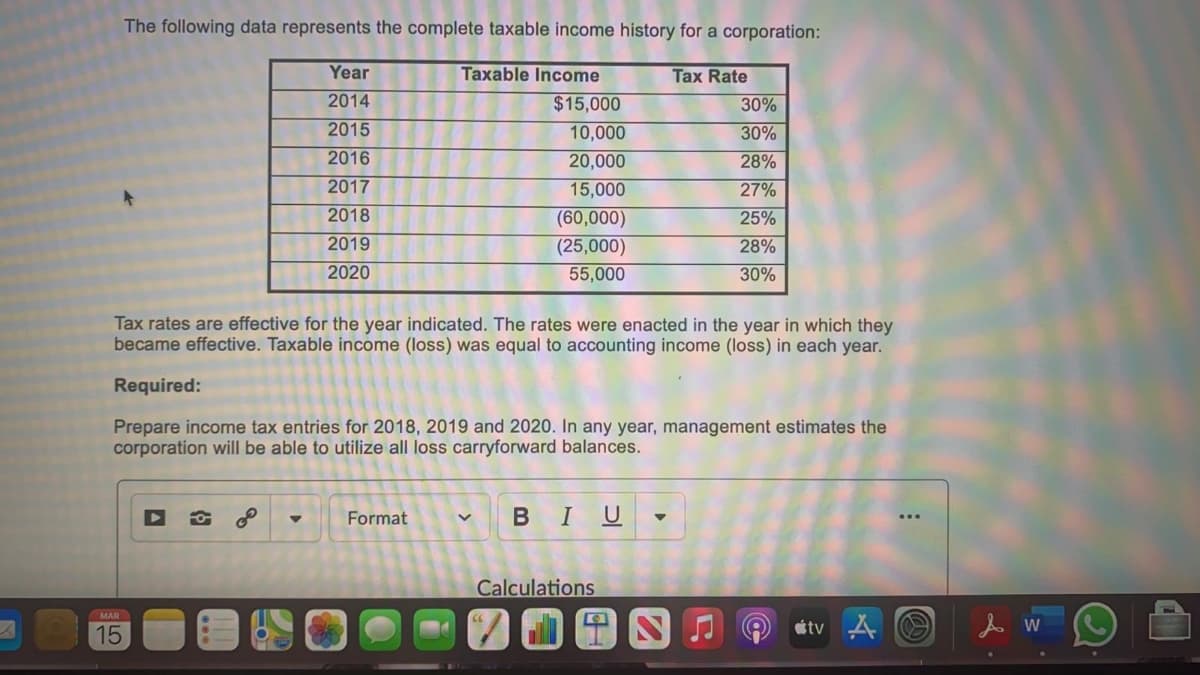

The following data represents the complete taxable income history for a corporation: Year Taxable Income Tax Rate 2014 $15,000 30% 2015 10,000 30% 2016 20,000 28% 2017 15,000 27% 2018 (60,000) 25% 2019 (25,000) 28% 2020 55,000 30% Tax rates are effective for the year indicated. The rates were enacted in the year in which they became effective. Taxable income (loss) was equal to accounting income (loss) in each year. Required: Prepare income tax entries for 2018, 2019 and 2020. In any year, management estimates the corporation will be able to utilize all loss carryforward balances.

The following data represents the complete taxable income history for a corporation: Year Taxable Income Tax Rate 2014 $15,000 30% 2015 10,000 30% 2016 20,000 28% 2017 15,000 27% 2018 (60,000) 25% 2019 (25,000) 28% 2020 55,000 30% Tax rates are effective for the year indicated. The rates were enacted in the year in which they became effective. Taxable income (loss) was equal to accounting income (loss) in each year. Required: Prepare income tax entries for 2018, 2019 and 2020. In any year, management estimates the corporation will be able to utilize all loss carryforward balances.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 26CE

Related questions

Question

Transcribed Image Text:The following data represents the complete taxable income history for a corporation:

Year

Taxable Income

Tax Rate

2014

$15,000

10,000

30%

2015

30%

2016

20,000

15,000

28%

2017

27%

2018

(60,000)

25%

2019

(25,000)

55,000

28%

2020

30%

Tax rates are effective for the year indicated. The rates were enacted in the year in which they

became effective. Taxable income (loss) was equal to accounting income (loss) in each year.

Required:

Prepare income tax entries for 2018, 2019 and 2020. In any year, management estimates the

corporation will be able to utilize all loss carryforward balances.

Format

BIU

Calculations

MAR

15

étv A O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you