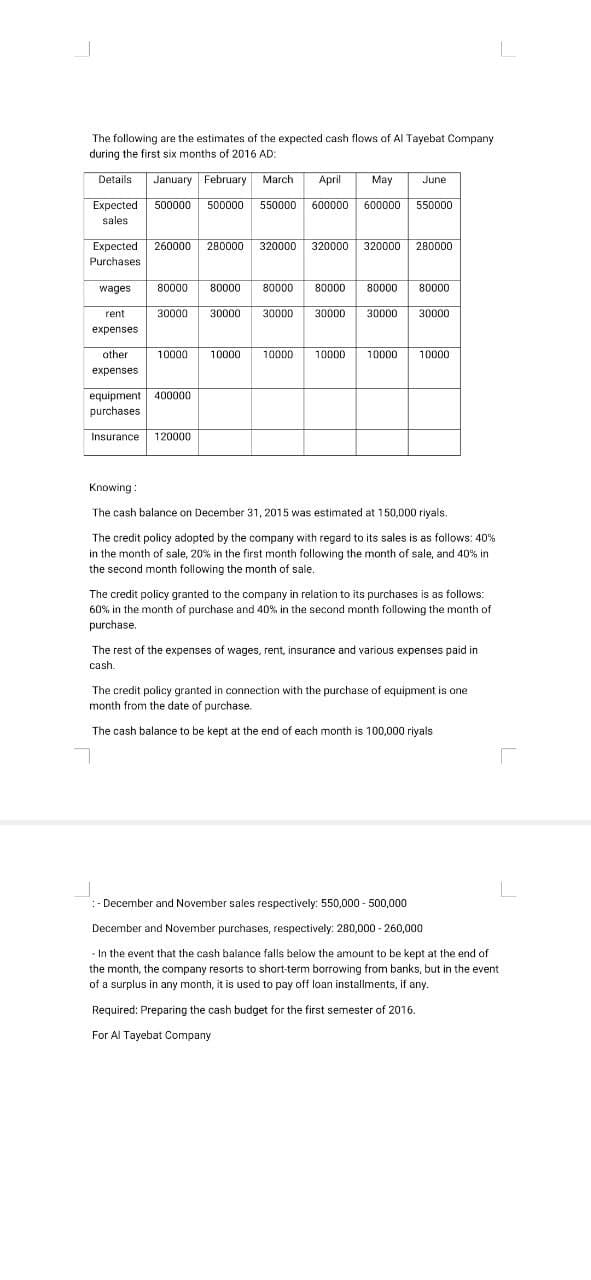

The following are the estimates of the expected cash flows of Al Tayebat Company during the first six months of 2016 AD: Details January February March Expected 500000 500000 550000 600000 600000 550000 April May June sales Expected 260000 280000 320000 320000 320000 280000 Purchases wages 80000 80000 80000 80000 80000 80000 30000 30000 30000 30000 30000 30000 rent expenses other 10000 10000 10000 10000 10000 10000 expenses equipment 400000 purchases Insurance 120000 Knowing : The cash balance on December 31, 2015 was estimated at 150,000 riyals. The credit policy adopted by the company with regard to its sales is as follows: 40% in the month of sale, 20% in the first month following the month of sale, and 40% in the second month following the month of sale. The credit policy granted to the company in relation to its purchases is as follows: 60% in the month of purchase and 40% in the second month following the manth of purchase. The rest of the expenses of wages, rent, insurance and various expenses paid in cash. The credit policy granted in connection with the purchase of equipment is one month from the date of purchase. The cash balance to be kept at the end of each month is 100,000 riyals :- December and November sales respectively. 550,000 - 500,000 December and November purchases, respectively. 280,000 - 260,000 - In the event that the cash balance falls below the amount to be kept at the end of the month, the company resorts to short-term borrowing from banks, but in the event of a surplus in any month, it is used to pay off loan installments, if any. Required: Preparing the cash budget for the first semester of 2016.

The following are the estimates of the expected cash flows of Al Tayebat Company during the first six months of 2016 AD: Details January February March Expected 500000 500000 550000 600000 600000 550000 April May June sales Expected 260000 280000 320000 320000 320000 280000 Purchases wages 80000 80000 80000 80000 80000 80000 30000 30000 30000 30000 30000 30000 rent expenses other 10000 10000 10000 10000 10000 10000 expenses equipment 400000 purchases Insurance 120000 Knowing : The cash balance on December 31, 2015 was estimated at 150,000 riyals. The credit policy adopted by the company with regard to its sales is as follows: 40% in the month of sale, 20% in the first month following the month of sale, and 40% in the second month following the month of sale. The credit policy granted to the company in relation to its purchases is as follows: 60% in the month of purchase and 40% in the second month following the manth of purchase. The rest of the expenses of wages, rent, insurance and various expenses paid in cash. The credit policy granted in connection with the purchase of equipment is one month from the date of purchase. The cash balance to be kept at the end of each month is 100,000 riyals :- December and November sales respectively. 550,000 - 500,000 December and November purchases, respectively. 280,000 - 260,000 - In the event that the cash balance falls below the amount to be kept at the end of the month, the company resorts to short-term borrowing from banks, but in the event of a surplus in any month, it is used to pay off loan installments, if any. Required: Preparing the cash budget for the first semester of 2016.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:The following are the estimates of the expected cash flows of Al Tayebat Company

during the first six months of 2016 AD:

Details

January February March

April

Аprl

May

June

Expected

500000

500000

550000 600000 600000 550000

sales

Expected

260000

280000

320000

320000

320000

280000

Purchases

wages

80000

80000

80000

80000

80000

80000

rent

30000

30000

30000

30000

30000

30000

expenses

other

10000

10000

10000

10000

10000

10000

expenses

equipment 400000

purchases

Insurance

120000

Knowing :

The cash balance on December 31, 2015 was estimated at 150,000 riyals.

The credit policy adopted by the company with regard to its sales is as follows: 40%

in the month of sale, 20% in the first month following the month of sale, and 40% in

the second month following the month of sale.

The credit policy granted to the company in relation to its purchases is as follows:

60% in the month of purchase and 40% in the second month following the manth of

purchase.

The rest of the expenses of wages, rent, insurance and various expenses paid in

cash.

The credit policy granted in connection with the purchase of equipment is one

month from the date of purchase.

The cash balance to be kept at the end of each month is 100,000 riyals

L

- December and November sales respectively: 550,000 - 500,000

December and November purchases, respectively: 280,000 - 260,000

- In the event that the cash balance falls below the amount to be kept at the end of

the month, the company resorts to short-term borrowing from banks, but in the event

of a surplus in any month, it is used to pay off loan installments, if any.

Required: Preparing the cash budget for the first semester of 2016.

For Al Tayebat Company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning