[The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 31,800 88,800 111,000 10,700 276,000 $518,300 $ 128,400 96,000 163,000 130,900 1 Year Ago Current Year $ 35,500 63,000 80,000 9,450 257,500 $ 445,450 $ 75,500 $ 50,000 98,000 82,200 163,000 163,000 108,950 80,300 $518,300 $ 445,450 $ 375,500 $ 465,000 240,250 11,400 9,350 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $ 775,000 2 Years Ago 726,000 $ 49,000 $ 3.01 $ 37,200 49,000 55,000 5,300 229,000 $ 375,500 For both the Current Year and 1 Year Ago, compute the following ratins 1 Year Ago $ 396,800 148,800 13,100 8,725 $ 620,000 567,425 $ 52,575 $ 3.23

[The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 31,800 88,800 111,000 10,700 276,000 $518,300 $ 128,400 96,000 163,000 130,900 1 Year Ago Current Year $ 35,500 63,000 80,000 9,450 257,500 $ 445,450 $ 75,500 $ 50,000 98,000 82,200 163,000 163,000 108,950 80,300 $518,300 $ 445,450 $ 375,500 $ 465,000 240,250 11,400 9,350 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $ 775,000 2 Years Ago 726,000 $ 49,000 $ 3.01 $ 37,200 49,000 55,000 5,300 229,000 $ 375,500 For both the Current Year and 1 Year Ago, compute the following ratins 1 Year Ago $ 396,800 148,800 13,100 8,725 $ 620,000 567,425 $ 52,575 $ 3.23

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 39E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

![[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value

Retained earnings

Total liabilities and equity

Current Year

Interest expense

Income tax expense

Total costs and expenses

Net income

$ 31,800

88,800

111,000

10,700

276,000

$518,300

$ 128,400

$ 75,500

98,000

96,000

163,000

130,900

163,000

108,950

$ 518,300 $ 445,450

Current Year

1 Year Ago

$ 465,000

240,250

$ 35,500

63,000

80,000

9,450

257,500

$ 445,450

11,400

9,350

The company's income statements for the Current Year and 1 Year Ago, follow.

For Year Ended December 31

Sales

Cost of goods sold

Other operating expenses

$ 775,000

726,000

$ 49,000

$ 3.01

2 Years Ago

$ 37,200

49,000

55,000

5,300

229,000

$ 375,500

Earnings per share

For both the Current Year and 1 Year Ago, compute the following ratios:

$ 50,000

82,200

163,000

80,300

$ 375,500

1 Year Ago

$ 396,800

148,800

13,100

8,725

$ 620,000

567,425

$ 52,575

$ 3.23](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F603fb863-551d-4e2c-baf1-38f56fb13d9e%2F23ee5e2c-0d7b-468c-9304-5a7da1fa7749%2Fld9h40e_processed.jpeg&w=3840&q=75)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value

Retained earnings

Total liabilities and equity

Current Year

Interest expense

Income tax expense

Total costs and expenses

Net income

$ 31,800

88,800

111,000

10,700

276,000

$518,300

$ 128,400

$ 75,500

98,000

96,000

163,000

130,900

163,000

108,950

$ 518,300 $ 445,450

Current Year

1 Year Ago

$ 465,000

240,250

$ 35,500

63,000

80,000

9,450

257,500

$ 445,450

11,400

9,350

The company's income statements for the Current Year and 1 Year Ago, follow.

For Year Ended December 31

Sales

Cost of goods sold

Other operating expenses

$ 775,000

726,000

$ 49,000

$ 3.01

2 Years Ago

$ 37,200

49,000

55,000

5,300

229,000

$ 375,500

Earnings per share

For both the Current Year and 1 Year Ago, compute the following ratios:

$ 50,000

82,200

163,000

80,300

$ 375,500

1 Year Ago

$ 396,800

148,800

13,100

8,725

$ 620,000

567,425

$ 52,575

$ 3.23

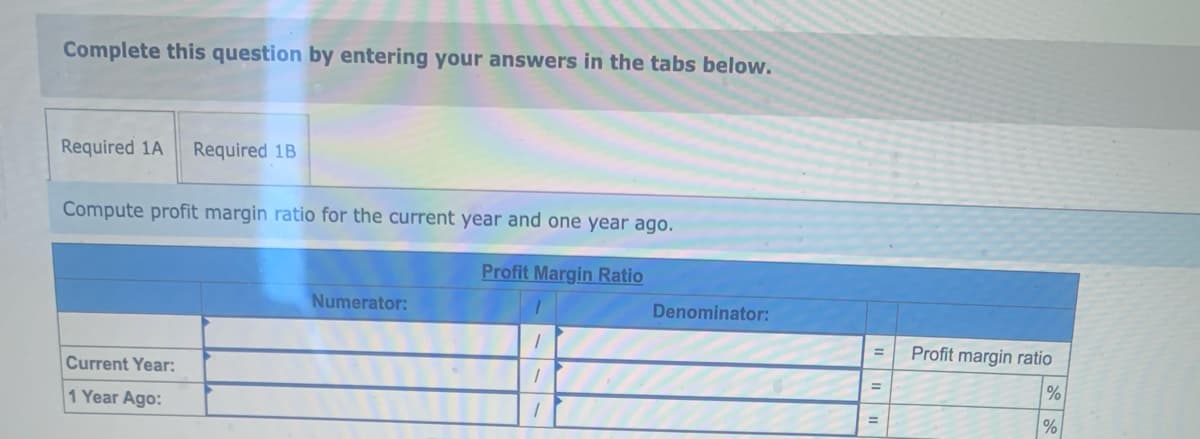

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1A Required 1B

Compute profit margin ratio for the current year and one year ago.

Profit Margin Ratio

Current Year:

1 Year Ago:

Numerator:

1

1

1

Denominator:

=

=

Profit margin ratio

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning