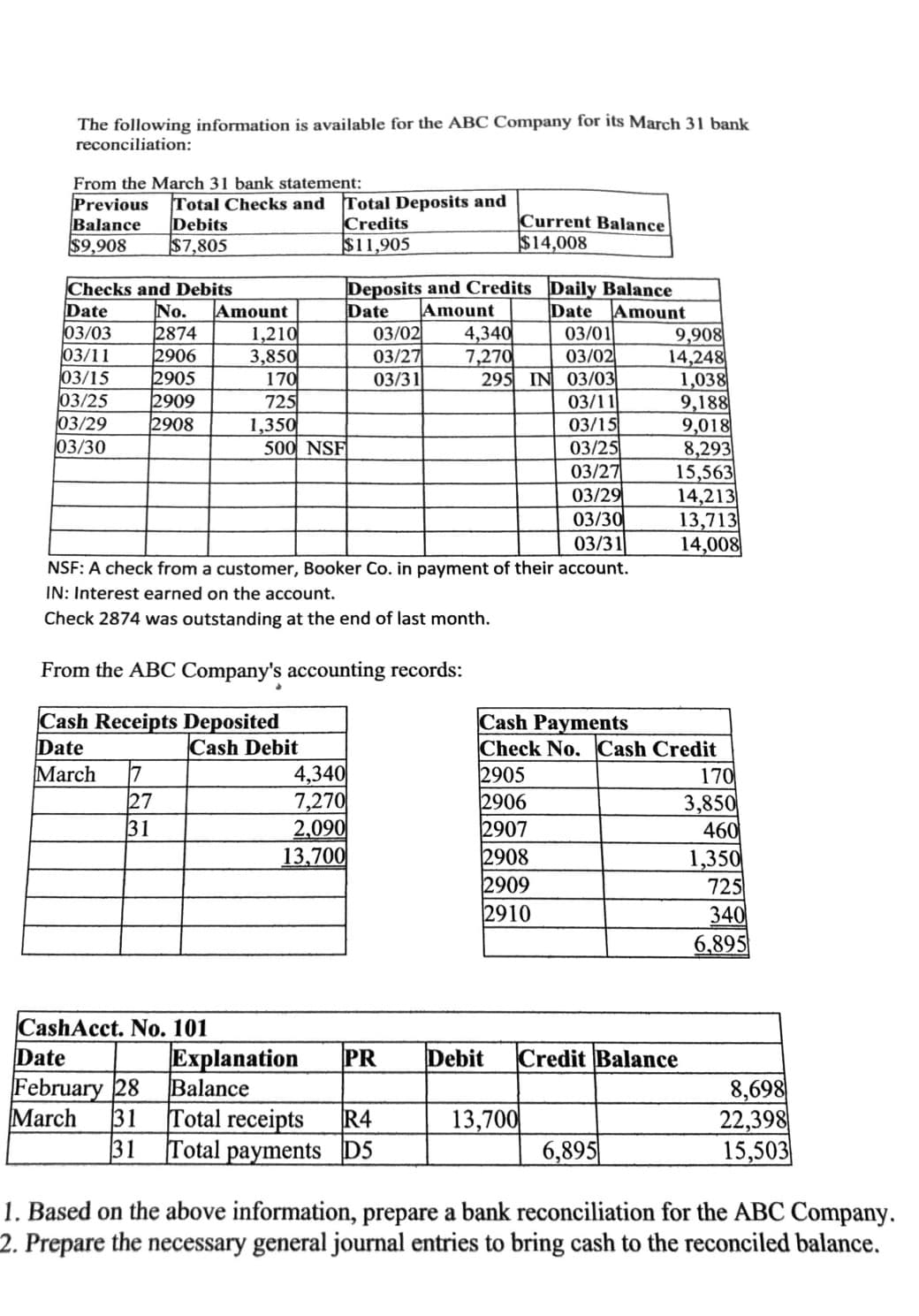

The following information is available for the ABC Company for its March 31 bank reconciliation: From the March 31 bank statement: Previous Balance $9,908 Total Checks and Total Deposits and Debits $7,805 Credits $11,905 Current Balance $14,008 Deposits and Credits Daily Balance Checks and Debits Date 03/03 03/11 03/15 03/25 03/29 03/30 Amount 1,210 3,850 170 725 1,350 500 NSF Date Amount 03/02 03/27 03/31 Date 03/01 03/02 295 IN 03/03| 03/11 03/15 03/25 03/27 03/29 03/30 03/31 NSF: A check from a customer, Booker Co. in payment of their account. Amount 9,908 14,248 1,038 9,188 9,018 8,293 15,563 14,213 13,713 14,008 No. 2874 2906 2905 2909 2908 4,340 7,270 IN: Interest earned on the account. Check 2874 was outstanding at the end of last month. From the ABC Company's accounting records: Cash Receipts Deposited Cash Debit 4,340 7,270 2,090 13,700 Cash Payments Check No. Cash Credit 2905 2906 2907 2908 2909 2910 Date March 27 31 170 3,850 460 1,350 725 340 6,895 ashAcct. No. 101 ate bruary 28 Explanation Balance PR Debit Credit Balance 8,698 22,398 31 Total receipts R4 D5 13,700 arch 31 Total pavments 6 895 15. 503

The following information is available for the ABC Company for its March 31 bank reconciliation: From the March 31 bank statement: Previous Balance $9,908 Total Checks and Total Deposits and Debits $7,805 Credits $11,905 Current Balance $14,008 Deposits and Credits Daily Balance Checks and Debits Date 03/03 03/11 03/15 03/25 03/29 03/30 Amount 1,210 3,850 170 725 1,350 500 NSF Date Amount 03/02 03/27 03/31 Date 03/01 03/02 295 IN 03/03| 03/11 03/15 03/25 03/27 03/29 03/30 03/31 NSF: A check from a customer, Booker Co. in payment of their account. Amount 9,908 14,248 1,038 9,188 9,018 8,293 15,563 14,213 13,713 14,008 No. 2874 2906 2905 2909 2908 4,340 7,270 IN: Interest earned on the account. Check 2874 was outstanding at the end of last month. From the ABC Company's accounting records: Cash Receipts Deposited Cash Debit 4,340 7,270 2,090 13,700 Cash Payments Check No. Cash Credit 2905 2906 2907 2908 2909 2910 Date March 27 31 170 3,850 460 1,350 725 340 6,895 ashAcct. No. 101 ate bruary 28 Explanation Balance PR Debit Credit Balance 8,698 22,398 31 Total receipts R4 D5 13,700 arch 31 Total pavments 6 895 15. 503

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 7EB: Using the following information, prepare a bank reconciliation. Bank balance: $4,021 Book balance:...

Related questions

Question

Transcribed Image Text:The following information is available for the ABC Company for its March 31 bank

reconciliation:

From the March 31 bank statement:

Previous

Balance

$9,908

Total Checks and Total Deposits and

Debits

$7,805

Current Balance

Credits

$11,905

$14,008

Checks and Debits

Date

03/03

03/11

03/15

03/25

03/29

03/30

Deposits and Credits Daily Balance

Date

No.

2874

2906

2905

2909

2908

Amount

1,210

3,850

170

725

1,350

500 NSF

Amount

4,340

7,270

Amount

9,908

14,248

1,038

9,188

9,018

8,293

15,563

14,213

Date

03/02

03/01

03/02

03/27

03/31

295 IN 03/03

03/11

03/15

03/25

03/27

03/29

03/30

03/31

NSF: A check from a customer, Booker Co. in payment of their account.

13,713

14,008

IN: Interest earned on the account.

Check 2874 was outstanding at the end of last month.

From the ABC Company's accounting records:

Cash Receipts Deposited

Cash Debit

4,340

7,270

2,090

13,700

Cash Payments

Check No. Cash Credit

2905

2906

2907

2908

2909

2910

Date

March

27

31

170

3,850

460

1,350

725

340

6,895

CashAcct. No. 101

Date

Explanation

Balance

PR

Debit

Credit Balance

February 28

March

8,698

22,398

15,503

31

Total receipts

13,700

6,895

R4

31

Total payments D5

1. Based on the above information, prepare a bank reconciliation for the ABC Company.

2. Prepare the necessary general journal entries to bring cash to the reconciled balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage