Wildhorse Solutions, Inc., has just invested $4,869,000 in new equipment. The firm uses a payback period criteria of rejecting any project that takes more than four years to recover its costs. Management anticipates cash flows of $746,600, $745,400, $874,300, $1,556,400, $3,094,500, and $1,830,100 over the next six years. (Round answer to 2 decimal places, e.g. 15.25.) What is the payback period of this investment? Payback period is years. Should Wildhorse Solutions, Inc. go ahead with this project? The firm : the project.

Wildhorse Solutions, Inc., has just invested $4,869,000 in new equipment. The firm uses a payback period criteria of rejecting any project that takes more than four years to recover its costs. Management anticipates cash flows of $746,600, $745,400, $874,300, $1,556,400, $3,094,500, and $1,830,100 over the next six years. (Round answer to 2 decimal places, e.g. 15.25.) What is the payback period of this investment? Payback period is years. Should Wildhorse Solutions, Inc. go ahead with this project? The firm : the project.

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter25: Capital Investment Analysis

Section: Chapter Questions

Problem 25.20EX

Related questions

Question

100%

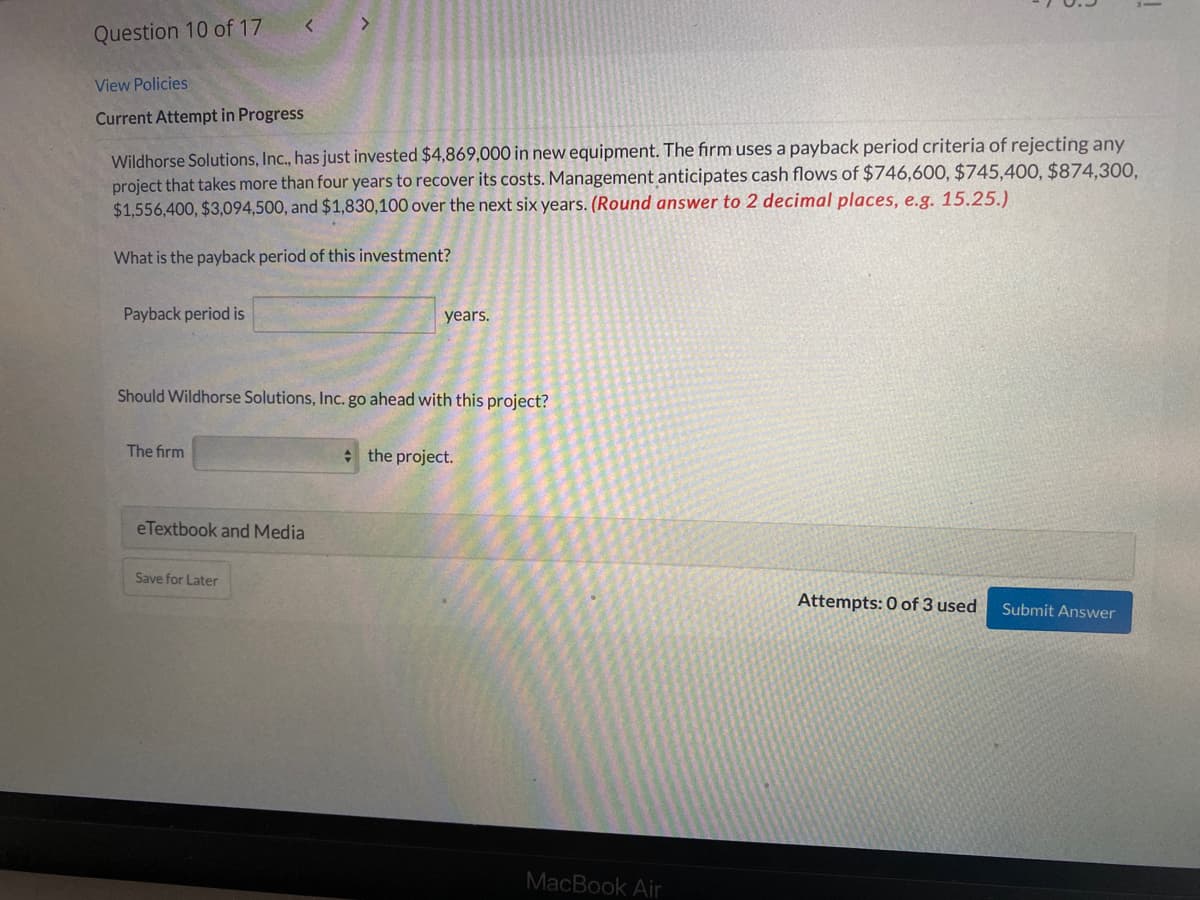

Transcribed Image Text:Question 10 of 17

View Policies

Current Attempt in Progress

Wildhorse Solutions, Inc., has just invested $4,869,000 in new equipment. The firm uses a payback period criteria of rejecting any

project that takes more than four years to recover its costs. Management anticipates cash flows of $746,600, $745,400, $874,300,

$1,556,400, $3,094,500, and $1,830,100 over the next six years. (Round answer to 2 decimal places, e.g. 15.25.)

What is the payback period of this investment?

Payback period is

years.

Should Wildhorse Solutions, Inc. go ahead with this project?

The firm

* the project.

eTextbook and Media

Save for Later

Attempts: 0 of 3 used

Submit Answer

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning