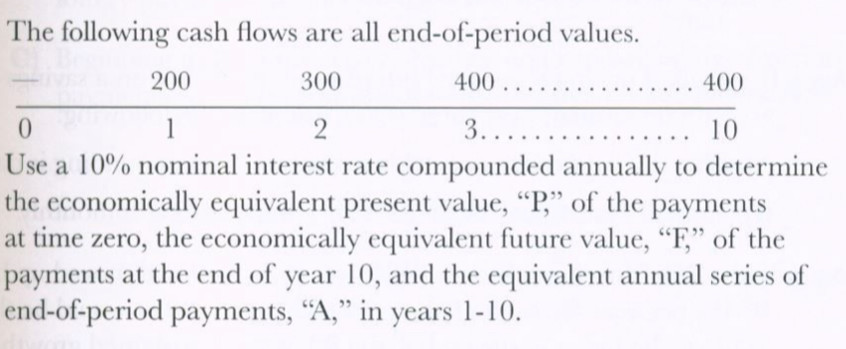

The following cash flows are all end-of-period values. .. 400 200 400 .. 300 2 3..... 10 Use a 10% nominal interest rate compounded annually to determine the economically equivalent present value, “P," of the payments at time zero, the economically equivalent future value, "F," of the payments at the end of year 10, and the equivalent annual series of end-of-period payments, "A," in years 1-10.

The following cash flows are all end-of-period values. .. 400 200 400 .. 300 2 3..... 10 Use a 10% nominal interest rate compounded annually to determine the economically equivalent present value, “P," of the payments at time zero, the economically equivalent future value, "F," of the payments at the end of year 10, and the equivalent annual series of end-of-period payments, "A," in years 1-10.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 29P

Related questions

Question

Transcribed Image Text:The following cash flows are all end-of-period values.

.. 400

200

400 ..

300

2

3.....

10

Use a 10% nominal interest rate compounded annually to determine

the economically equivalent present value, “P," of the payments

at time zero, the economically equivalent future value, "F," of the

payments at the end of year 10, and the equivalent annual series of

end-of-period payments, "A," in years 1-10.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning