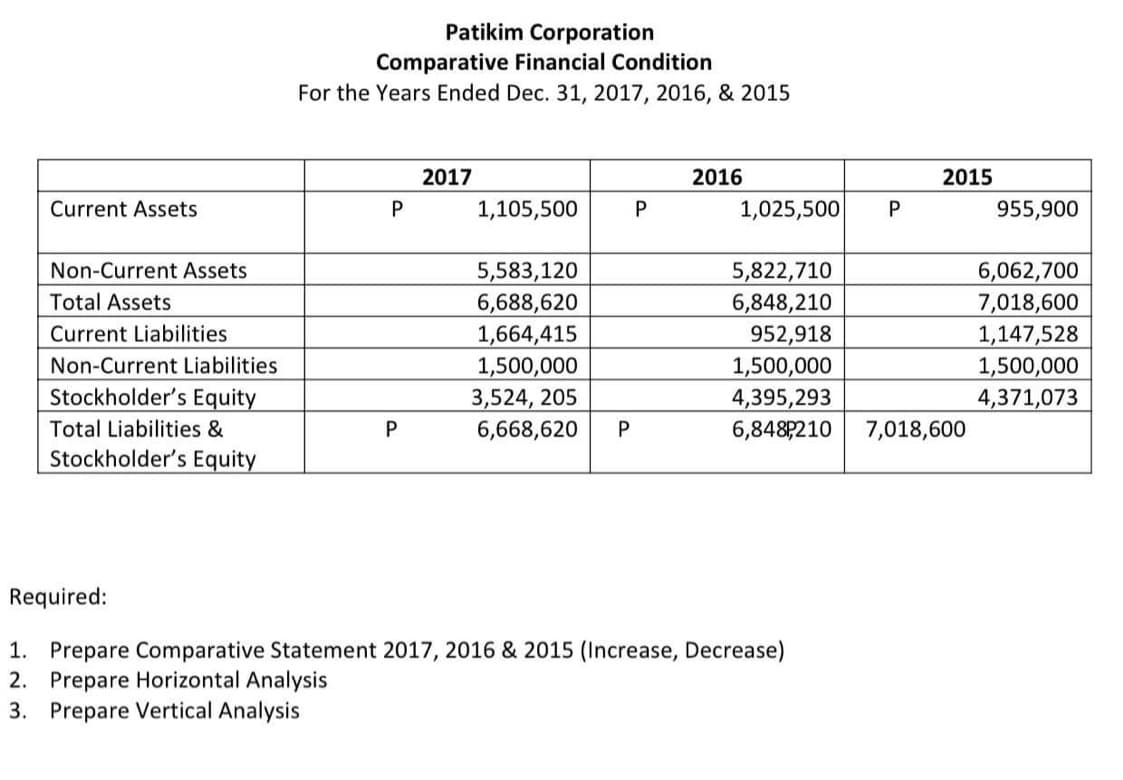

Current Assets .. Non-Current Assets Total Assets Current Liabilities Non-Current Liabilities Stockholder's Equity Total Liabilities & Stockholder's Equity Patikim Corporation Comparative Financial Condition For the Years Ended Dec. 31, 2017, 2016, & 2015 P P 2017 1,105,500 5,583,120 6,688,620 1,664,415 1,500,000 3,524, 205 6,668,620 P P 2016 1,025,500 5,822,710 6,848,210 952,918 Required: Prepare Comparative Statement 2017, 2016 & 2015 (Increase, Decrease) Prepare Horizontal Analysis . Prepare Vertical Analysis P 2015 1,500,000 4,395,293 6,848,210 7,018,600 955,900 6,062,700 7,018,600 1,147,528 1,500,000 4,371,073

Current Assets .. Non-Current Assets Total Assets Current Liabilities Non-Current Liabilities Stockholder's Equity Total Liabilities & Stockholder's Equity Patikim Corporation Comparative Financial Condition For the Years Ended Dec. 31, 2017, 2016, & 2015 P P 2017 1,105,500 5,583,120 6,688,620 1,664,415 1,500,000 3,524, 205 6,668,620 P P 2016 1,025,500 5,822,710 6,848,210 952,918 Required: Prepare Comparative Statement 2017, 2016 & 2015 (Increase, Decrease) Prepare Horizontal Analysis . Prepare Vertical Analysis P 2015 1,500,000 4,395,293 6,848,210 7,018,600 955,900 6,062,700 7,018,600 1,147,528 1,500,000 4,371,073

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Transcribed Image Text:Current Assets

Non-Current Assets

Total Assets

Current Liabilities

Non-Current Liabilities

Stockholder's Equity

Total Liabilities &

Stockholder's Equity

Required:

Patikim Corporation

Comparative Financial Condition

For the Years Ended Dec. 31, 2017, 2016, & 2015

P

P

2017

1,105,500

5,583,120

6,688,620

1,664,415

1,500,000

3,524, 205

6,668,620 P

P

2016

1,025,500

P

1. Prepare Comparative Statement 2017, 2016 & 2015 (Increase, Decrease)

2. Prepare Horizontal Analysis

3. Prepare Vertical Analysis

2015

5,822,710

6,848,210

952,918

1,500,000

4,395,293

6,848,210 7,018,600

955,900

6,062,700

7,018,600

1,147,528

1,500,000

4,371,073

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College