[The following information applies to the questions displayed below.] Antuan Company set the following standard costs for one unit of its product. Direct materials (3.0 Ibs. @ $5.00 per Ib.) $ 15.00 Direct labor (2.0 hrs. @ $12.00 per hr.) 24.00 Overhead (2.0 hrs. @ $18.50 per hr.) 37.00 Total standard cost $ 76.00 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 90,000 Power 15,000 Repairs and maintenance 45,000 Total variable overhead costs $ 165,000 Fixed overhead costs Depreciation—Building 24,000 Depreciation—Machinery 70,000 Taxes and insurance 17,000 Supervision 279,000 Total fixed overhead costs 390,000 Total overhead costs $ 555,000 The company incurred the following actual costs when it operated at 75% of capacity in October. Direct materials (45,500 Ibs. @ $5.20 per lb.) $ 236,600 Direct labor (22,000 hrs. @ $12.30 per hr.) 270,600 Overhead costs Indirect materials $ 41,100 Indirect labor 176,400 Power 17,250 Repairs and maintenance 51,750 Depreciation—Building 24,000 Depreciation—Machinery 94,500 Taxes and insurance 15,300 Supervision 279,000 699,300 Total costs $ 1,206,500 rev: 04_27_2020_QC_CS-209738 3. Compute the direct materials cost variance, including its price and quantity variances. (Indicate the effect of each variance by selecting for favorable, unfavorable, and No variance.)

[The following information applies to the questions displayed below.]

Antuan Company set the following standard costs for one unit of its product.

| Direct materials (3.0 Ibs. @ $5.00 per Ib.) | $ | 15.00 |

| Direct labor (2.0 hrs. @ $12.00 per hr.) | 24.00 | |

| Overhead (2.0 hrs. @ $18.50 per hr.) | 37.00 | |

| Total |

$ | 76.00 |

The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level.

| Overhead Budget (75% Capacity) | |||||

| Variable overhead costs | |||||

| Indirect materials | $ | 15,000 | |||

| Indirect labor | 90,000 | ||||

| Power |

15,000 |

||||

| Repairs and maintenance | 45,000 | ||||

| Total variable overhead costs | $ | 165,000 | |||

| Fixed overhead costs | |||||

| 24,000 | |||||

| Depreciation—Machinery | 70,000 | ||||

| Taxes and insurance | 17,000 | ||||

| Supervision | 279,000 | ||||

| Total fixed overhead costs | 390,000 | ||||

| Total overhead costs | $ | 555,000 | |||

The company incurred the following actual costs when it operated at 75% of capacity in October.

| Direct materials (45,500 Ibs. @ $5.20 per lb.) | $ | 236,600 | |||

| Direct labor (22,000 hrs. @ $12.30 per hr.) | 270,600 | ||||

| Overhead costs | |||||

| Indirect materials | $ | 41,100 | |||

| Indirect labor | 176,400 | ||||

| Power | 17,250 | ||||

| Repairs and maintenance | 51,750 | ||||

| Depreciation—Building | 24,000 | ||||

| Depreciation—Machinery | 94,500 | ||||

| Taxes and insurance | 15,300 | ||||

| Supervision | 279,000 | 699,300 | |||

| Total costs | $ | 1,206,500 | |||

rev: 04_27_2020_QC_CS-209738

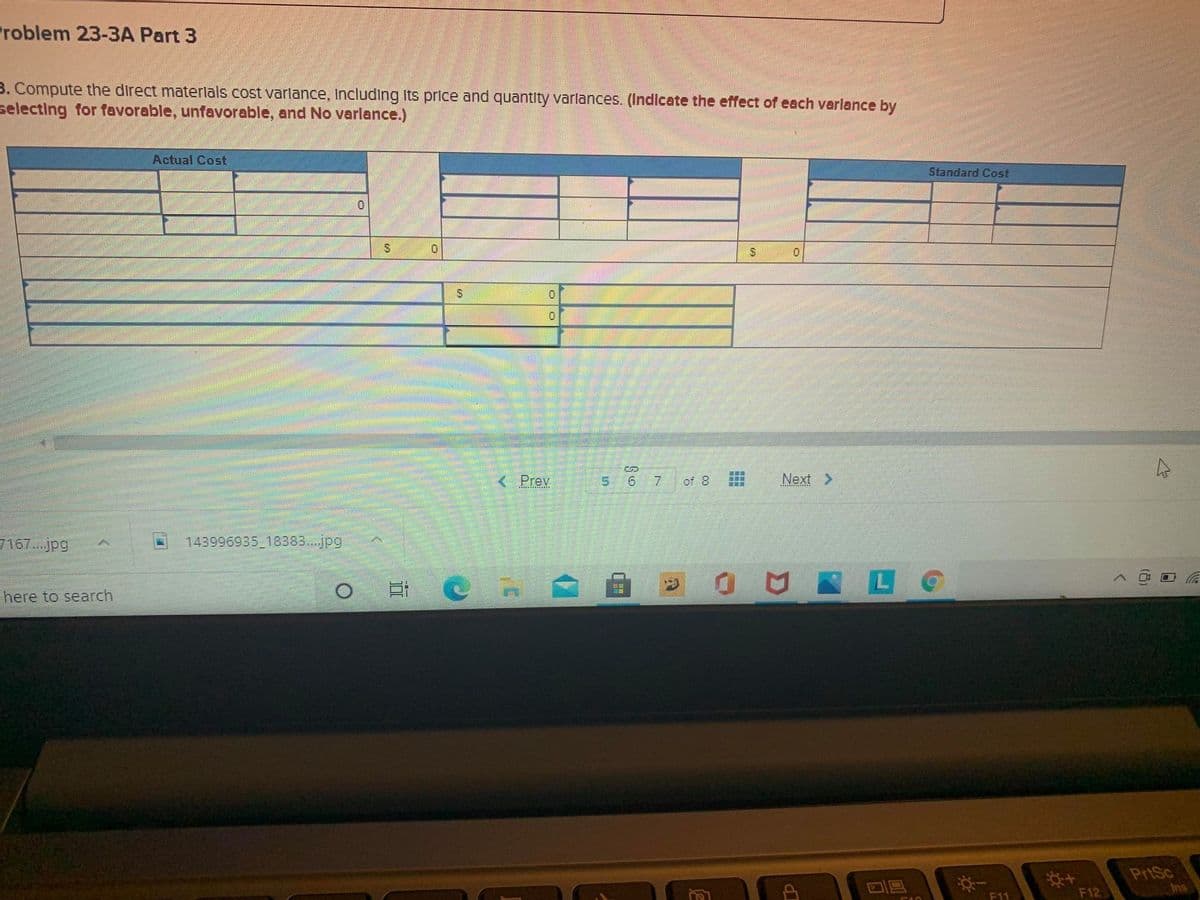

3. Compute the direct materials cost variance, including its price and quantity variances. (Indicate the effect of each variance by selecting for favorable, unfavorable, and No variance.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps