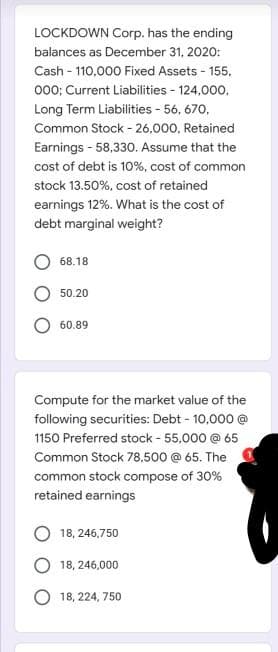

LOCKDOWN Corp. has the ending balances as December 31, 2020: Cash - 110,000 Fixed Assets - 155. 000; Current Liabilities - 124,000. Long Term Liabilities - 56, 670, Common Stock - 26,000, Retained Earnings - 58,330. Assume that the cost of debt is 10%, cost of common stock 13.50%, cost of retained earnings 12%. What is the cost of debt marginal weight? O 68.18 O 50.20 O 60.89

LOCKDOWN Corp. has the ending balances as December 31, 2020: Cash - 110,000 Fixed Assets - 155. 000; Current Liabilities - 124,000. Long Term Liabilities - 56, 670, Common Stock - 26,000, Retained Earnings - 58,330. Assume that the cost of debt is 10%, cost of common stock 13.50%, cost of retained earnings 12%. What is the cost of debt marginal weight? O 68.18 O 50.20 O 60.89

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter16: Financial Planning And Forecasting

Section: Chapter Questions

Problem 8P: LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and...

Related questions

Question

Transcribed Image Text:LOCKDOWN Corp. has the ending

balances as December 31, 2020:

Cash - 110,000 Fixed Assets - 155,

000; Current Liabilities - 124,000.

Long Term Liabilities - 56, 670,

Common Stock - 26,000, Retained

Earnings - 58,330. Assume that the

cost of debt is 10%, cost of common

stock 13.50%, cost of retained

earnings 12%. What is the cost of

debt marginal weight?

68.18

50.20

60.89

Compute for the market value of the

following securities: Debt - 10,000 @

1150 Preferred stock - 55,000 @ 65

Common Stock 78,500 @ 65. The

common stock compose of 30%

retained earnings

18, 246,750

18, 246,000

18, 224, 750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT