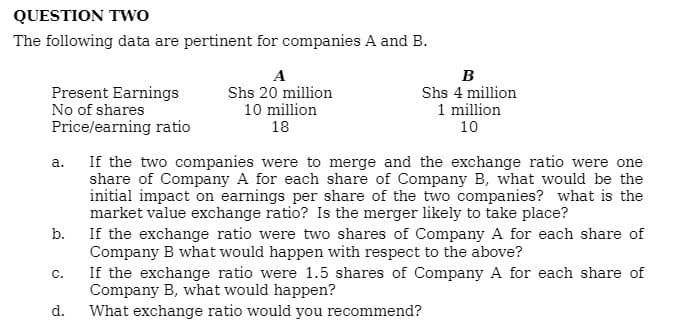

The following data are pertinent for companies A and B. A Shs 20 million 10 million 18 в Shs 4 million 1 million 10 Present Earnings No of shares Price/earning ratio If the two companies were to merge and the exchange ratio were one share of Company A for each share of Company B, what would be the initial impact on earnings per share of the two companies? what is the market value exchange ratio? Is the merger likely to take place? If the exchange ratio were two shares of Company A for each share of Company B what would happen with respect to the above? If the exchange ratio were 1.5 shares of Company A for each share of Company B, what would happen? What exchange ratio would you recommend? а. b. С. d.

The following data are pertinent for companies A and B. A Shs 20 million 10 million 18 в Shs 4 million 1 million 10 Present Earnings No of shares Price/earning ratio If the two companies were to merge and the exchange ratio were one share of Company A for each share of Company B, what would be the initial impact on earnings per share of the two companies? what is the market value exchange ratio? Is the merger likely to take place? If the exchange ratio were two shares of Company A for each share of Company B what would happen with respect to the above? If the exchange ratio were 1.5 shares of Company A for each share of Company B, what would happen? What exchange ratio would you recommend? а. b. С. d.

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 7P

Related questions

Question

Please help me with this. thanks

Transcribed Image Text:QUESTION TWo

The following data are pertinent for companies A and B.

A

B

Present Earnings

No of shares

Shs 20 million

10 million

Shs 4 million

1 million

10

Price/earning ratio

18

a. If the two companies were to merge and the exchange ratio were one

share of Company A for each share of Company B, what would be the

initial impact on earnings per share of the two companies? what is the

market value exchange ratio? Is the merger likely to take place?

If the exchange ratio were two shares of Company A for each share of

Company B what would happen with respect to the above?

If the exchange ratio were 1.5 shares of Company A for each share of

Company B, what would happen?

What exchange ratio would you recommend?

b.

C.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT