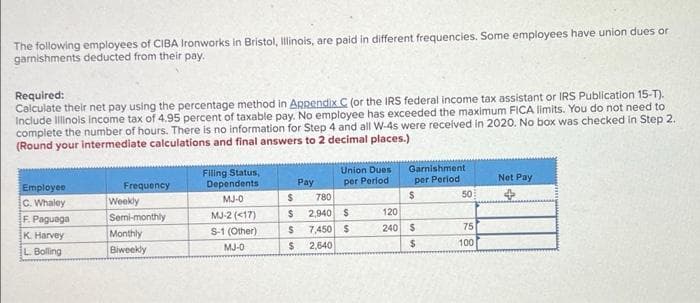

The following employees of CIBA Ironworks in Bristol, Ilinois, are paid in different frequencies. Some employees have union dues or garnishments deducted from their pay. Required: Calculate their net pay using the percentage method in Aprendix C (or the IRS federal income tax assistant or IRS Publication 15-T). Include Illinols income tax of 4.95 percent of taxable pay. No employee has exceeded the maximum FICA limits. You do not need to complete the number of hours. There is no information for Step 4 and all W-4s were received in 2020. No box was checked in Step 2. (Round your Intermediate calculations and final answers to 2 decimal places.) Filing Status, Dependents Union Dues per Perlod 780 Garnishment per Period Net Pay Frequency Pay Employee 50 Weekly Semi-monthly Monthly Biweekly MJ-0 C. Whaley F. Paguaga K. Harvey L. Bolling $ 2,940 $ 7,450 S 2,640 120 MJ-2 (<17) S-1 (Other) 240 $ 75 100 MJ-0

The following employees of CIBA Ironworks in Bristol, Ilinois, are paid in different frequencies. Some employees have union dues or garnishments deducted from their pay. Required: Calculate their net pay using the percentage method in Aprendix C (or the IRS federal income tax assistant or IRS Publication 15-T). Include Illinols income tax of 4.95 percent of taxable pay. No employee has exceeded the maximum FICA limits. You do not need to complete the number of hours. There is no information for Step 4 and all W-4s were received in 2020. No box was checked in Step 2. (Round your Intermediate calculations and final answers to 2 decimal places.) Filing Status, Dependents Union Dues per Perlod 780 Garnishment per Period Net Pay Frequency Pay Employee 50 Weekly Semi-monthly Monthly Biweekly MJ-0 C. Whaley F. Paguaga K. Harvey L. Bolling $ 2,940 $ 7,450 S 2,640 120 MJ-2 (<17) S-1 (Other) 240 $ 75 100 MJ-0

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 7E

Related questions

Question

Transcribed Image Text:The following employees of CIBA Ironworks in Bristol, Illinois, are paid in different frequencies. Some employees have union dues or

garnishments deducted from their pay.

Required:

Calculate their net pay using the percentage method in ARpendix C (or the IRS federal income tax assistant or IRS Publication 15-T).

Include Illinols income tax of 4.95 percent of taxable pay. No employee has exceeded the maximum FICA limits. You do not need to

complete the number of hours. There is no information for Step 4 and all W-4s were received in 2020. No box was checked in Step 2.

(Round your Intermediate calculations and final answers to 2 decimal places.)

Union Dues

Garnishment

Filing Status,

Dependents

Pay

per Period

per Period

Net Pay

Employee

Frequency

780

2$

50

MJ-0

C. Whaley

F. Paguaga

K. Harvey

Weekly

2,940 $

120

Semi-monthly

Monthly

Biweekly

MJ-2 (<17)

S-1 (Other)

7,450 $

240 $

75

100

MJ-0

2,640

L. Bolling

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT