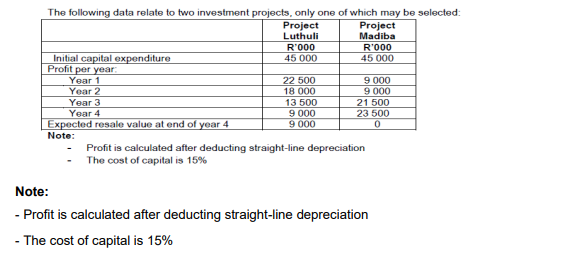

The following data relate to two investment projects, only one of which may be selected: Initial capital expenditure Profit per year Year 1 Year 2 Year 3 Year 4 Expected resale value at end of year 4 Note: Project Luthuli R'000 Project Madiba R'000 45 000 45 000 22 500 9 000 18 000 9000 13 500 21 500 9 000 23 500 9 000 0 Note: Profit is calculated after deducting straight-line depreciation The cost of capital is 15% - Profit is calculated after deducting straight-line depreciation -The cost of capital is 15%

The following data relate to two investment projects, only one of which may be selected: Initial capital expenditure Profit per year Year 1 Year 2 Year 3 Year 4 Expected resale value at end of year 4 Note: Project Luthuli R'000 Project Madiba R'000 45 000 45 000 22 500 9 000 18 000 9000 13 500 21 500 9 000 23 500 9 000 0 Note: Profit is calculated after deducting straight-line depreciation The cost of capital is 15% - Profit is calculated after deducting straight-line depreciation -The cost of capital is 15%

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 16E

Related questions

Question

3.1 Calculate the payback period for both projects each (year, month and days)

3.2 Calculate the accounting

3.3 Use the

3.4 Briefly discuss the merits of using the NPV method

Transcribed Image Text:The following data relate to two investment projects, only one of which may be selected:

Initial capital expenditure

Profit per year

Year 1

Year 2

Year 3

Year 4

Expected resale value at end of year 4

Note:

Project

Luthuli

R'000

Project

Madiba

R'000

45 000

45 000

22 500

9 000

18 000

9000

13 500

21 500

9

000

23 500

9 000

0

Note:

Profit is calculated after deducting straight-line depreciation

The cost of capital is 15%

- Profit is calculated after deducting straight-line depreciation

-The cost of capital is 15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning