The following information is available for Coronado Corporation for 2020. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $114,000. This difference will reverse in equal amounts of $28,500 over the years 2021-2024. 1. 2. Interest received on municipal bonds was $10,200. Rent collected in advance on January 1, 2020, totaled $61,800 for a 3-year period. Of this amount, $41,200 was reported as unearned at December 31, 2020, for book purposes. 3. 4. The tax rates are 40% for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $308,000 are due per the tax return for 2020. 6. No deferred taxes existed at the beginning of 2020.

The following information is available for Coronado Corporation for 2020. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $114,000. This difference will reverse in equal amounts of $28,500 over the years 2021-2024. 1. 2. Interest received on municipal bonds was $10,200. Rent collected in advance on January 1, 2020, totaled $61,800 for a 3-year period. Of this amount, $41,200 was reported as unearned at December 31, 2020, for book purposes. 3. 4. The tax rates are 40% for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $308,000 are due per the tax return for 2020. 6. No deferred taxes existed at the beginning of 2020.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter12: Liabilities: Off-balance-sheet Financing, Retirement Benefits, And Income Taxes

Section: Chapter Questions

Problem 26E

Related questions

Question

Transcribed Image Text:View Policies

Show Attempt History

Current Attempt in Progress

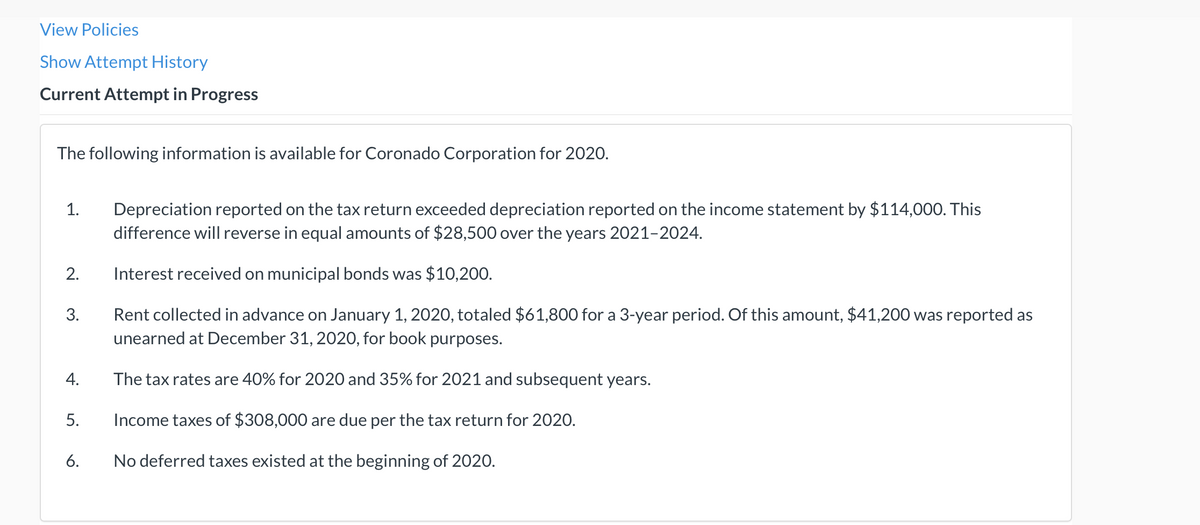

The following information is available for Coronado Corporation for 2020.

Depreciation reported on the tax return exceeded depreciation reported on the income statement by $114,000. This

difference will reverse in equal amounts of $28,500 over the years 2021-2024.

1.

2.

Interest received on municipal bonds was $10,200.

Rent collected in advance on January 1, 2020, totaled $61,800 for a 3-year period. Of this amount, $41,200 was reported as

unearned at December 31, 2020, for book purposes.

3.

4.

The tax rates are 40% for 2020 and 35% for 2021 and subsequent years.

5.

Income taxes of $308,000 are due per the tax return for 2020.

6.

No deferred taxes existed at the beginning of 2020.

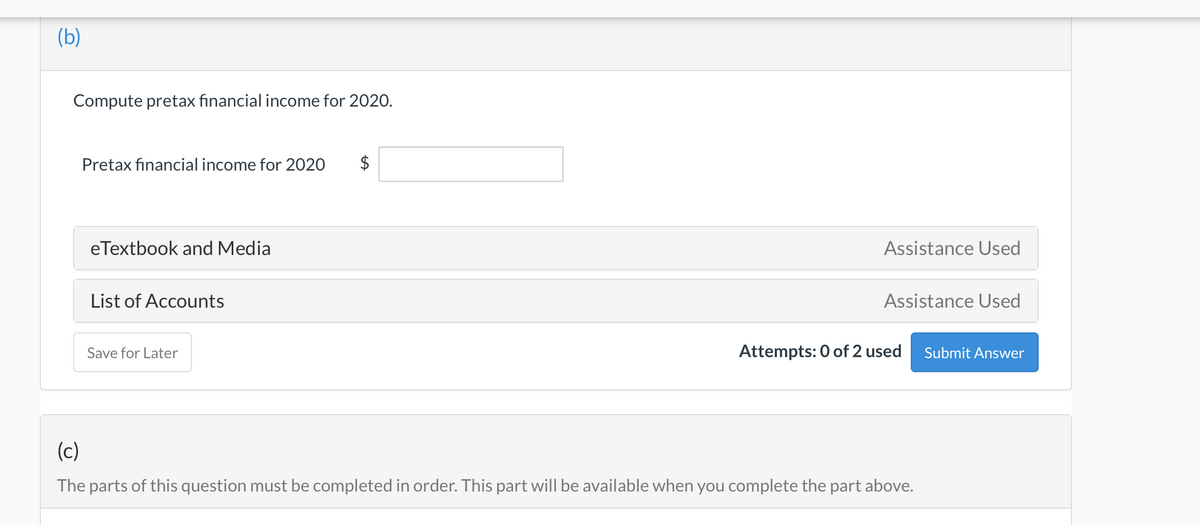

Transcribed Image Text:(b)

Compute pretax financial income for 2020.

Pretax financial income for 2020

$

eTextbook and Media

Assistance Used

List of Accounts

Assistance Used

Save for Later

Attempts: 0 of 2 used

Submit Answer

(c)

The parts of this question must be completed in order. This part will be available when you complete the part above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning