[The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,975,000 useful life of five years and no salvage value. The company's discount rate income in each of five years as follows: Sales $ 2,735,000 1,000,000 1,735,000 Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs Depreciation Total fixed expenses $ 735,000 595,000 1,330,000 $ 405,000 Net operating income Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount 14. Assume a postaudit showed that all estimates including total sales) were exactly correct ex which actually turned out to be 45%. What was the project's actual payback period? (Round yo

[The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,975,000 useful life of five years and no salvage value. The company's discount rate income in each of five years as follows: Sales $ 2,735,000 1,000,000 1,735,000 Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs Depreciation Total fixed expenses $ 735,000 595,000 1,330,000 $ 405,000 Net operating income Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount 14. Assume a postaudit showed that all estimates including total sales) were exactly correct ex which actually turned out to be 45%. What was the project's actual payback period? (Round yo

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2CMA: Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of...

Related questions

Question

![Required information

[The following information applies to the questions displayed below.]

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a

useful life of five years and no salvage value. The company's discount rate

income in each of five years as follows:

$ 2,735,000

1,000,000

Sales

Variable expenses

Contribution margin

Fixed expenses:

Advertising, salaries, and other fixed out-

of-pocket costs

Depreciation

Total fixed expenses

1,735,000

$ 735,000

595,000

1,330,000

Net operating income

$ 405,000

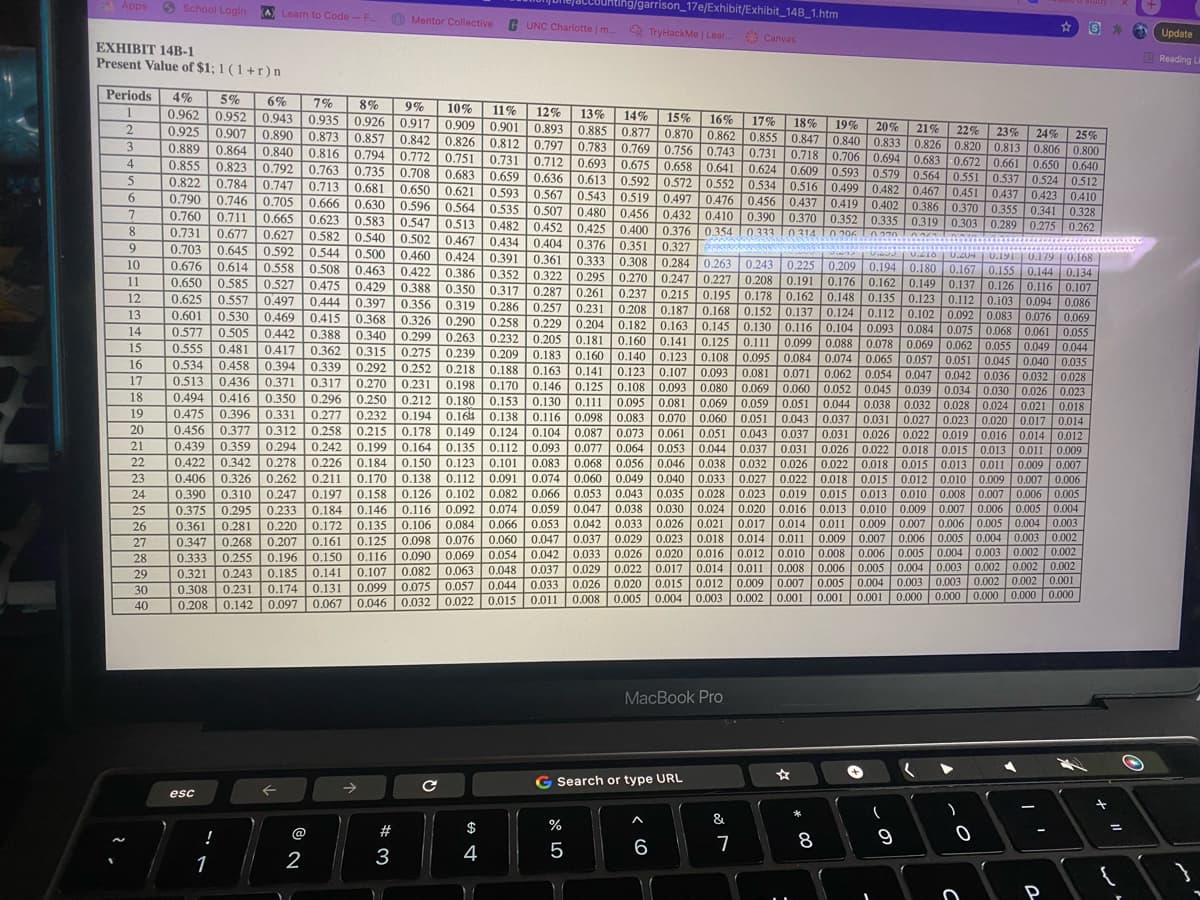

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table.

14. Assume a postaudit showed that all estimates including total sales) were exactly correct except for the variable expense ratio,

which actually turned out to be 45%. What was the project's actual payback period? (Round your answer to 2 decimal places.)

Payback period

years](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fda625b26-af5c-4d40-b5ca-dba856450987%2Fc41f5094-45f8-43c8-bc47-2b3fb29e6833%2F7p420zj_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a

useful life of five years and no salvage value. The company's discount rate

income in each of five years as follows:

$ 2,735,000

1,000,000

Sales

Variable expenses

Contribution margin

Fixed expenses:

Advertising, salaries, and other fixed out-

of-pocket costs

Depreciation

Total fixed expenses

1,735,000

$ 735,000

595,000

1,330,000

Net operating income

$ 405,000

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table.

14. Assume a postaudit showed that all estimates including total sales) were exactly correct except for the variable expense ratio,

which actually turned out to be 45%. What was the project's actual payback period? (Round your answer to 2 decimal places.)

Payback period

years

Transcribed Image Text:0.593

0.467

Apps School Login

iting/garrison_17e/Exhibit/Exhibit_14B_1.htm

0.135

0.255

0 424

A Learn to Code-F.

O Mentor Collective

G UNC Charlotte | m.

A TryHackMe | Lear Canvas

Update

EXHIBIT 14B-1

Present Value of $1; 1 ( 1 + r ) n

Reading L

Periods

4%

5%

0.952

6%

7%

8%

9%

10%

0.926 0,917 0.909 0.901

11%

12%

0.893 0.885 0.877

0.797 | 0.783 0.769

0.712 0.693

1

0.962

0.943

13%

14%

15%

0.935

0.873 0.857 0.826

0.816| 0.794

16%

18%

0.870 0.862 0.855 0.847 0.840 0.833

17%

19% 20%

21%

0.826 0.820 0.813 0.806

0.683 0.672 0.661 0.650 0.640

0.925

0.907

0,890

0.873

22%

23%

24% 25%

0.842

0.812

3.

0.756 0.743 0.731 0

0.658 0.641

0.889

0.864

0.840

0.800

0.718 0.706

0.624 0.609 0.593

0.772 0.751

0.731

0.694

4

0.855

0.675

0.823

0.822 | 0.784

0.792 0.763 0.735 0.708

0.579 0.564 0.551| 0.537 | 0.524 0512

0.683

0.041

0.659

0.593

0.564| 0.535

5

0.636 0.613 0.592 0572 0.552 0.534 0.516 0.499 0.482 0.467 0.451

0.713 0.681 0.650

0.747

0.746 0.705

0.567

0.543 0.519 0.497 0.476 0.456

0.480 0.456 0.432 0.410 0.390

0.425 0.400

0.376 0.351

0.437 0.423 0.410

0.370 0.3550.341 0.328

0.289 0.275 0.262

0.021

0.790

0.760 0.711

0.731 0.677

0.703 0.645 0,592

0.437 0.419

0.370 0.352 0.335 0.319

0.666

0.630

0.665 0.623 0.583

0.627 0.582 0.540 | 0,502

0.500

0.508 0.463

0.596

0.419

0.402 0.386

O.J04

0.513

0.507

0.547

0.303

0.482

0.434 0.404

8.

0.452

0.376 0.354 0 333 o 214

0.289

0 206

0270

0.467

0.327

0.308 0.284

0.270 0.247

0.544

0.460

0.424 0.391

| U.191 | 0.179 |0.168

0.361

0.352 0.322 | 0.295

0.317 0.287

0,333

0.225 0.209 | 0.194 0.180 0.167 0.155 0.144 0.134

0.208 0.191 0.176 0.162 0.149 0.137 0.126 0.116 0.107

0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086

0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069

10

11

0.263

0.205

0.227

0.676

0.614 |

0,585 0.527

0.557 0.497 0.444

0.558 0.508

0.422

0.243

2

0.386

0.650

1770

0.208

0.178

0.208 0.187 0.168 0.152

0.475

0.350

0.350

0.397 0.356 0.319 0.286 0.257

0.429

0.388

0.261

0.237

12

0.625

0.195

0.530

0.326

0.231

13

0.469

0.100

0.163 0.145

0.601

0.530

0.415

0.368

0.137

0.258 0.229

0.232 0.205

0.209 0,183

0.188 0.163

0.290

0,204

U.520

0.299

0.299

0.275

0.577 0,505 0.388

0.182

0.130 | 0.116 0.104 0.093 0.084 0.075 0.068

0.110

0.099

0.104

0.088

14

0.061

0.055

0.069 0.062 0.055 0.049 0.044

0.045 0.040 0.035

0.054 0.047 0.042 0.036 0.032 0.028

0.442

0.340

0.263

0.181

0.141 0.125 0.111

0.160

0.140 | 0.123

15

0.555

0.481

0.417

0.362

0.315

0.239

0.160

0.108 0.095 0.084 0.074 0.065 0.057 0.051

0.093 |0.081

0.080 0.069

16

0.534

0.458

0.394 0.339

0.292

0.252

0.218

0.188

0.141

0.123 | 0.107

0.071 | 0.062

0.060 0.052 0.045 0.039 0.034 0.030

0.051 |

0.270

0.270

O 199

0.198

17

0.513

0.494

0.436 0.371

0.317

0.231

0.198 0.170 0.146 0.125 0.108 0.093 0.080

0.170

0.153

0.026 0.023

0.028 0.0240.021 0.018

0.027 | 0.023 0.020 | 0.017 | 0.014

18

0.416

0.350

0.296

0.250

0.212

0.180

0.130

0 130

0.095 0.081

0.098 0.083 0.070

0.111

0.212

0.194

0.178

0.180

0.164

0.069

0.059

0.044 0.038

0.032

19

0.475

0.396

0.331

0.277

0.232

0.138

0.116

0.060 0.051

0.043

0.138

0.043

0.037

0.031

0.456

0.258 0.215

0.242 0.199

0.226 0.184

20

0.377

0.312

0.149

0.135

0.104

0.051

0.044

0.124

0.087

0.073 0.061

0.178

0.164

0.037 | 0.031 0.026 0.022 | 0.019 | 0.016 0.014 0.012

0.026 0.022 0.018 0.015 | 0.013 0.011

21

0.439

0.359

0.294

0.112 | 0.093

0.037 0.031

0.032 0.026 0.022 0.018 0.015 0.013 0.011

0.027 | 0.022

0.077 0.064

0.053

0.009

22

0.422

0.342

0.278 |

0.184 0.150

0.123 | 0.101

0.083

0.056 | 0.046

0.049

0.068

0.038

0.033

0.028

0.024 0.020 0.016 0.013

0.009 0.007

0.018 | 0.015 0.012 0.010 0.009 0.007 0.006

0.007 | 0.006 | 0.005

0.007 | 0.006 0.005 0.004

0.004 0.003

0.004 | 0.003 0.002

0.004 0.003 0.002 0.002

0.002 0.002 0.002

0.003 0.003 0.002 0.002 0.001

23

O 406

0.406

0.326

0210

0.310

0.170 | 0.138

0.158

O 146

0.262 | 0.211

0.112

0.091

0.074

0.060

0.040

O 200

0.390

0.102 | 0.082

0,074

24

0.247

| 0.197

0.126

0.066

0.053

0.043

0.035

0.023

0.019

0.015

0.013 0.010 | 0.008

0.047

0.038 0.030

0.184

O 172

0.146

O 135

25

0.375

0.295

0.233

0.116

0.092

0.059

0.010 0.009

0.084

0.076 | 0.060

0.054

0.017

0.014 0.011

0.012 |0.010

0.011 | 0.009 0.007 0.006

0.006 | 0.005

0.042 | 0.033

0.026

0.021

0.106

0.098

0.066 0.053

0.172

O161

26

0.281

0.220

0.135

0.125

0.361

0.268

O 207

0.207

0.047

0.037

0.029

0.023

0.018

0.009 0.007

0.347

0.322

27

0.161

0.042 | 0.033 0.026 0.020

0.048 0.037 0.029 0.022 0.017

28

0.333

0.255

0.196

0.150

0.116

0.090 0.069

0.016

0.008

0.006 0.005

29

0.321

0.243

0.185

0.141

0.107

0.082

0.063

0.014 0.011

0.008

0.006

0.005 0.004 0.003

0.015 0.012 0.009 0.007 0.005 0.004

0.099 | 0.075 0.057 | 0.044 0.033 0.026

0.008

0.020

30

0.308

0.231

0.174 0.131

0.208

0.005 0.004 0.003 | 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000

0.142 | 0.097 | 0.067 0.046 | | 0.015 0.011

0.032 0.022

40

MacBook Pro

G Search or type URL

esc

キ

&

@

#

$

%

!

8

9

3

4

5

6.

1

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College