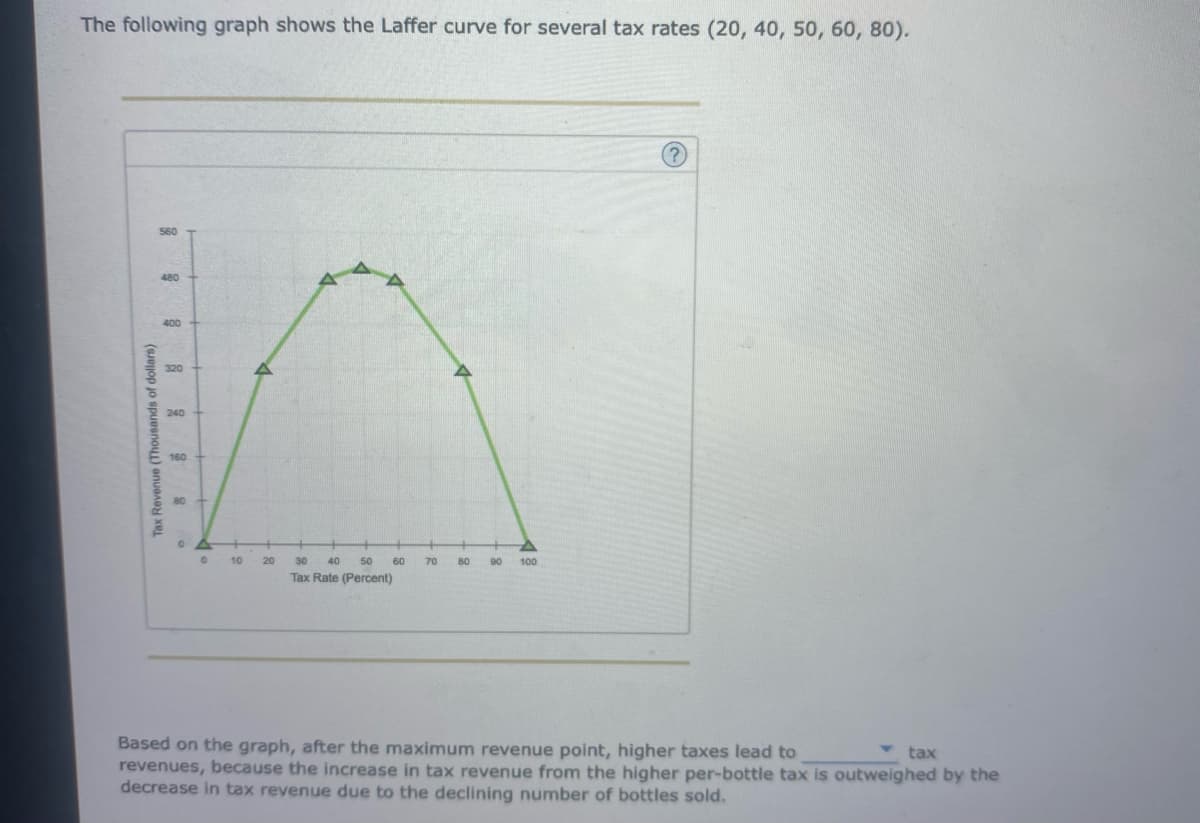

The following graph shows the Laffer curve for several tax rates (20, 40, 50, 60, 80). Tax Revenue (Thousands of dollars) 560 480 400 320 240 160 80 0 10 10 20 30 40 50 Tax Rate (Percent) 60 70 80 90 100 Based on the graph, after the maximum revenue point, higher taxes lead to tax revenues, because the increase in tax revenue from the higher per-bottle tax is outweighed by the decrease in tax revenue due to the declining number of bottles sold.

The following graph shows the Laffer curve for several tax rates (20, 40, 50, 60, 80). Tax Revenue (Thousands of dollars) 560 480 400 320 240 160 80 0 10 10 20 30 40 50 Tax Rate (Percent) 60 70 80 90 100 Based on the graph, after the maximum revenue point, higher taxes lead to tax revenues, because the increase in tax revenue from the higher per-bottle tax is outweighed by the decrease in tax revenue due to the declining number of bottles sold.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter3: Demand And Supply

Section: Chapter Questions

Problem 53P: Table 3.8 shows information on the demand and supply for bicycles, where the quantities of bicycles...

Related questions

Question

Confused and not sure how to answer

Transcribed Image Text:The following graph shows the Laffer curve for several tax rates (20, 40, 50, 60, 80).

Tax Revenue (Thousands of dollars)

560

480

400

320

240

160

80

0

0 10 20

30 40 50 60

Tax Rate (Percent)

70

80 90 100

Based on the graph, after the maximum revenue point, higher taxes lead to

revenues, because the increase in tax revenue from the higher per-bottle tax is outweighed by the

decrease in tax revenue due to the declining number of bottles sold.

tax

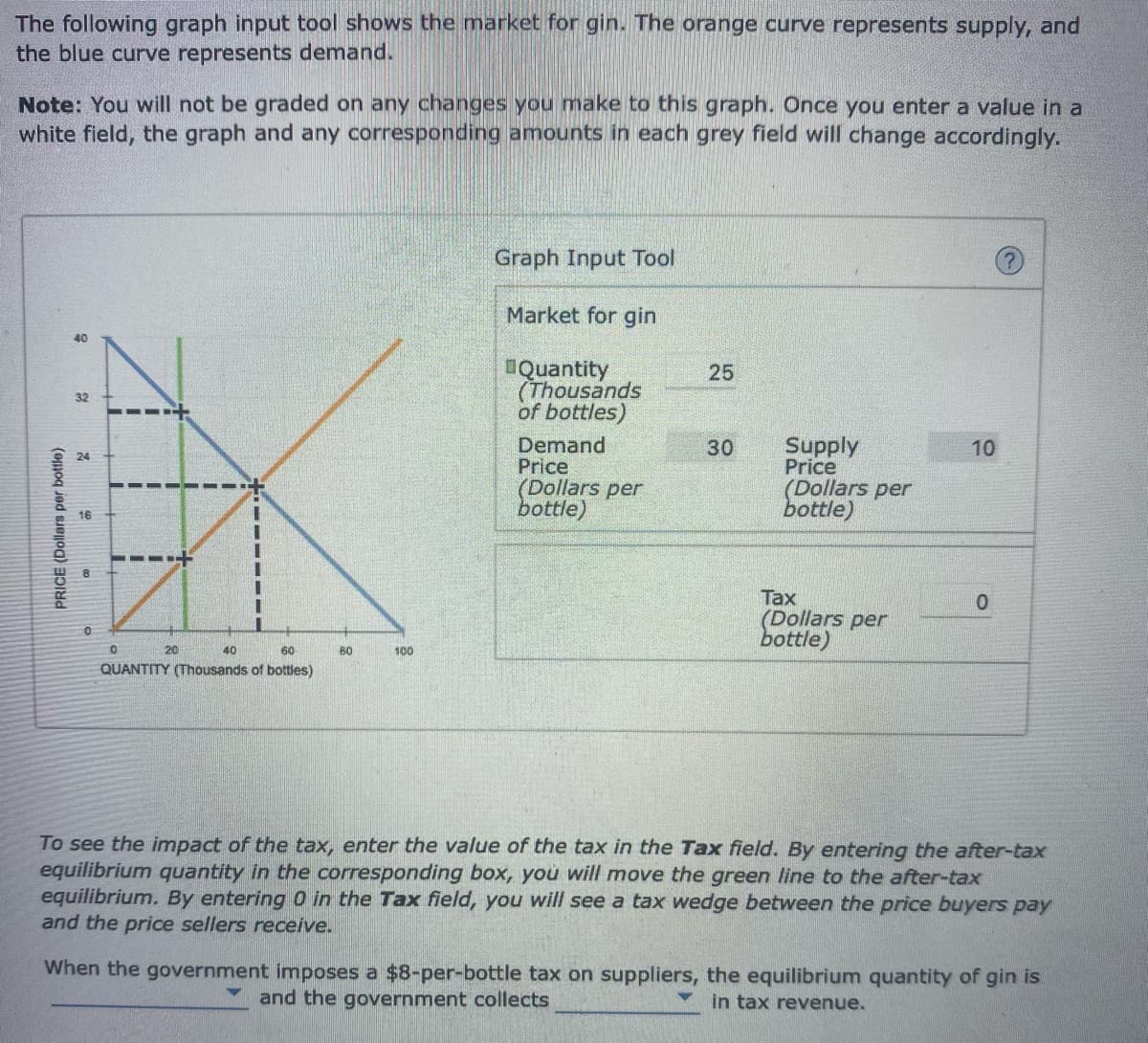

Transcribed Image Text:The following graph input tool shows the market for gin. The orange curve represents supply, and

the blue curve represents demand.

Note: You will not be graded on any changes you make to this graph. Once you enter a value in a

white field, the graph and any corresponding amounts in each grey field will change accordingly.

PRICE (Dollars per bottle)

40

32

07

16

00

0

TIIRT

0

55

11

40

60

QUANTITY (Thousands of bottles)

1

20

BO

100

Graph Input Tool

Market for gin

Quantity

(Thousands

of bottles)

Demand

Price

(Dollars per

bottle)

25

30

Supply

Price

(Dollars per

bottle)

Tax

(Dollars per

bottle)

10

0

To see the impact of the tax, enter the value of the tax in the Tax field. By entering the after-tax

equilibrium quantity in the corresponding box, you will move the green line to the after-tax

equilibrium. By entering 0 in the Tax field, you will see a tax wedge between the price buyers pay

and the price sellers receive.

When the government imposes a $8-per-bottle tax on suppliers, the equilibrium quantity of gin is

and the government collects

in tax revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning