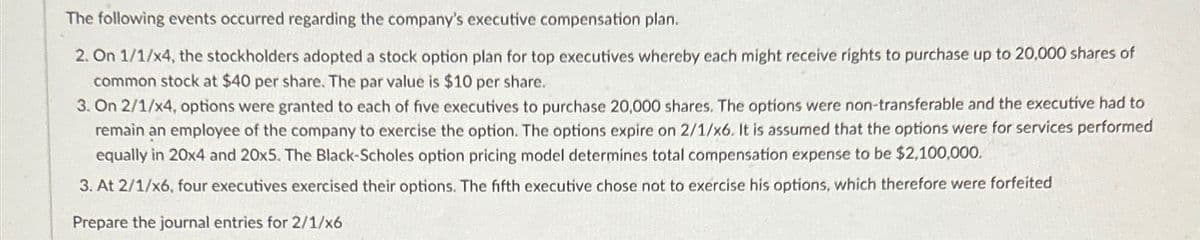

The following events occurred regarding the company's executive compensation plan. 2. On 1/1/x4, the stockholders adopted a stock option plan for top executives whereby each might receive rights to purchase up to 20,000 shares of common stock at $40 per share. The par value is $10 per share. 3. On 2/1/x4, options were granted to each of five executives to purchase 20,000 shares. The options were non-transferable and the executive had to remain an employee of the company to exercise the option. The options expire on 2/1/x6. It is assumed that the options were for services performed equally in 20x4 and 20x5. The Black-Scholes option pricing model determines total compensation expense to be $2,100,000. 3. At 2/1/x6, four executives exercised their options. The fifth executive chose not to exercise his options, which therefore were forfeited Prepare the journal entries for 2/1/x6

The following events occurred regarding the company's executive compensation plan. 2. On 1/1/x4, the stockholders adopted a stock option plan for top executives whereby each might receive rights to purchase up to 20,000 shares of common stock at $40 per share. The par value is $10 per share. 3. On 2/1/x4, options were granted to each of five executives to purchase 20,000 shares. The options were non-transferable and the executive had to remain an employee of the company to exercise the option. The options expire on 2/1/x6. It is assumed that the options were for services performed equally in 20x4 and 20x5. The Black-Scholes option pricing model determines total compensation expense to be $2,100,000. 3. At 2/1/x6, four executives exercised their options. The fifth executive chose not to exercise his options, which therefore were forfeited Prepare the journal entries for 2/1/x6

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:The following events occurred regarding the company's executive compensation plan.

2. On 1/1/x4, the stockholders adopted a stock option plan for top executives whereby each might receive rights to purchase up to 20,000 shares of

common stock at $40 per share. The par value is $10 per share.

3. On 2/1/x4, options were granted to each of five executives to purchase 20,000 shares. The options were non-transferable and the executive had to

remain an employee of the company to exercise the option. The options expire on 2/1/x6. It is assumed that the options were for services performed

equally in 20x4 and 20x5. The Black-Scholes option pricing model determines total compensation expense to be $2,100,000.

3. At 2/1/x6, four executives exercised their options. The fifth executive chose not to exercise his options, which therefore were forfeited

Prepare the journal entries for 2/1/x6

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning