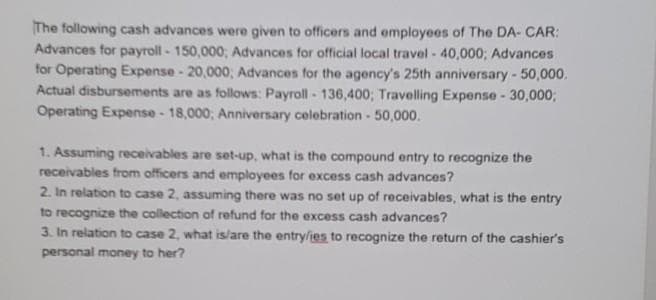

The following cash advances were given to officers and employees of The DA- CAR: Advances for payroll-150,000; Advances for official local travel - 40,000; Advances for Operating Expense - 20,000; Advances for the agency's 25th anniversary-50,000. Actual disbursements are as follows: Payroll - 136,400; Travelling Expense - 30,000; Operating Expense - 18,000; Anniversary celebration - 50,000. 1. Assuming receivables are set-up, what is the compound entry to recognize the receivables from officers and employees for excess cash advances? 2. In relation to case 2, assuming there was no set up of receivables, what is the entry to recognize the collection of refund for the excess cash advances? 3. In relation to case 2, what is/are the entry/ies to recognize the return of the cashier's personal money to her?

The following cash advances were given to officers and employees of The DA- CAR: Advances for payroll-150,000; Advances for official local travel - 40,000; Advances for Operating Expense - 20,000; Advances for the agency's 25th anniversary-50,000. Actual disbursements are as follows: Payroll - 136,400; Travelling Expense - 30,000; Operating Expense - 18,000; Anniversary celebration - 50,000. 1. Assuming receivables are set-up, what is the compound entry to recognize the receivables from officers and employees for excess cash advances? 2. In relation to case 2, assuming there was no set up of receivables, what is the entry to recognize the collection of refund for the excess cash advances? 3. In relation to case 2, what is/are the entry/ies to recognize the return of the cashier's personal money to her?

Chapter13: Choice Of Business Entity—general Tax And Nontax Factors/formation

Section: Chapter Questions

Problem 56P

Related questions

Question

Transcribed Image Text:The following cash advances were given to officers and employees of The DA- CAR:

Advances for payroll - 150,000,; Advances for official local travel - 40,000; Advances

for Operating Expense - 20,000; Advances for the agency's 25th anniversary - 50,000.

Actual disbursements are as follows: Payroll - 136,400; Travelling Expense - 30,000;

Operating Expense - 18,000; Anniversary celebration - 50,000.

1. Assuming receivables are set-up, what is the compound entry to recognize the

receivables from officers and employees for excess cash advances?

2. In relation to case 2, assuming there was no set up of receivables, what is the entry

to recognize the collection of refund for the excess cash advances?

3. In relation to case 2, what is/are the entry/ies to recognize the return of the cashier's

personal money to her?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning