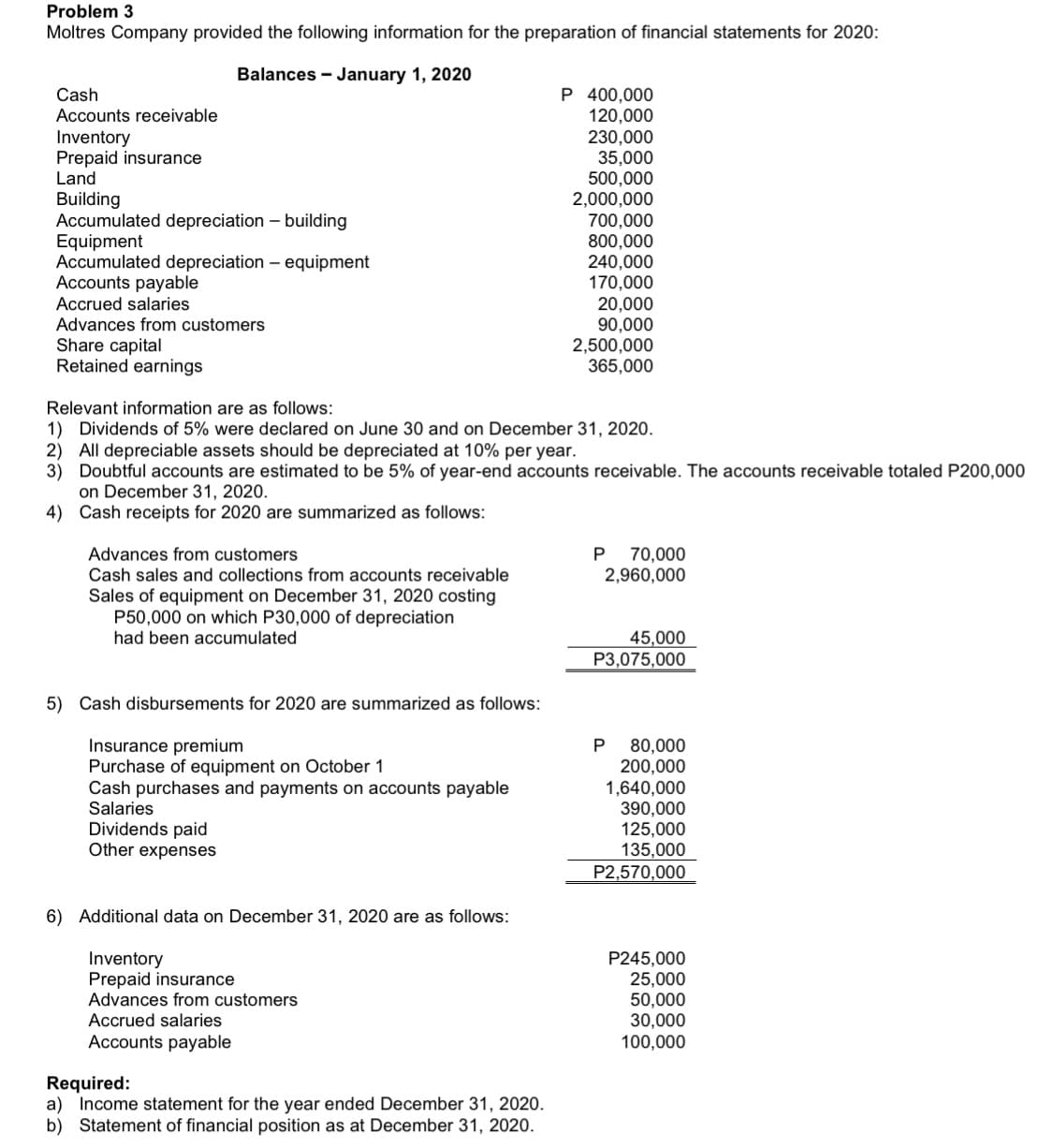

Moltres Company provided the following information for the preparation of financial statements for 2020: Balances - January 1, 2020 P 400,000 120,000 230,000 35,000 500,000 2,000,000 700,000 800,000 240,000 170,000 20,000 90,000 2,500,000 365,000 Cash Accounts receivable Inventory Prepaid insurance Land Building Accumulated depreciation - building Equipment Accumulated depreciation – equipment Accounts payable Accrued salaries Advances from customers Share capital Retained earnings Relevant information are as follows: 1) Dividends of 5% were declared on June 30 and on December 31, 2020. 2) All depreciable assets should be depreciated at 10% per year. 3) Doubtful accounts are estimated to be 5% of year-end accounts receivable. The accounts receivable totaled P200,000 on December 31, 2020. 4) Cash receipts for 2020 are summarized as follows: Advances from customers Cash sales and collections from accounts receivable 70,000 2,960,000 Sales of equipment on December 31, 2020 costing P50,000 on which P30,000 of depreciation had been accumulated 45,000 P3,075,000 5) Cash disbursements for 2020 are summarized as follows: Insurance premium Purchase of equipment on October 1 Cash purchases and payments on accounts payable Salaries 80,000 200,000 1,640,000 390,000 125,000 135,000 Dividends paid Other expenses P2,570,000 6) Additional data on December 31, 2020 are as follows: Inventory Prepaid insurance Advances from customers P245,000 25,000 50,000 30,000 100,000 Accrued salaries Accounts payable Required: a) Income statement for the year ended December 31, 2020. b) Statement of financial position as at December 31, 2020.

Moltres Company provided the following information for the preparation of financial statements for 2020: Balances - January 1, 2020 P 400,000 120,000 230,000 35,000 500,000 2,000,000 700,000 800,000 240,000 170,000 20,000 90,000 2,500,000 365,000 Cash Accounts receivable Inventory Prepaid insurance Land Building Accumulated depreciation - building Equipment Accumulated depreciation – equipment Accounts payable Accrued salaries Advances from customers Share capital Retained earnings Relevant information are as follows: 1) Dividends of 5% were declared on June 30 and on December 31, 2020. 2) All depreciable assets should be depreciated at 10% per year. 3) Doubtful accounts are estimated to be 5% of year-end accounts receivable. The accounts receivable totaled P200,000 on December 31, 2020. 4) Cash receipts for 2020 are summarized as follows: Advances from customers Cash sales and collections from accounts receivable 70,000 2,960,000 Sales of equipment on December 31, 2020 costing P50,000 on which P30,000 of depreciation had been accumulated 45,000 P3,075,000 5) Cash disbursements for 2020 are summarized as follows: Insurance premium Purchase of equipment on October 1 Cash purchases and payments on accounts payable Salaries 80,000 200,000 1,640,000 390,000 125,000 135,000 Dividends paid Other expenses P2,570,000 6) Additional data on December 31, 2020 are as follows: Inventory Prepaid insurance Advances from customers P245,000 25,000 50,000 30,000 100,000 Accrued salaries Accounts payable Required: a) Income statement for the year ended December 31, 2020. b) Statement of financial position as at December 31, 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Question

100%

Singles entry:

Transcribed Image Text:Problem 3

Moltres Company provided the following information for the preparation of financial statements for 2020:

Balances - January 1, 2020

P 400,000

120,000

230,000

35,000

500,000

2,000,000

700,000

800,000

240,000

170,000

20,000

90,000

2,500,000

365,000

Cash

Accounts receivable

Inventory

Prepaid insurance

Land

Building

Accumulated depreciation – building

Equipment

Accumulated depreciation – equipment

Accounts payable

Accrued salaries

Advances from customers

Share capital

Retained earnings

Relevant information are as follows:

1) Dividends of 5% were declared on June 30 and on December 31, 2020.

2) All depreciable assets should be depreciated at 10% per year.

3) Doubtful accounts are estimated to be 5% of year-end accounts receivable. The accounts receivable totaled P200,000

on December 31, 2020.

4) Cash receipts for 2020 are summarized as follows:

Advances from customers

Cash sales and collections from accounts receivable

70,000

2,960,000

Sales of equipment on December 31, 2020 costing

P50,000 on which P30,000 of depreciation

45,000

P3,075,000

had been accumulated

5) Cash disbursements for 2020 are summarized as follows:

Insurance premium

Purchase of equipment on October 1

Cash purchases and payments on accounts payable

Salaries

80,000

200,000

1,640,000

390,000

125,000

135,000

P2,570,000

Dividends paid

Other expenses

6) Additional data on December 31, 2020 are as follows:

Inventory

Prepaid insurance

Advances from customers

P245,000

25,000

50,000

30,000

100,000

Accrued salaries

Accounts payable

Required:

a) Income statement for the year ended December 31, 2020.

b) Statement of financial position as at December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning