The following has 1. An amount of irrecoverable.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5EA: Review the following transactions and prepare any necessary journal entries for Tolbert Enterprises....

Related questions

Question

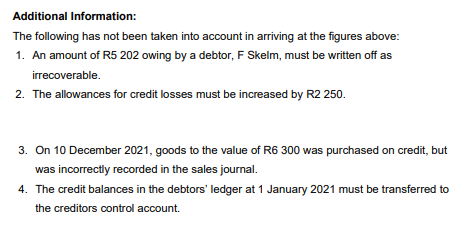

Transcribed Image Text:Additional Information:

The following has not been taken into account in arriving at the figures above:

1. An amount of R5 202 owing by a debtor, F Skelm, must be written off as

irrecoverable.

2. The allowances for credit losses must be increased by R2 250.

3. On 10 December 2021, goods to the value of R6 300 was purchased on credit, but

was incorrectly recorded in the sales journal.

4. The credit balances in the debtors' ledger at 1 January 2021 must be transferred to

the creditors control account.

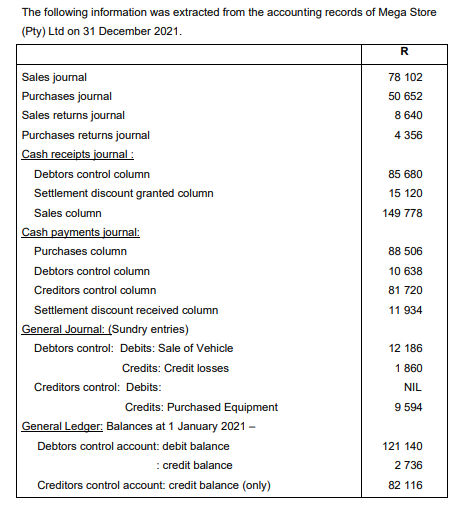

Transcribed Image Text:The following information was extracted from the accounting records of Mega Store

(Pty) Ltd on 31 December 2021.

R

Sales journal

78 102

Purchases joumal

Sales returns journal

50 652

8 640

Purchases returns journal

Cash receipts journal :

4 356

Debtors control column

85 680

Settlement discount granted column

15 120

Sales column

149 778

Cash payments journal:

Purchases column

88 506

Debtors control column

10 638

Creditors control column

81 720

Settlement discount received column

11 934

General Journal: (Sundry entries)

Debtors control: Debits: Sale of Vehicle

12 186

Credits: Credit losses

1 860

Creditors control: Debits:

NIL

Credits: Purchased Equipment

9 594

General Ledger: Balances at 1 January 2021 –

Debtors control account: debit balance

121 140

: credit balance

2736

Creditors control account: credit balance (only)

82 116

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub