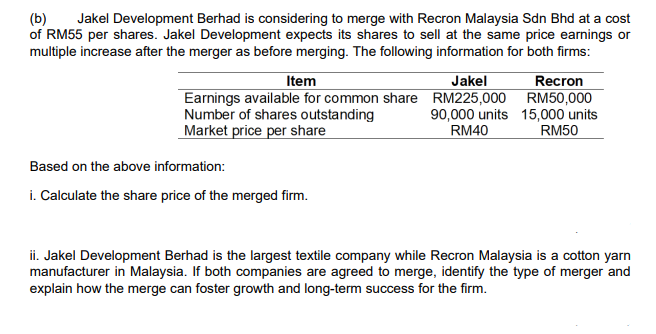

(b) of RM55 per shares. Jakel Development expects its shares to sell at the same price earnings or multiple increase after the merger as before merging. The following information for both firms: Jakel Development Berhad is considering to merge with Recron Malaysia Sdn Bhd at a cost Recron Earnings available for common share RM225,000 RM50,000 90,000 units 15,000 units RM50 Item Jakel Number of shares outstanding Market price per share RM40 Based on the above information: i. Calculate the share price of the merged firm. ii. Jakel Development Berhad is the largest textile company while Recron Malaysia is a cotton yarn manufacturer in Malaysia. If both companies are agreed to merge, identify the type of merger and explain how the merge can foster growth and long-term success for the firm.

(b) of RM55 per shares. Jakel Development expects its shares to sell at the same price earnings or multiple increase after the merger as before merging. The following information for both firms: Jakel Development Berhad is considering to merge with Recron Malaysia Sdn Bhd at a cost Recron Earnings available for common share RM225,000 RM50,000 90,000 units 15,000 units RM50 Item Jakel Number of shares outstanding Market price per share RM40 Based on the above information: i. Calculate the share price of the merged firm. ii. Jakel Development Berhad is the largest textile company while Recron Malaysia is a cotton yarn manufacturer in Malaysia. If both companies are agreed to merge, identify the type of merger and explain how the merge can foster growth and long-term success for the firm.

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:(b)

of RM55 per shares. Jakel Development expects its shares to sell at the same price earnings or

multiple increase after the merger as before merging. The following information for both firms:

Jakel Development Berhad is considering to merge with Recron Malaysia Sdn Bhd at a cost

Recron

Earnings available for common share RM225,000 RM50,000

90,000 units 15,000 units

RM50

Item

Jakel

Number of shares outstanding

Market price per share

RM40

Based on the above information:

i. Calculate the share price of the merged firm.

ii. Jakel Development Berhad is the largest textile company while Recron Malaysia is a cotton yarn

manufacturer in Malaysia. If both companies are agreed to merge, identify the type of merger and

explain how the merge can foster growth and long-term success for the firm.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT