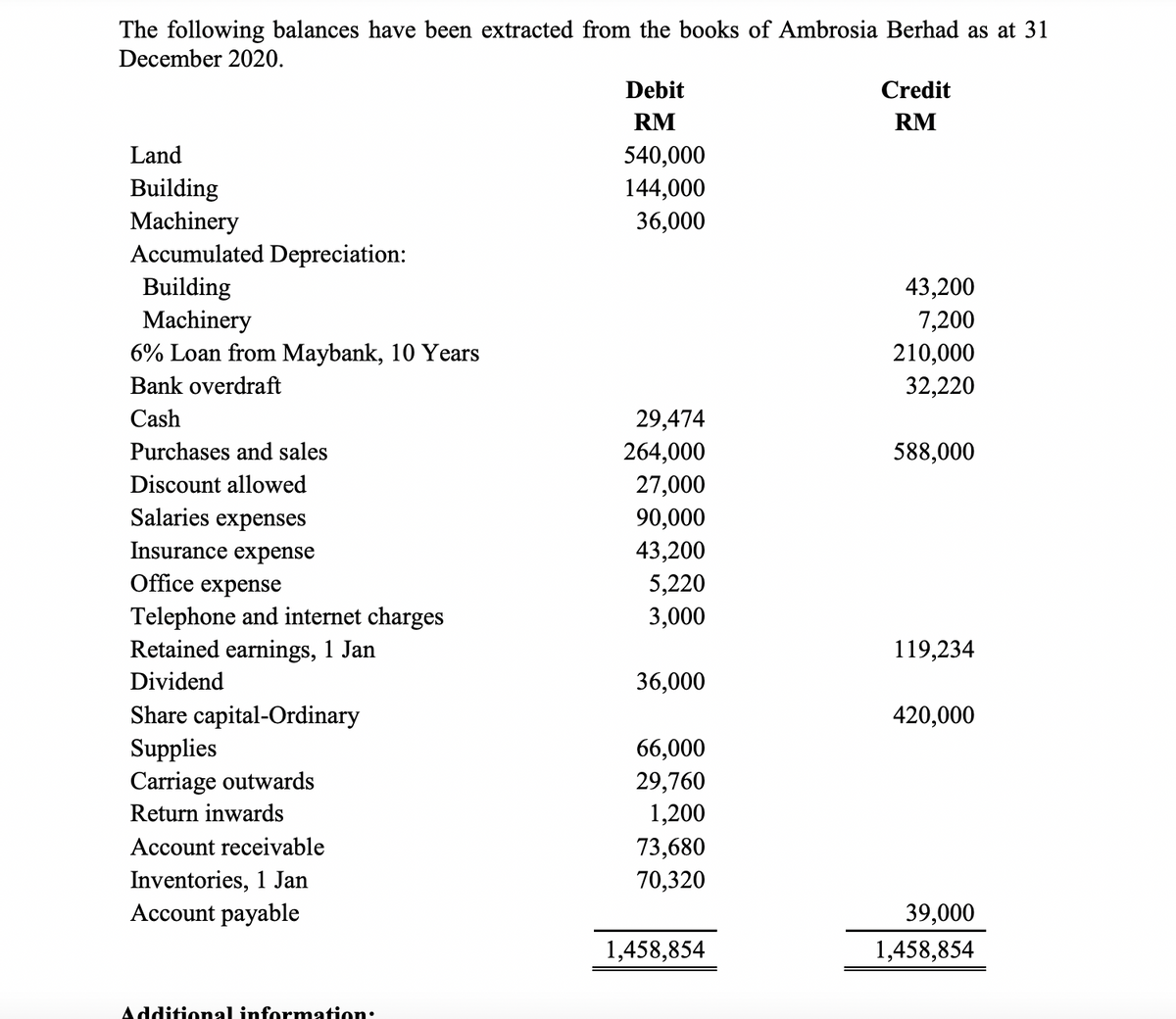

The following balances have been extracted from the books of Ambrosia Berhad as at 31 December 2020. Debit Credit RM RM Land Building Machinery Accumulated Depreciation: 540,000 144,000 36,000 Building Machinery 6% Loan from Maybank, 10 Years 43,200 7,200 210,000 32,220 Bank overdraft Cash 29,474 Purchases and sales 264,000 588,000 Discount allowed 27,000 Salaries expenses 90,000 43,200 Insurance expense Office expense 5,220 3,000 Telephone and internet charges Retained earnings, 1 Jan Dividend 119,234 36,000 Share capital-Ordinary Supplies Carriage outwards 420,000 66,000 29,760 Return inwards 1,200 Account receivable 73,680 Inventories, 1 Jan Account payable 70,320 39,000 1,458,854 1,458,854

The following balances have been extracted from the books of Ambrosia Berhad as at 31 December 2020. Debit Credit RM RM Land Building Machinery Accumulated Depreciation: 540,000 144,000 36,000 Building Machinery 6% Loan from Maybank, 10 Years 43,200 7,200 210,000 32,220 Bank overdraft Cash 29,474 Purchases and sales 264,000 588,000 Discount allowed 27,000 Salaries expenses 90,000 43,200 Insurance expense Office expense 5,220 3,000 Telephone and internet charges Retained earnings, 1 Jan Dividend 119,234 36,000 Share capital-Ordinary Supplies Carriage outwards 420,000 66,000 29,760 Return inwards 1,200 Account receivable 73,680 Inventories, 1 Jan Account payable 70,320 39,000 1,458,854 1,458,854

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 2CE

Related questions

Question

The questions. ( Requirement).

A) Prepare the statement of profit or loss for the year ended 31 December 2020

B)Prepare the

C)Prepare the

Can solve the above questions for me.

Transcribed Image Text:The following balances have been extracted from the books of Ambrosia Berhad as at 31

December 2020.

Debit

Credit

RM

RM

Land

540,000

144,000

Building

Machinery

Accumulated Depreciation:

Building

Machinery

6% Loan from Maybank, 10 Years

36,000

43,200

7,200

210,000

Bank overdraft

32,220

Cash

29,474

Purchases and sales

264,000

588,000

Discount allowed

27,000

Salaries expenses

90,000

Insurance expense

43,200

Office expense

5,220

Telephone and internet charges

Retained earnings, 1 Jan

3,000

119,234

Dividend

36,000

Share capital-Ordinary

Supplies

Carriage outwards

420,000

66,000

29,760

Return inwards

1,200

Account receivable

73,680

Inventories, 1 Jan

70,320

Account payable

39,000

1,458,854

1,458,854

Additional information:

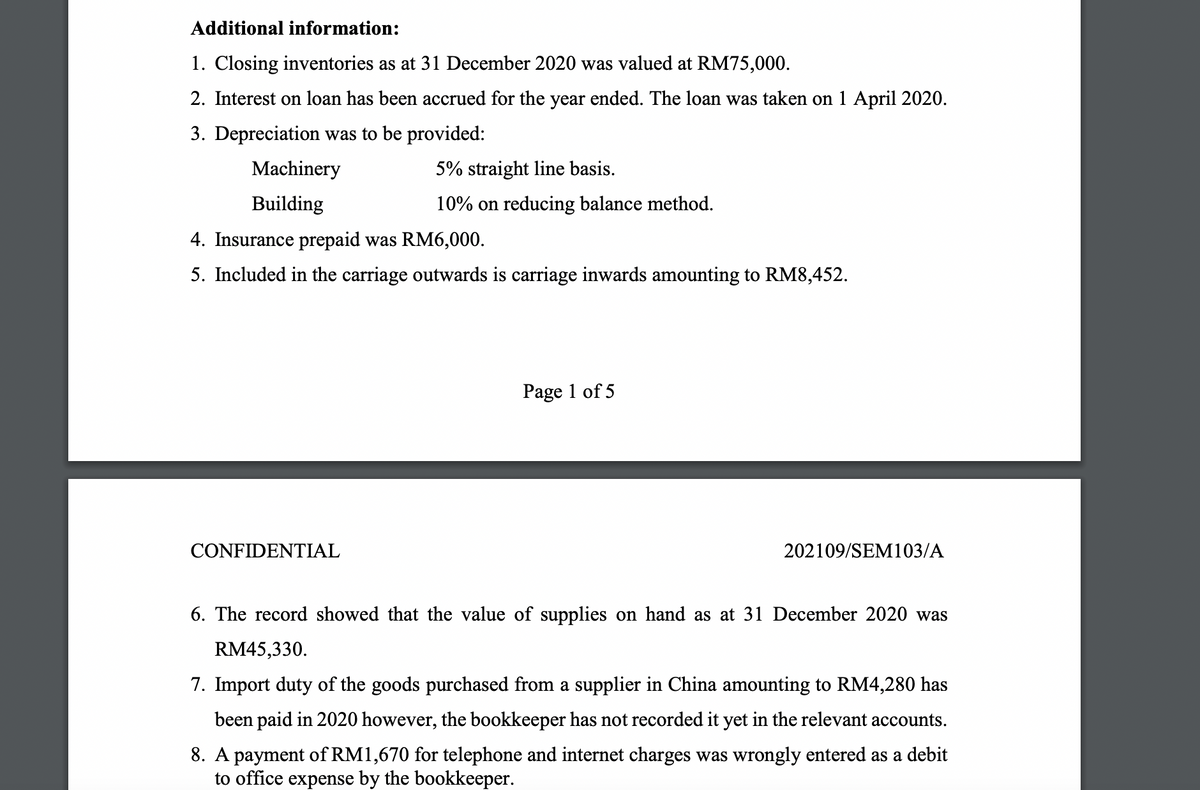

Transcribed Image Text:Additional information:

1. Closing inventories as at 31 December 2020 was valued at RM75,000.

2. Interest on loan has been accrued for the year ended. The loan was taken on 1 April 2020.

3. Depreciation was to be provided:

Machinery

5% straight line basis.

Building

10% on reducing balance method.

4. Insurance prepaid was RM6,000.

5. Included in the carriage outwards is carriage inwards amounting to RM8,452.

Page 1 of 5

CONFIDENTIAL

202109/SEM103/A

6. The record showed that the value of supplies on hand as at 31 December 2020 was

RM45,330.

7. Import duty of the goods purchased from a supplier in China amounting to RM4,280 has

been paid in 2020 however, the bookkeeper has not recorded it yet in the relevant accounts.

8. A payment of RM1,670 for telephone and internet charges was wrongly entered as a debit

to office expense by the bookkeeper.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning