[The following information applies to the questions displayed below.] The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Date Checks Deposits Other Balance December l $ 36,000 December 6 $ 7,520 28,480 December l1 450 $ 27,000 55,030 December 17 8,900 46,130 December 23 34,000 80,130 December 26 450 79,680 December 30 12,200 18,000 NSF* $ 200 85,280 December 31 Interest earned 20 85,300 December 31 Service charge 50 85,250 NSF check from J. Left, a customer. Cash (A) Debit Credit December 1 Balance 36,000 Checks written during Deposits December: December 11 27,000 7,520 December 23 34,000 450 December 30 18,000 8,900 December 31 11,000 450 50 12,200 5,700 December 31 Balance 90,730 There were no deposits in transit or outstanding checks at November 30.

[The following information applies to the questions displayed below.] The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Date Checks Deposits Other Balance December l $ 36,000 December 6 $ 7,520 28,480 December l1 450 $ 27,000 55,030 December 17 8,900 46,130 December 23 34,000 80,130 December 26 450 79,680 December 30 12,200 18,000 NSF* $ 200 85,280 December 31 Interest earned 20 85,300 December 31 Service charge 50 85,250 NSF check from J. Left, a customer. Cash (A) Debit Credit December 1 Balance 36,000 Checks written during Deposits December: December 11 27,000 7,520 December 23 34,000 450 December 30 18,000 8,900 December 31 11,000 450 50 12,200 5,700 December 31 Balance 90,730 There were no deposits in transit or outstanding checks at November 30.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 11MC

Related questions

Question

100%

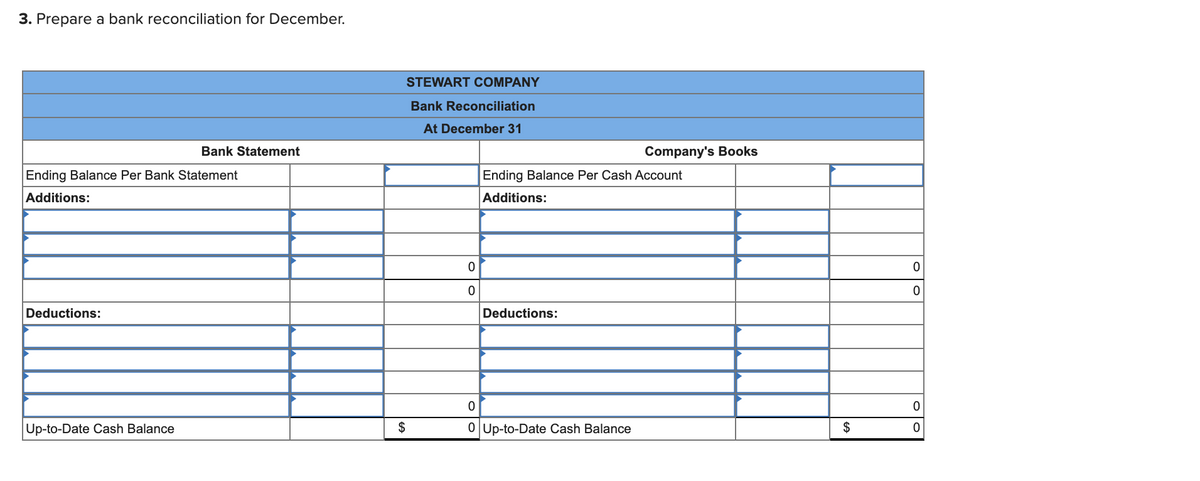

Transcribed Image Text:3. Prepare a bank reconciliation for December.

STEWART COMPANY

Bank Reconciliation

At December 31

Bank Statement

Company's Books

Ending Balance Per Bank Statement

Ending Balance Per Cash Account

Additions:

Additions:

Deductions:

Deductions:

Up-to-Date Cash Balance

$

0 Up-to-Date Cash Balance

$

![Required information

[The following information applies to the questions displayed below.]

The December bank statement and cash T-account for Stewart Company follow:

BANK STATEMENT

Date

Checks

Deposits

Other

Balance

December 1

$ 36,000

December 6

$ 7,520

28,480

55,030

December 11

450

$ 27,000

December 17

8,900

46,130

December 23

34,000

80,130

December 26

450

79,680

December 30

12,200

18,000

NSF*

$ 200

85,280

December 31

Interest earned

20

85,300

December 31

Service charge

50

85,250

NSF check from J. Left, a customer.

Cash (A)

Debit

Credit

December 1

Balance

36,000

Checks written during

Deposits

December:

December 11

27,000

7,520

December 23

34,000

450

December 30

18,000

8,900

December 31

11,000

450

50

12,200

5,700

December 31

Balance

90,730

There were no deposits in transit or outstanding checks at November 30.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F7512406d-bb01-42f7-ad46-687324c63c1e%2F32aa5bc1-4876-4f37-ba72-8bb07c229d64%2Fvdc888b_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

The December bank statement and cash T-account for Stewart Company follow:

BANK STATEMENT

Date

Checks

Deposits

Other

Balance

December 1

$ 36,000

December 6

$ 7,520

28,480

55,030

December 11

450

$ 27,000

December 17

8,900

46,130

December 23

34,000

80,130

December 26

450

79,680

December 30

12,200

18,000

NSF*

$ 200

85,280

December 31

Interest earned

20

85,300

December 31

Service charge

50

85,250

NSF check from J. Left, a customer.

Cash (A)

Debit

Credit

December 1

Balance

36,000

Checks written during

Deposits

December:

December 11

27,000

7,520

December 23

34,000

450

December 30

18,000

8,900

December 31

11,000

450

50

12,200

5,700

December 31

Balance

90,730

There were no deposits in transit or outstanding checks at November 30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning