[The following information applies to the questions displaye Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. Sales price per unit $ Units produced this year Units sold this year 300 per unit 115,000 units 118,250 units 3,250 units Units in beginning-year inventory Beginning inventory costs $ 438,750 Variable (3,250 units x $135) Fixed (3,250 units x $80) Total 260,000 $698,750 Manufacturing costs this year Direct materials $ $ Direct labor Overhead costs this year Variable overhead $3,000,000 Fixed overhead $7,400,000 Selling and administrative costs this year Variable Fixed $1,300,000 4,400,000 - Prepare the current-year income statement for the company using absorption costing. OAK MART COMPANY Absorption Costing Income Statement < Prev of 5 ▪▪▪ - 4 48 per unit 64 per unit Next >

[The following information applies to the questions displaye Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. Sales price per unit $ Units produced this year Units sold this year 300 per unit 115,000 units 118,250 units 3,250 units Units in beginning-year inventory Beginning inventory costs $ 438,750 Variable (3,250 units x $135) Fixed (3,250 units x $80) Total 260,000 $698,750 Manufacturing costs this year Direct materials $ $ Direct labor Overhead costs this year Variable overhead $3,000,000 Fixed overhead $7,400,000 Selling and administrative costs this year Variable Fixed $1,300,000 4,400,000 - Prepare the current-year income statement for the company using absorption costing. OAK MART COMPANY Absorption Costing Income Statement < Prev of 5 ▪▪▪ - 4 48 per unit 64 per unit Next >

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 14E: For each of the following independent situations, calculate the missing values: 1. The Belen plant...

Related questions

Question

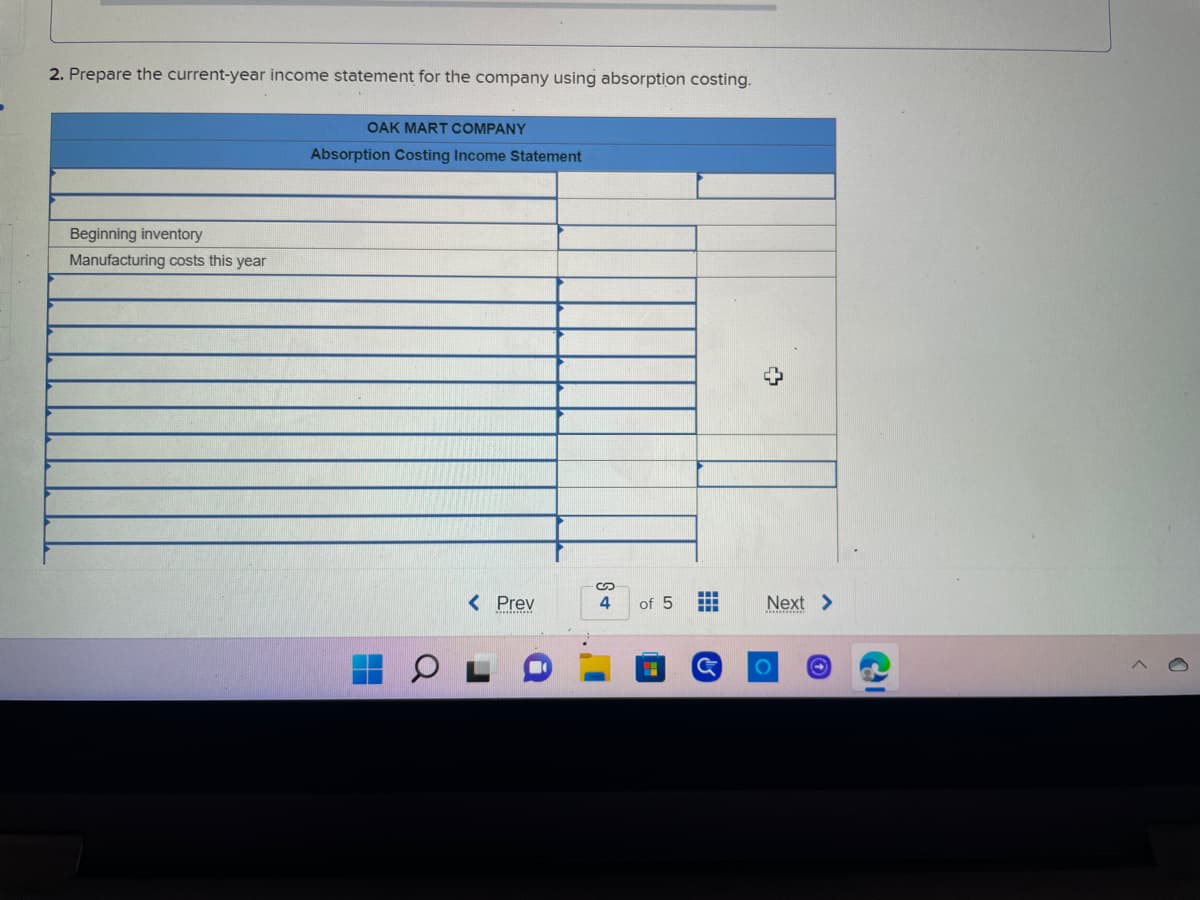

Transcribed Image Text:2. Prepare the current-year income statement for the company using absorption costing.

OAK MART COMPANY

Absorption Costing Income Statement

Beginning inventory

Manufacturing costs this year

< Prev

a

S+

4

of 5

#

G

+

Next >

O

O

![[The following information applies to the questions displayed below.]

Oak Mart, a producer of solid oak tables, reports the following data from its second year of business.

Sales price per unit

$

Units produced this year

Units sold this year

300 per unit

115,000 units

118,250 units

3,250 units

Units in beginning-year inventory

Beginning inventory costs

$ 438,750

Variable (3,250 units x $135)

Fixed (3,250 units x $80)

260,000

Total

$

698,750

Manufacturing costs this year

Direct materials

$

Direct labor

$

Overhead costs this year

Variable overhead

$3,000,000

Fixed overhead

$7,400,000

Selling and administrative costs this year

Variable

Fixed

$1,300,000

4,400,000

2. Prepare the current-year income statement for the company using absorption costing.

OAK MART COMPANY

Absorption Costing Income Statement

< Prev

of 5

-

‒‒‒

4

48 per unit

64 per unit

Next >

O](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F57d77e85-cb4a-442d-a233-3c45dc012dc1%2F5a0b24ac-5b0a-408e-a452-def639641122%2F9aye5x_processed.jpeg&w=3840&q=75)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Oak Mart, a producer of solid oak tables, reports the following data from its second year of business.

Sales price per unit

$

Units produced this year

Units sold this year

300 per unit

115,000 units

118,250 units

3,250 units

Units in beginning-year inventory

Beginning inventory costs

$ 438,750

Variable (3,250 units x $135)

Fixed (3,250 units x $80)

260,000

Total

$

698,750

Manufacturing costs this year

Direct materials

$

Direct labor

$

Overhead costs this year

Variable overhead

$3,000,000

Fixed overhead

$7,400,000

Selling and administrative costs this year

Variable

Fixed

$1,300,000

4,400,000

2. Prepare the current-year income statement for the company using absorption costing.

OAK MART COMPANY

Absorption Costing Income Statement

< Prev

of 5

-

‒‒‒

4

48 per unit

64 per unit

Next >

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning