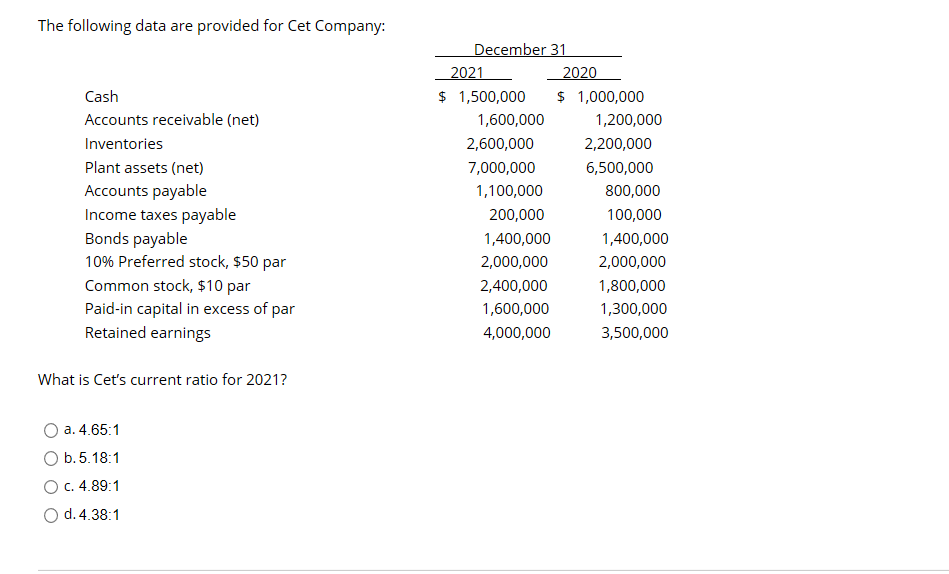

The following data are provided for Cet Company: December 31 2021 2020 Cash $ 1,500,000 $ 1,000,000 Accounts receivable (net) 1,600,000 1,200,000 Inventories 2,600,000 2,200,000 Plant assets (net) 7,000,000 6,500,000 Accounts payable Income taxes payable Bonds payable 10% Preferred stock, $50 par 1,100,000 800,000 200,000 100,000 1,400,000 1,400,000 2,000,000 2,000,000 Common stock, $10 par Paid-in capital in excess of par Retained earnings 2,400,000 1,800,000 1,600,000 1,300,000 4,000,000 3,500,000 What is Cet's current ratio for 2021? O a. 4.65:1 O b.5.18:1 O c. 4.89:1 O d.4.38:1

The following data are provided for Cet Company: December 31 2021 2020 Cash $ 1,500,000 $ 1,000,000 Accounts receivable (net) 1,600,000 1,200,000 Inventories 2,600,000 2,200,000 Plant assets (net) 7,000,000 6,500,000 Accounts payable Income taxes payable Bonds payable 10% Preferred stock, $50 par 1,100,000 800,000 200,000 100,000 1,400,000 1,400,000 2,000,000 2,000,000 Common stock, $10 par Paid-in capital in excess of par Retained earnings 2,400,000 1,800,000 1,600,000 1,300,000 4,000,000 3,500,000 What is Cet's current ratio for 2021? O a. 4.65:1 O b.5.18:1 O c. 4.89:1 O d.4.38:1

Chapter12: Capital Structure

Section: Chapter Questions

Problem 1PROB

Related questions

Question

Transcribed Image Text:The following data are provided for Cet Company:

December 31

2021

2020

Cash

$ 1,500,000

$ 1,000,000

Accounts receivable (net)

1,600,000

1,200,000

Inventories

2,600,000

2,200,000

Plant assets (net)

7,000,000

6,500,000

Accounts payable

Income taxes payable

Bonds payable

10% Preferred stock, $50 par

1,100,000

800,000

200,000

100,000

1,400,000

1,400,000

2,000,000

2,000,000

Common stock, $10 par

Paid-in capital in excess of par

Retained earnings

2,400,000

1,800,000

1,600,000

1,300,000

4,000,000

3,500,000

What is Cet's current ratio for 2021?

O a. 4.65:1

O b.5.18:1

O c. 4.89:1

O d.4.38:1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning