The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic expansion in Canada leads to an increase in the incomes of Canadian households, causing imports from Europe to rise. On the graph, illustrate the effect of an economic expansion on the market for euros by shifting the appropriate curve or curves. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther.

The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic expansion in Canada leads to an increase in the incomes of Canadian households, causing imports from Europe to rise. On the graph, illustrate the effect of an economic expansion on the market for euros by shifting the appropriate curve or curves. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter13: Open-economy Macroeconomics: Basic Concepts

Section: Chapter Questions

Problem 6PA

Related questions

Question

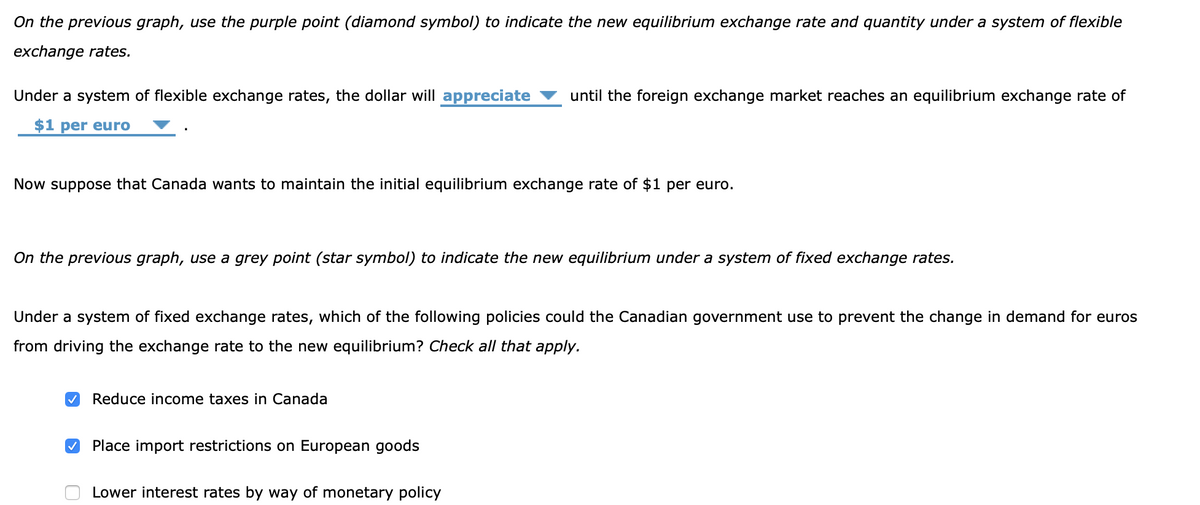

Transcribed Image Text:On the previous graph, use the purple point (diamond symbol) to indicate the new equilibrium exchange rate and quantity under a system of flexible

exchange rates.

Under a system of flexible exchange rates, the dollar will appreciate until the foreign exchange market reaches an equilibrium exchange rate of

$1 per euro

Now suppose that Canada wants to maintain the initial equilibrium exchange rate of $1 per euro.

On the previous graph, use a grey point (star symbol) to indicate the new equilibrium under a system of fixed exchange rates.

Under a system of fixed exchange rates, which of the following policies could the Canadian government use to prevent the change in demand for euros

from driving the exchange rate to the new equilibrium? Check all that apply.

✓ Reduce income taxes in Canada

✓ Place import restrictions on European goods

Lower interest rates by way of monetary policy

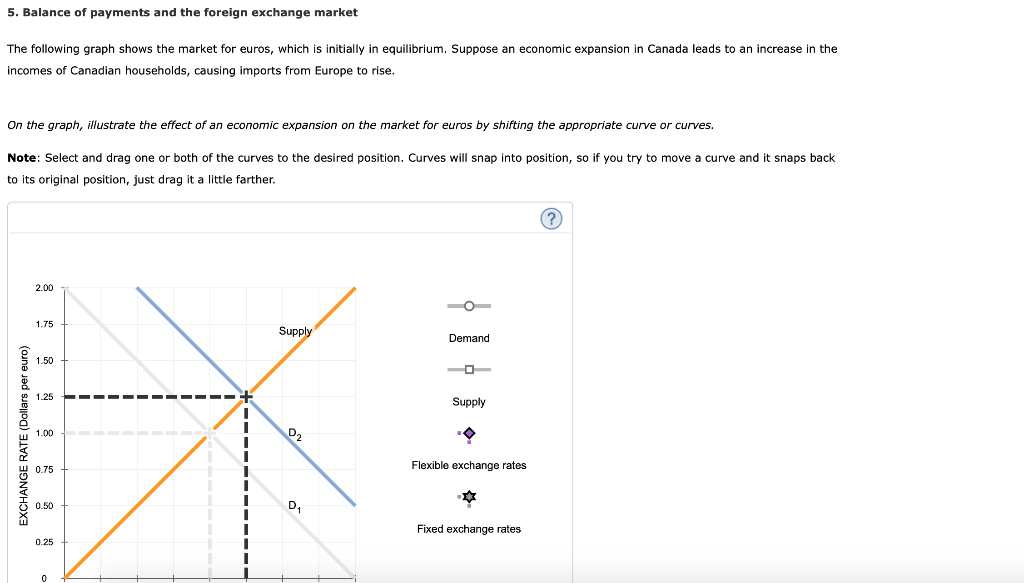

Transcribed Image Text:5. Balance of payments and the foreign exchange market

The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic expansion in Canada leads to an increase in the

incomes of Canadian households, causing imports from Europe to rise.

On the graph, illustrate the effect of an economic expansion on the market for euros by shifting the appropriate curve or curves.

Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back

to its original position, just drag it a little farther.

EXCHANGE RATE (Dollars per euro)

Supply

1.25

XXX

1.00

0.75

2.00

1.75

1.50

0.50

0.25

0

Demand

Supply

Flexible exchange rates

Fixed exchange rates

(?)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning