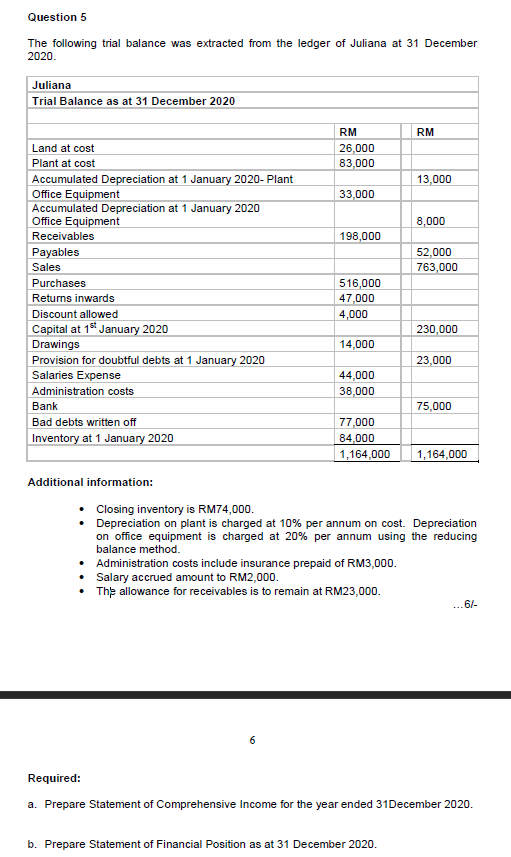

The following trial balance was extracted from the ledger of Juliana at 31 December 2020. Juliana Trial Balance as at 31 December 2020 RM RM Land at cost 26,000 83,000 Plant at cost Accumulated Depreciation at 1 January 2020- Plant Office Equipment Accumulated Depreciation at 1 January 2020 Office Equipment Receivables 13,000 33,000 8,000 198,000 Payables Sales 52,000 763,000 Purchases 516,000 47,000 4,000 Returns inwards Discount allowed Capital at 18 January 2020 230,000 Drawings 14,000 23,000 Provision for doubtful debts at 1 January 2020 Salaries Expense 44,000 Administration costs 38,000 Bank 75,000 Bad debts written off Inventory at 1 January 2020 77,000 84,000 1,164,000 1,164,000 Additional information: Closing inventory is RM74,000. Depreciation on plant is charged at 10% per annum on cost. Depreciation on office equipment is charged at 20% per annum using the reducing balance method. • Administration costs include insurance prepaid of RM3,000. Salary accrued amount to RM2,000. The allowance for receivables is to remain at RM23,000. ...6/- Required: a. Prepare Statement of Comprehensive Income for the year ended 31December 2020. b. Prepare Statement of Financial Position as at 31 December 2020.

The following trial balance was extracted from the ledger of Juliana at 31 December 2020. Juliana Trial Balance as at 31 December 2020 RM RM Land at cost 26,000 83,000 Plant at cost Accumulated Depreciation at 1 January 2020- Plant Office Equipment Accumulated Depreciation at 1 January 2020 Office Equipment Receivables 13,000 33,000 8,000 198,000 Payables Sales 52,000 763,000 Purchases 516,000 47,000 4,000 Returns inwards Discount allowed Capital at 18 January 2020 230,000 Drawings 14,000 23,000 Provision for doubtful debts at 1 January 2020 Salaries Expense 44,000 Administration costs 38,000 Bank 75,000 Bad debts written off Inventory at 1 January 2020 77,000 84,000 1,164,000 1,164,000 Additional information: Closing inventory is RM74,000. Depreciation on plant is charged at 10% per annum on cost. Depreciation on office equipment is charged at 20% per annum using the reducing balance method. • Administration costs include insurance prepaid of RM3,000. Salary accrued amount to RM2,000. The allowance for receivables is to remain at RM23,000. ...6/- Required: a. Prepare Statement of Comprehensive Income for the year ended 31December 2020. b. Prepare Statement of Financial Position as at 31 December 2020.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 7PA: Using the following information: A. make the December 31 adjusting journal entry for depreciation B....

Related questions

Question

Transcribed Image Text:Question 5

The following trial balance was extracted from the ledger of Juliana at 31 December

2020.

Juliana

Trial Balance as at 31 December 2020

RM

RM

Land at cost

26,000

83,000

Plant at cost

Accumulated Depreciation at 1 January 2020- Plant

Office Equipment

Accumulated Depreciation at 1 January 2020

Office Equipment

13,000

33,000

8,000

Receivables

198,000

Payables

52,000

Sales

763,000

Purchases

516,000

47,000

Returns inwards

Discount allowed

4,000

Capital at 1" January 2020

230,000

Drawings

14,000

23,000

Provision for doubtful debts at 1 January 2020

Salaries Expense

44,000

Administration costs

38,000

Bank

75,000

Bad debts written off

77,000

Inventory at 1 January 2020

84,000

1,164,000

1,164,000

Additional information:

• Closing inventory is RM74,000.

• Depreciation on plant is charged at 10% per annum on cost. Depreciation

on office equipment is charged at 20% per annum using the reducing

balance method.

• Administration costs include insurance prepaid of RM3,000.

• Salary accrued amount to RM2,000.

The allowance for receivables is to remain at RM23,000.

...6/-

Required:

a. Prepare Statement of Comprehensive Income for the year ended 31December 2020.

b. Prepare Statement of Financial Position as at 31 December 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning