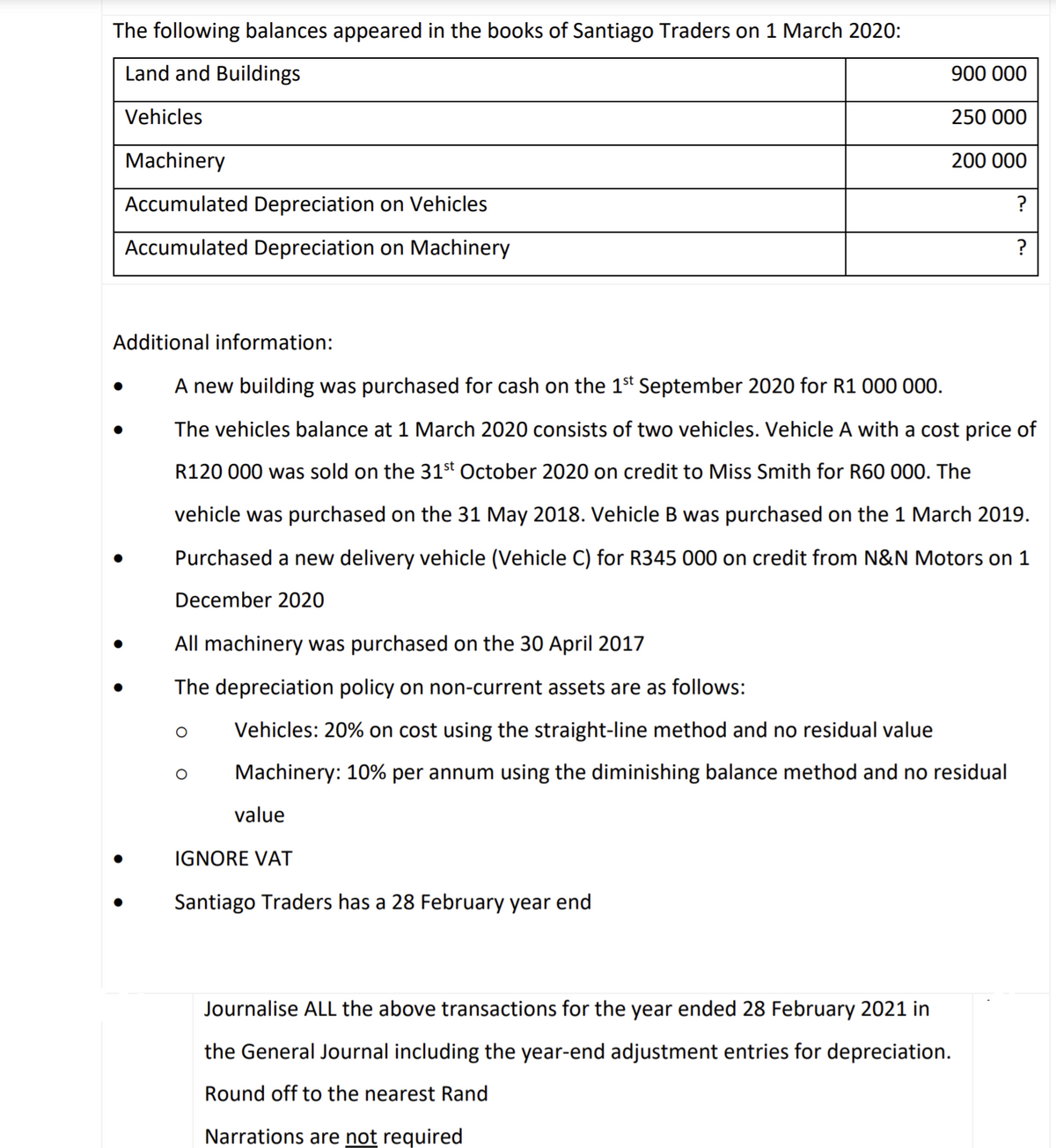

The following balances appeared in the books of Santiago Traders on 1 March 2020: Land and Buildings 900 000 Vehicles 250 000 Machinery 200 000 Accumulated Depreciation on Vehicles Accumulated Depreciation on Machinery Additional information: A new building was purchased for cash on the 1st September 2020 for R1 000 000. The vehicles balance at 1 March 2020 consists of two vehicles. Vehicle A with a cost price of R120 000 was sold on the 31st October 2020 on credit to Miss Smith for R60 000. The vehicle was purchased on the 31 May 2018. Vehicle B was purchased on the 1 March 2019. Purchased a new delivery vehicle (Vehicle C) for R345 000 on credit from N&N Motors on 1 December 2020 All machinery was purchased on the 30 April 2017 The depreciation policy on non-current assets are as follows: Vehicles: 20% on cost using the straight-line method and no residual value Machinery: 10% per annum using the diminishing balance method and no residual value IGNORE VAT Santiago Traders has a 28 February year end Journalise ALL the above transactions for the year ended 28 February 2021 in the General Journal including the year-end adjustment entries for depreciation. Round off to the nearest Rand Narrations are not reguired

The following balances appeared in the books of Santiago Traders on 1 March 2020: Land and Buildings 900 000 Vehicles 250 000 Machinery 200 000 Accumulated Depreciation on Vehicles Accumulated Depreciation on Machinery Additional information: A new building was purchased for cash on the 1st September 2020 for R1 000 000. The vehicles balance at 1 March 2020 consists of two vehicles. Vehicle A with a cost price of R120 000 was sold on the 31st October 2020 on credit to Miss Smith for R60 000. The vehicle was purchased on the 31 May 2018. Vehicle B was purchased on the 1 March 2019. Purchased a new delivery vehicle (Vehicle C) for R345 000 on credit from N&N Motors on 1 December 2020 All machinery was purchased on the 30 April 2017 The depreciation policy on non-current assets are as follows: Vehicles: 20% on cost using the straight-line method and no residual value Machinery: 10% per annum using the diminishing balance method and no residual value IGNORE VAT Santiago Traders has a 28 February year end Journalise ALL the above transactions for the year ended 28 February 2021 in the General Journal including the year-end adjustment entries for depreciation. Round off to the nearest Rand Narrations are not reguired

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 9P: During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the...

Related questions

Question

Please dont copy past other answers from other websites. They are wrong.

This is an activity in my workbook and is not for marks.

The second picture is the layout of the answer. I need help with how to write the answer in the layout that's in my textbook.

Question: Journalise ALL the above transactions for the year ended 28 February 2021 in

the General Journal including the year-end

Round off to the nearest Rand

Narrations are not required

Transcribed Image Text:The following balances appeared in the books of Santiago Traders on 1 March 2020:

Land and Buildings

900 000

Vehicles

250 000

Machinery

200 000

Accumulated Depreciation on Vehicles

?

Accumulated Depreciation on Machinery

?

Additional information:

A new building was purchased for cash on the 1st September 2020 for R1 000 000.

The vehicles balance at 1 March 2020 consists of two vehicles. Vehicle A with a cost price of

R120 000 was sold on the 31st October 2020 on credit to Miss Smith for R60 000. The

vehicle was purchased on the 31 May 2018. Vehicle B was purchased on the 1 March 2019.

Purchased a new delivery vehicle (Vehicle C) for R345 000 on credit from N&N Motors on 1

December 2020

All machinery was purchased on the 30 April 2017

The depreciation policy on non-current assets are as follows:

Vehicles: 20% on cost using the straight-line method and no residual value

Machinery: 10% per annum using the diminishing balance method and no residual

value

IGNORE VAT

Santiago Traders has a 28 February year end

Journalise ALL the above transactions for the year ended 28 February 2021 in

the General Journal including the year-end adjustment entries for depreciation.

Round off to the nearest Rand

Narrations are not required

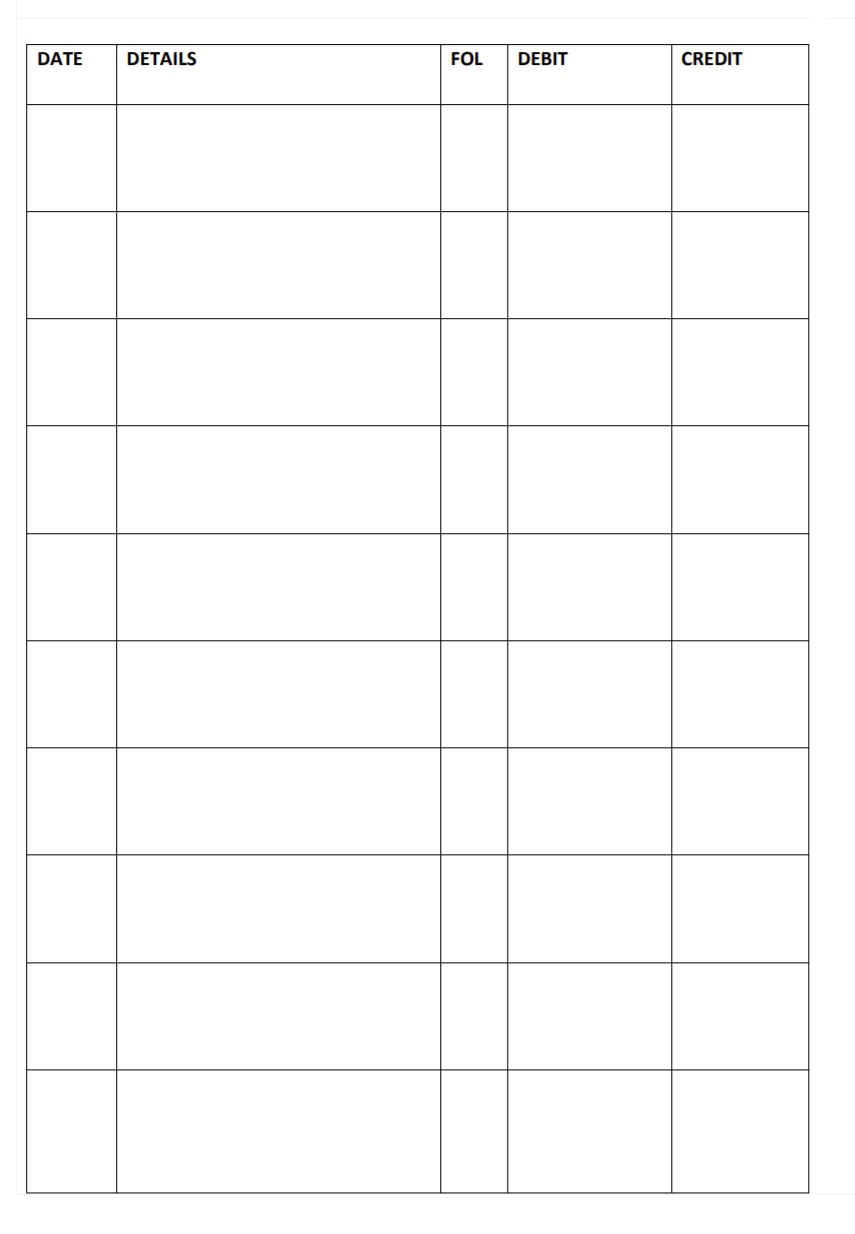

Transcribed Image Text:DATE

DETAILS

FOL

DEBIT

CREDIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning